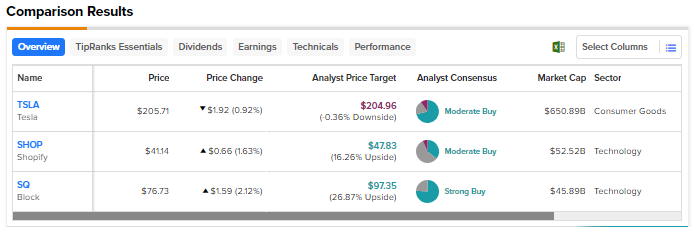

After getting battered last year by macro headwinds, several growth stocks have started this year on a positive note on improved investor sentiment. Nonetheless, the road ahead remains uncertain as continued rate hikes to tame inflation are expected to push the economy into a recession. With a long-term investment horizon in mind, we used TipRanks’ Stock Comparison Tool to place Tesla (NASDAQ:TSLA), Shopify (NYSE:SHOP), and Block (NYSE:SQ) against each other to pick the best growth stock as per Wall Street analysts.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Tesla (NASDAQ:TSLA)

Tesla stock has rallied 67% so far this year after crashing terribly in 2022. Despite supply chain issues and macro pressures, Tesla delivered upbeat Q4 2022 earnings. Overall, the electric vehicle maker’s revenue grew 51% to $71.5 billion in 2022, while adjusted EPS jumped 80% to $4.07. Moreover, free cash flow increased 51% to $7.6 billion.

The company remains confident about the road ahead and is aggressively investing in capacity expansion to ensure that it hits its production target of 50% compound annual growth rate (CAGR).

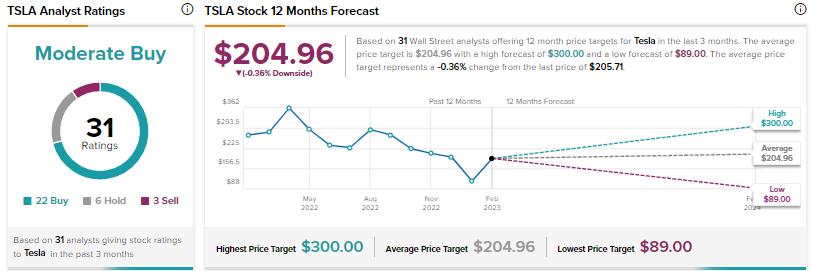

What is the Target Price for TSLA Stock?

Commenting on Tesla’s Investor Day scheduled on March 1, Barclays analyst Dan Levy feels that it could be a “sell-the-news event”, given the strong run in TSLA stock recently. However, Levy reiterated a Buy rating and a price target of $275 as he believes that the event would reinforce Tesla’s long-term potential.

The analyst noted that Tesla CEO Elon Musk recently tweeted that the Investor Day will reveal details about the company’s Master Plan 3, “the path to a fully sustainable energy future for Earth.” Levy contended that while a number of goals under the Master Plan 2 never fully materialized, the company did enhance its product portfolio and accelerated the EV transition. Investors will be looking forward to Musk’s commentary on the third-generation platform, which could be the basis for Tesla’s mass-market car.

Wall Street is cautiously optimistic about Tesla, with a Moderate Buy consensus rating based on 22 Buys, six Holds, and three Sell ratings. The average TSLA stock price target of $204.96 suggests that the stock could be range-bound over the near term.

Shopify (NYSE:SHOP)

After significantly benefiting from pandemic-induced demand, e-commerce platform Shopify has been under pressure since the reopening of the economy. Additionally, the company’s performance was hit by the impact of inflation on consumer spending.

Revenue growth slowed down considerably to 21% in 2022, compared to 57% in 2021. Moreover, the company’s Q1 2023 revenue growth guidance in the high-teen percentages spooked investors and reflected further deceleration in the top-line growth rate compared to 26% in Q4 2022.

Meanwhile, Shopify is focused on improving its profitability through efficiency and cost control measures, including job cuts.

Is Shopify a Buy, Sell, or Hold?

Recently, DA Davidson analyst Gil Luria upgraded Shopify to Buy from Hold and maintained a price target of $50. Luria believes that the post-earnings sell-off in the stock has created an attractive buying opportunity.

Luria also feels that the growth opportunity for Shopify Audiences is underappreciated by the market. Shopify Audiences is a marketing tool, supported by an audience network and machine learning, which helps merchants find “high-intent buyers” for their products. Luria opines that this tool is a great way to leverage the company’s first-party data for ad targeting and could drive gross merchandise value (GMV) expansion.

Luria also highlighted that Shopify recently hiked pricing for its Basic, Shopify, and Advanced plans by nearly 33%. This marked the first price hike in over a decade. The analyst believes that this hike could boost 2023 revenue by $200 million and EBITDA (earnings before interest, taxes, depreciation, and amortization) margin by 94 basis points.

Shopify scores 11 Buys, 18 Holds, and two Sells for a Moderate Buy consensus rating. At $47.83, the average SHOP stock price target implies 16.3% upside. Shares have risen over 18% year-to-date.

Block (NYSE:SQ)

Fintech giant Block recently reported mixed fourth-quarter results, but what impressed investors was the company’s assurance to improve its profitability through financial discipline and the growing adoption of its Square and Cash App ecosystems by customers.

In 2022, 44% of the Square ecosystem’s (comprises financial solutions for sellers or small businesses) gross profit came from sellers that used four or more monetized products. Meanwhile, Cash App had 51 million monthly transacting actives in December 2022, up 16% year-over-year.

The company expects to deliver adjusted EBITDA of $1.3 billion in 2023, supported by its cost control measures.

Is Block a Buy Right Now?

Following the Q4 print, Wolfe Research analyst Darrin Peller increased his price target for Block to $95 from $80 and reiterated a Buy rating.

“SQ intends to hold its stated profit targets for 2023, suggesting the ability to flex its spending in the event that growth comes in slower than expected. We believe this may give investors a sense of increased visibility into future profitability, something that some have found to be uncertain at points prior to the print,” said Peller.

Overall, Square earns the Street’s Strong Buy consensus rating based on 19 Buys and six Holds. The average SQ stock price target of $97.35 suggests about 27% upside. Shares have advanced 22% so far in 2023.

Conclusion

Wall Street believes in the long-term prospects of the three growth stocks that we discussed here. However, analysts are more bullish about Block compared to Tesla and Shopify. The rapid adoption of digital payments and a huge addressable market are expected to drive Block’s growth in the years ahead.