Topgolf Callaway (NYSE:MODG) stock is down more than 50% from its 52-week high. There are plenty of beaten-down growth stocks out there, but Topgolf Callaway stands out because analysts say that its shares can more than double, as we’ll discuss below. I’m bullish on Topgolf Callaway based on its depressed price, reasonable valuation, favorable analyst outlook, and the long-term potential of its fast-growing Topgolf business.

Topgolf: The Growth Driver

Callaway, the maker of golf clubs and other equipment, already had a nice niche for itself in high-performance golf equipment. However, the company transformed dramatically in 2021 when it acquired Topgolf.

If you’ve never been to a Topgolf location, you can think of it as a driving range that features electronic tracking of golf balls and a variety of games, along with food and beverages. It’s a great place for “on-course” golfers (golfers that use traditional golf courses) to go and brush up their skills, and it’s also a hit with beginners, families, and groups who can hit golf balls in a fun environment while enjoying a day out.

The company plans to expand Topgolf’s footprint rapidly. MODG opened two new Topgolf locations during the most recent quarter and is on track to open 11 stores for the full year. Similarly, the company’s goal is to open 11 new venues per year, going forward. There is ample runway for Topgolf to keep growing, as there are only 89 locations open in the United States.

Topgolf is a major growth driver for MODG. During the most recent quarter, Topgolf’s revenue increased by $67.1 million to $471 million, good for a year-over-year increase of 16.6%. Furthermore, these venues are profitable. MODG is on track to achieve its goal of “four-wall” adjusted EBITDAR margin of 35% by 2025.

The Gift that Keeps on Giving

The growth of Topgolf could be the gift that keeps on giving for MODG as it grows the overall popularity of the sport. A survey from the National Golf Foundation found that 10% of on-course golfers credited Topgolf with introducing them to the game.

CEO Chip Brewer expects that each year, these 11 new venues will create three to four million new “off-course” golfers (those that engage in golf-related activities or games outside of traditional golf courses), which he believes will “help drive growth across the entire modern golf ecosystem.” This growth has the potential to create a powerful flywheel effect, as these newly-minted golfers will need clubs, balls, and apparel from Callaway and its competitors.

Why is MODG Stock Down?

So why is the stock down? The story is now more complicated than a simple golf equipment business, and the market likely isn’t appreciating the flywheel effect that Topgolf will have for the rest of the business as it helps to grow the game.

There has also been plenty of talk of rising inflation and a fragile economy curbing the consumer’s discretionary spending power. Still, this doesn’t seem to be playing out on the ground, as the company has reported seven consecutive quarters of same-venue sales growth.

More broadly, The Wall Street Journal recently published an article stating, “Americans can’t stop spending” despite economic challenges, so a nationwide belt-tightening doesn’t seem to be on the horizon. The category benefiting the most? Recreation.

Skeptics also seem to think that golf experienced a one-time boom during the COVID-19 pandemic and that many of these new golfers will eventually hang up their spikes. However, this may not be as drastic as many expect. Golf Digest reports that while rounds played in the U.S. declined by 3.7% last year following a record-setting 2021, the total was still 15% higher than during 2017-19, indicating that the game is in healthier overall shape than it was before the pandemic.

Because of this uncertainty, the market is treating Topgolf Callaway as a “show-me” story, but if the company continues to execute, the market will eventually come back around to it.

Is MODG Stock a Buy, According to Analysts?

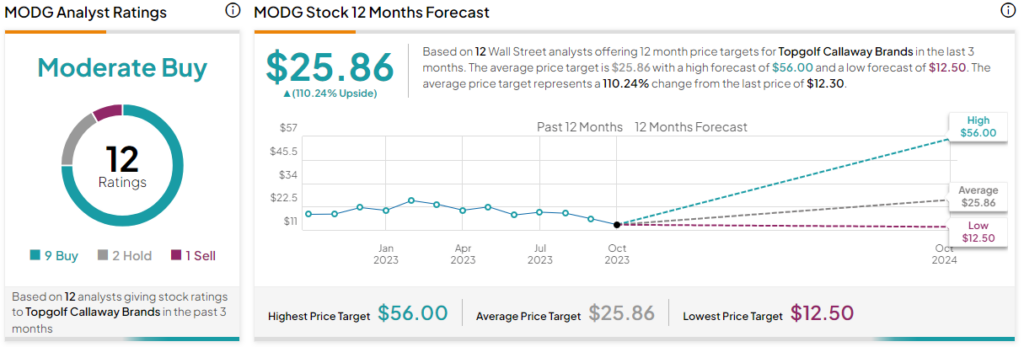

Turning to Wall Street, MODG earns a Moderate Buy consensus rating based on nine Buys, two Holds, and one Sell rating assigned in the past three months. The average MODG stock price target of $25.86 implies 110.2% upside potential.

Some sell-side analysts are even more bullish. Randal Konik from Jefferies has a Street-high $56 price target on the stock, implying upside of 355% from current levels. Meanwhile, Ivan Feinseth of Tigress Financial has a $38 price target on the stock, implying potential upside of nearly 210%.

Even the lowest forecast on the Street, a $12.50 price target from Morgan Stanley’s (NYSE:MS) Megan Alexander, is near where shares trade today, indicating that much of the downside may already be priced into the stock.

Investor Takeaway

As Topgolf continues to rapidly grow its footprint each year, revenue is likely to keep increasing, and the flywheel effect will become more powerful as more new golfers buy equipment and apparel. Further, investors aren’t paying a premium for this growth as the stock trades for a reasonable 14.4 times forward earnings estimates.

Also, sell-side analysts see considerable upside in shares, as the average analyst price target is more than double the current share price.

I view Topgolf Callaway as an attractive growth stock based on its unique business model, the high growth potential of the Topgolf concept, its favorable analyst outlook, and its reasonable valuation. I own a small position in the company.