Headquartered in California, (TWTR) is a popular social media site for short-form public posts. I am neutral on the stock.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Earnings season is kicking off this week, and Twitter will be among the big tech names to report later this month. Normally, that would be the most important news for Twitter stock traders to know. However, there’s nothing normal about the drama surrounding Twitter lately.

Bear in mind, we’re living in a time when Tesla (TSLA) CEO, Elon Musk, can cause a cryptocurrency or a stock price to move with (ironically enough) just a single posting on Twitter. His influence cannot be underestimated, but Musk’s personality is known to be eccentric and unpredictable. Unfortunately, this can make it difficult for a company to conduct business with him.

In Twitter’s case, Musk came courting with a buyout bid, but now the deal’s reportedly off the table and it looks like a no-win situation for Twitter. Without the optimism generated by Musk’s takeover talk, Twitter’s investors don’t have much to get excited about now. What’s left for them is a company and a stock that shouldn’t inspire much confidence in 2022’s second half.

On TipRanks, TWTR scores a 1 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to underperform the broader market.

Already in the Doghouse

Even before all of the Musk-related drama came to a head, Twitter stock was in bad shape. It’s been all pain and no gain, as the Twitter share price has slid from its 52-week high of $73.34 to the $30s recently.

Now, you might want to assume that Twitter stock must be a screaming bargain since it’s been cut in half. However, a reliable valuation metric doesn’t indicate a bargain at all. Currently, Twitter’s trailing 12-month P/E ratio is 153.38, and that’s not an enticing valuation multiple. Frankly, there are plenty of other technology stocks with much more reasonable P/E ratios.

In other words, Twitter and its stock were already in the doghouse prior to the latest wrinkle in the ongoing Musk drama, which we’ll definitely get to in a moment. What investors need to know, though, is that Twitter has problems that aren’t necessarily connected to Musk.

First of all, Twitter is in the midst of a difficult transition as Parag Agrawal has taken over the company’s CEO position from Jack Dorsey, who was effectively the face of Twitter for years. Agrawal took over just as Twitter was dealing with issues pertaining to censorship and free speech. Furthermore, there’s the problem of spam/fake accounts, with Twitter actively removing 1 million spam accounts per day.

Those aren’t the only issues. Bear in mind that around 90% of Twitter’s revenue comes from digital advertising. Persistently high inflation means that businesses are forced to slash their advertising budgets, which is bad news for Twitter.

Amid this challenging backdrop, Twitter recently disclosed that the company is laying off 30% of its talent-acquisition team. This comes on the heels of a previous indication that Twitter is halting most of the company’s hiring processes across multiple segments.

Not Surprising, but Still Shocking

Perhaps we all should have seen it coming. On May 13, Musk revealed in a tweet that his $44 billion offer to take over Twitter was “temporarily on hold.” This, in hindsight, was an obvious hint that the deal was in jeopardy.

Apparently Musk was concerned about fake Twitter accounts, though it’s hard to know for certain what he’s really thinking at any given moment. It is known, however, that Musk terminated the takeover deal on Friday, and Twitter has hired a law firm to sue Elon Musk and thereby force him to go through with the acquisition.

Bret Taylor, Twitter’s chairman, has reportedly vowed a legal fight, and the company plans to file a lawsuit in Delaware. This certainly won’t make life any easier for Musk, but it’s also apparently hampering morale at Twitter. The Wall Street Journal quoted one Twitter employee as saying, “There is a lot of confusion and frustration right now.”

It’s hard to envision a scenario in which Twitter would “win” in any meaningful way. If Twitter’s lawsuit fails and Musk successfully abandons the takeover deal, it would be an emotional letdown for Twitter’s stakeholders. On the other hand, if Musk is forced to take over Twitter, then the company would have an unpredictable and possibly hostile leader.

Wall Street’s Take

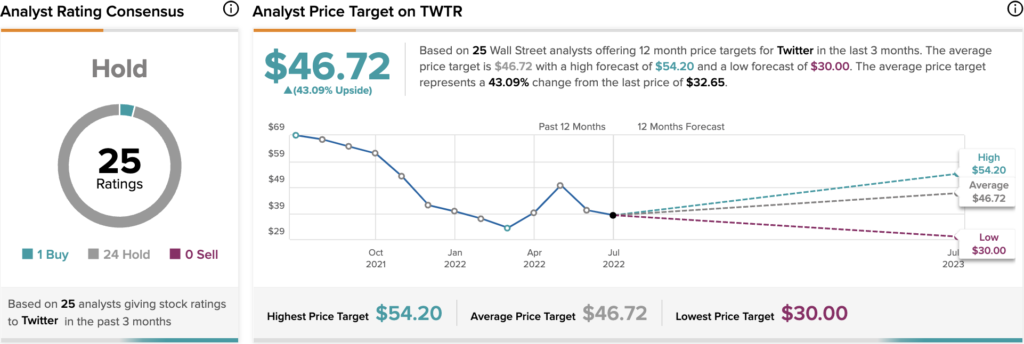

According to TipRanks’ analyst rating consensus, TWTR is a Hold, based on 1 Buy rating, and 24 Hold ratings. The average Twitter price target is $46.72, implying 43.09% upside potential.

The Takeaway

In the final analysis, there are more questions than concrete answers. How will Twitter’s lawsuit be resolved? How low is the morale at Twitter, and how much worse will it get? Also, does the company really want Musk to be its unwilling leader?

What’s been established is that Twitter is laying off employees, and that’s not a positive sign. Moreover, Twitter stock has been on a steep downward trajectory, yet isn’t a bargain, judging by the stock’s P/E ratio. All in all, caution is advised as chaos and confusion are likely to persist for a while, so Twitter shares could easily lose more value in the coming months.

Read full Disclosure