There is a lot to like right now about Trevena (TRVN), says H.C. Wainwright analyst Douglas Tsao.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Tsao’s positive thesis for the drug maker is based on the latest developments regarding Olinvyk, the company’s opioid agonist which last year gained FDA approval for the treatment of moderate to severe acute pain in adults. The drug was launched earlier this year, and all is going swimmingly so far.

“Even though the Olinvyk field force has only been active since February and mostly through digital channels, Trevena has already achieved 10 formulary wins and had 60 accounts in various stages of review as it makes progress toward a goal of 100 wins by the end of the year,” the analyst said.

The goal is reasonable enough, according to Tsao, who also believes the wins are a strong indication the drug is “gaining traction.” Although, to date, the “digital engagements” have been relatively successful, and brought contact with 98% of the target audience – far higher than the industry average – Tsao thinks that as more sales calls are done in person, the pace of wins will pick up, with “the latest proportion increasing to 70%.”

Additionally, a new clinical outcome study is slated to launch in 3Q, which will further showcase Olinvyk’s safety profile.

The open-label study will enroll approximately 200 patients and will further define “safety outcomes in the postoperative setting” vs. historic opioid data. The “prestigious” Cleveland Clinic will take charge of the study.

As data for this type of drug class is generally “sparse” and there is no consensus on methodology, Tsao is excited about the use of new continuous monitoring technology for the respiratory safety assessment. Another element to look out for will be the “cognitive function outcome” – in earlier studies, investigators had “anecdotally observed a benefit.”

“Though it is still unclear if this data can be used for a label expansion or be added to the label, another safety assessment should bolster Olinvyk’s already strong body of published literature and could catalyze further formulary wins,” the analyst further noted.

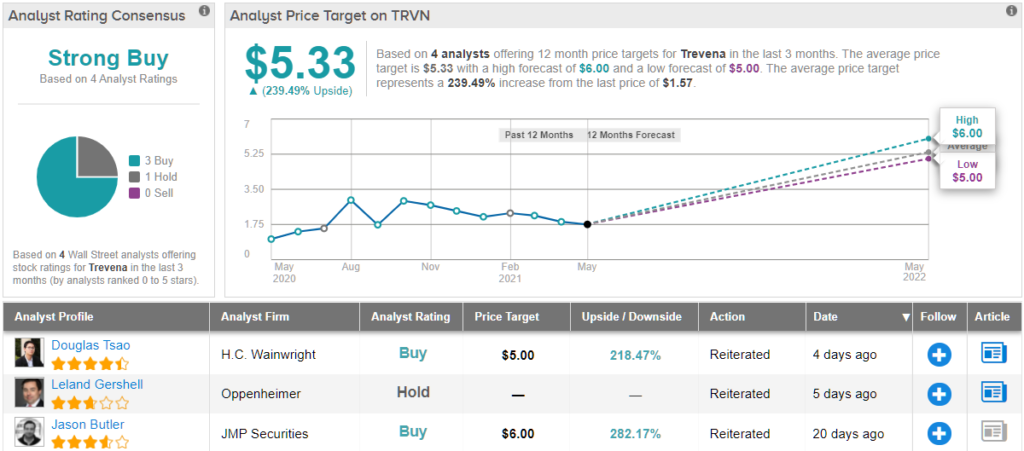

Tsao’s confidence in Trevena’s success is confirmed by a Buy rating and $5 price target. The implication for investors? Investors stand to pocket ~218% gain should the analyst’s thesis play out. (To watch Tsao’s track record, click here)

The rest of the Street has no doubts concerning Trevena’s prospects, either. TRVN’s Strong Buy consensus rating is backed by 3 Buys and 1 Hold. The average price target stands at $5.33, and implies possible upside of ~239% over the next year. (See TRVN stock analysis on TipRanks)

To find good ideas for biotech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.