Twilio (TWLO), which is a provider of APIs and other technologies for communications, did not impress Wall Street with its quarterly report on May 5. On the news, shares dropped by 8% to $307, bringing the market capitalization to $53 billion.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

So, let’s get a run-down of the quarterly numbers. Revenues jumped by 62% to $590 million, which beat the consensus estimate of $532.9 million. Keep in mind that the top line got a $44.6 million boost from the acquisition of Segment (the company operates a platform for customer data).

What about the bottom line? Well, the non-GAAP earnings came in at 5 cents a share, while the Street was looking for a loss of 9 cents a share.

Then why were investors disappointed? It looks like they wanted even more from the quarter, and there were some red flags too. First of all, the revenue dollar-based net expansion rate (a metric that indicates the growth from existing customers) was 133%, but the fourth quarter’s number was 139%. Granted, this is not necessarily a big drop, but it is a bit worrisome.

Next, the guidance for the current quarter calls for a quarterly net loss of 13 cents to 16 cents a share. However, Wall Street was looking for a loss of 5 cents a share.

The Growth Strategy

During the past few years, Twilio has undergone a significant transformation. Part of this has been through acquisitions, such as the Segment and SendGrid deals. However, there has also been considerable internal development, with the company very much an engineer-driven organization.

It should be noted that Twilio has become an extensive platform. Just some of the capabilities include APIs and systems for texts, emails, voice, video and contact center functions.

As a result, the total addressable market opportunity has expanded greatly for the company. In 2017, it was $46 billion, but as of now, it is $110 billion.

There is a secular trend towards digital transformation, especially for interacting with customers. According to Twilio CEO and cofounder, Jeff Lawson, in his shareholder letter, “Consumer expectations are constantly evolving. They are no longer tied to just one form of communication, and they expect companies to pull together disparate interactions to deliver increasingly personalized content based on what they’re doing — anytime, anywhere, and over their preferred channels. As a result, companies are accelerating their digital transformation efforts to adapt to these changing expectations.”

At the core of Twilio is a disruptive business model. For example, the pricing is based on usage, not subscriptions, which allows for more flexibility. The Twilio technology also focuses on developers, which have become a powerful distribution channel for growth.

There are currently 235,000 active customer accounts, up from 190,000 in the same quarter a year ago. Some of the top customers include Salesforce.com (CRM), Airbnb (ABNB), and Uber (UBER).

Bottom Line On Twilio Stock

A major catalyst for growth for Twilio has been the COVID-19 pandemic as many companies have had little choice but to find ways to digitize their systems. That being said, as the pandemic starts to diminish, this could weigh on the growth.

This is problematic since Twilio stock has a premium multiple, with its price-to-sales ratio at 26.5. In other words, investors are factoring in considerable growth for years to come.

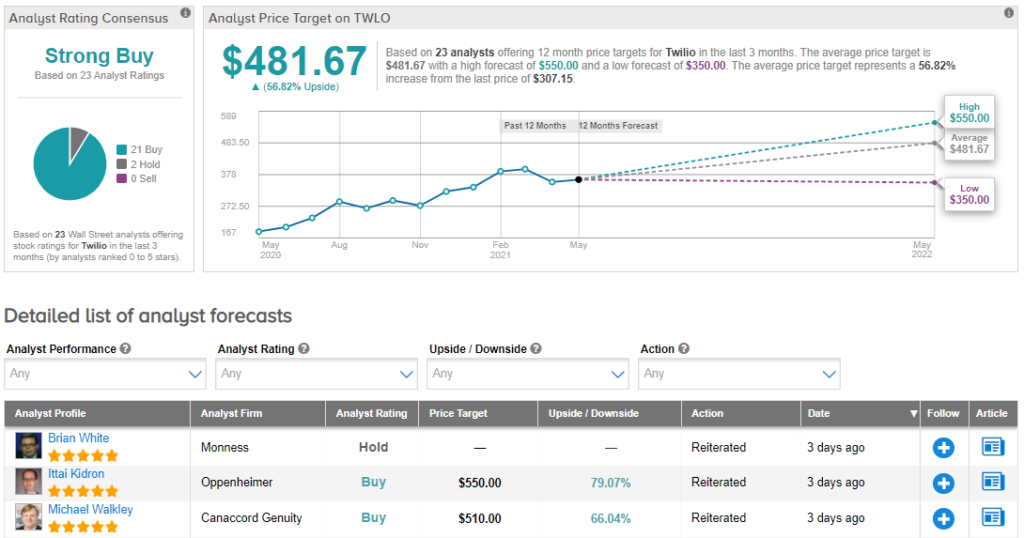

Now it’s true that Wall Street analysts have robust price targets on the stock. At $481.67, the average analyst price target suggests 57% upside potential. Additionally, given that 21 Buy ratings and 2 Hold ratings have been assigned in the last three months, the consensus rating for TWLO is a Strong Buy. (See Twilio stock analysis on TipRanks)

But this is the case with many growth tech plays right now. Yet they have been mostly under pressure – and this is likely due to a rotation as well as concerns about growth. Thus, it may be a good idea to be cautious on Twilio stock for now.

Disclosure: Tom Taulli held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.