In this piece, I evaluated two electric vehicle (EV) stocks, Tesla (NASDAQ:TSLA) and Rivian Automotive (NASDAQ:RIVN), using TipRanks’ comparison tool to determine which is better. A deeper analysis suggests bullish views for both.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Known for the Model S, Model X, Model Y, Model 3, and Cybertruck, Tesla is an EV and clean energy company that designs and manufactures EVs, stationary battery energy storage devices, solar panels and solar shingles, and related products and services. Meanwhile, Rivian Automotive is an EV manufacturer that produces the R1S electric SUV and R1T electric pickup truck.

Despite a 9% decline over the last three months, shares of Tesla are up 105% year-to-date, although they’re up only 16% over the last 12 months. Rivian Automotive stock is flat year-to-date after plummeting 22% over the last three months. The stock is off 48% over the last 12 months.

With such a dramatic difference in stock price performance that has boosted Tesla and weighed on Rivian Automotive, it’s no surprise that Tesla is profitable while Rivian is not. A closer look is needed to determine whether this dramatic difference in share price performance is warranted.

Tesla (NASDAQ:TSLA)

At a P/E of 71.6, Tesla is trading at a small discount to the automotive industry’s current P/E of 74.9. However, given the automotive industry’s three-year average P/E of 105, contradictory news headlines that are muddying the supply/demand picture for EV makers, and Tesla’s long-term stock price gains, a bullish view seems appropriate.

The big issue for EV makers currently is the large number of headlines declaring that EV sales are plunging. In fact, commentary from automakers appears to back up those headlines. For example, General Motors (NYSE:GM) CEO Mary Barra told analysts recently that the company is “taking immediate steps to enhance the profitability of [its] EV portfolio and adjust to slowing near-term growth.”

However, EV sales have been hitting new record highs lately, which seems to fly in the face of such comments. For example, Cox Automotive reported in October that quarterly EV sales in the U.S. surpassed 300,000 for the first time in the third quarter. Additionally, EV sales reached a record share of nearly 8% of total U.S. auto sales, up from 7.2% in the second quarter and 6.1% a year ago.

A recent study reconciles these contradictory reports, finding that EV inventories have nearly doubled from 3% of available new vehicles in January to 6% in September. This merely suggests EV sales haven’t been as brisk as automakers have been expecting — not that EV sales are slowing.

Despite concerns about high inflation and interest rates, which are contributing to a pile-up of unsold electric vehicles, these issues seem to be short-lived and are affecting the entire car industry, not just electric vehicles. In reality, electric vehicle sales continue to reach new heights, suggesting that demand remains strong. Thus, Tesla looks like a long-term buy-and-hold position, especially given its three-year stock price gain of 53% and five-year gain of 906%.

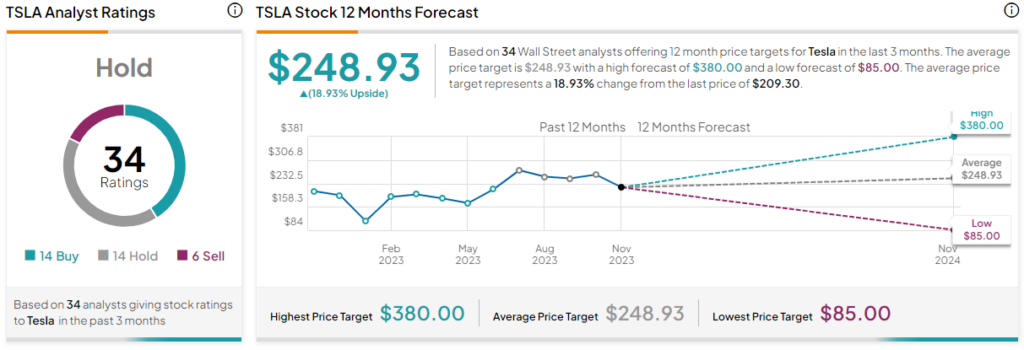

What is the Price Target for TSLA Stock?

Tesla has a Moderate Buy consensus rating based on 14 Buys, 14 Holds, and five Sell ratings assigned over the last three months. At $252.61, the average Tesla stock price target implies upside potential of 18.9%.

Rivian Automotive (NASDAQ:RIVN)

Rivian stock appears to be struggling recently due to its earlier-than-expected bond issuance. However, the company needed the extra capital to strengthen its balance sheet before geopolitical risks potentially made borrowing even more expensive than it is now. It certainly seems like a good idea now that the automaker has boosted its production guidance, suggesting a bullish view may be appropriate.

Unfortunately, the growing number of headlines suggesting that EV sales are plunging may be having an outsized impact on Rivian, given its newness relative to Tesla. However, citing robust demand, the company boosted its production forecast by 2,000 vehicles for 2023 with its third-quarter earnings report, bringing its estimate to 54,000 vehicles.

Meanwhile, other EV makers like Lucid Group (NASDAQ:LCID) have cut their production forecasts. In fact, the reports about EV sales reaching a new record high in the third quarter have also noted that Tesla’s share of the market has fallen to 50%. Reports note that Rivian is one of those eating into Tesla’s share, supported by the fact that it outpaced analyst expectations for third-quarter deliveries.

Unfortunately, Rivian is not profitable, but the trends discussed above suggest that could change quickly. In fact, the company expects to be profitable on a gross basis in 2024, with full profitability coming down the road.

Meanwhile, Tesla’s long-term stock price gains demonstrate what EV makers can expect if they’re successful in the long term. Additionally, Rivian remains well off its 52-week high of about $36, so I feel comfortable suggesting a bullish view for it right now.

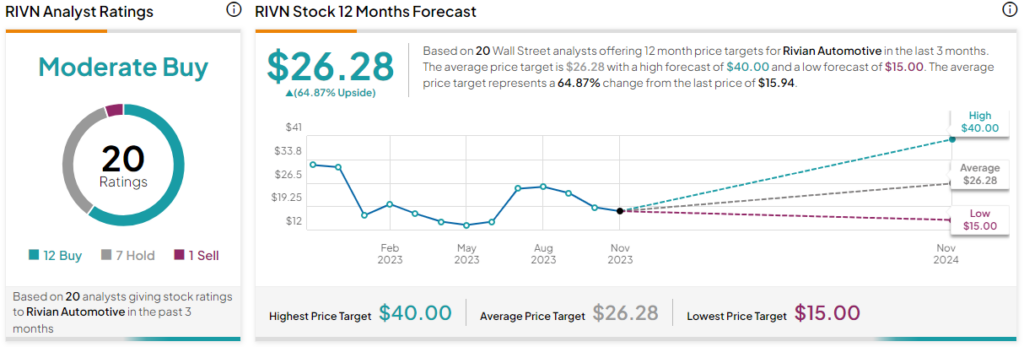

What is the Price Target for RIVN Stock?

Rivian has a Moderate Buy consensus rating based on 12 Buys, seven Holds, and one Sell rating assigned over the last three months. At $26.28, the average Rivian Automotive stock price target implies upside potential of 64.9%.

Conclusion: Bullish on TSLA, Bullish on RIVN

The headlines about allegedly slowing EV demand have certainly caused problems for EV stocks this year. However, investors shouldn’t forget about the contradictory headlines that preceded the claims of slowing demand by mere weeks.

Additionally, the current macroeconomic environment, with its relatively high inflation and high interest rates, just isn’t good for the auto market in general. However, the economy and the auto market should eventually recover, and long-term trends have been excellent for EVs, suggesting that it’s only a matter of time before EV stock prices recover.

Given Tesla’s long-running dominance and Rivian Automotive’s recent operational outperformance, it seems likely that these two companies will lead the charge as EV adoption explodes in the coming years.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue