Ah yes, the metaverse. A technological sensation, years in the making, which has been catapulted to the top of trending internet searches everywhere, is now driving investor interest across multiple companies, both large and small. As more applications and opportunities for monetization come into view, more firms are getting involved, and the speculative winners begin to be chosen.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The metaverse, a digitized virtual reality realm to be shared over a multitude of platforms and for innumerable uses, must be powered by more than just the gaming or social media developers themselves.

Here are two top metaverse stocks that have been identified by financial analysts as eventual benefactors of the proliferation of the virtual realm.

Nvidia

This graphics processing unit firm has seen its valuation nearly double over the last year, with several jolts to its share price occurring on the heels of Meta Platform’s (FB) name and business model shift. The Nvidia Corporation (NVDA) is anticipated to produce many of the necessary graphics infrastructure that will operate metaverse-linked software, as well as supply much needed data center and cloud-computing hardware.

In his recent report, Vijay Rakesh of Mizuho Securities noted this tailwind of demand. He explained that partnerships with hyperscaler companies like Meta could drive demand, as FB accelerates its own heavy investment into the space.

Rakesh rated NVDA a Buy, and assigned a price target of $335.

The truth is, the technology company is already seeing massive demand for its RTX graphics cards, with many stores out of stock and others marking them up past their MSRP. Meanwhile, Rakesh noted that NVDA recently unveiled its new generation of RTX cards at CES in Las Vegas.

The analyst remains bullish for the long-term, stating that gaming is maintaining a productive demand and should not be affected by seasonality. He sees a possible tailwind further aiding Nvidia as supply chain constraints ease through the back half of this year.

On TipRanks, NVDA has an analyst rating consensus of Strong Buy, based on 24 Buy and 2 hold ratings. The average Nvidia price target is $359.17, suggesting a possible 12-month upside of 39.07%.

Matterport

What’s a three-dimensional universe going to do without the ability to include 3D buildings and digital infrastructure? Not enough, believe analysts covering 3D space-capturing company Matterport Inc. (MTTR), as several throw their confidence behind the nascent firm. After going public nearly a year ago in February 2020, MTTR saw its valuation spike more than two-fold not-so-coincidentally with Meta’s announcement. Since then, it has come down considerably, allowing investors for potential entry at a discount.

Daniel Ives of Wedbush Securities delivered an enthusiastic report on the stock before the end of 2021, and before its shares came down over 55%. However, that does not make him incorrect, as the underlying fundamentals of the company have yet to reflect the stock’s recent weakness.

Ives rated the stock a Buy, and assigned a price target of $38. This came as a raise from his previous target of $30.

Noting Matterport’s massive $240 billion TAM and possibilities for monetization with subscription-based user plans, Ives could not have been more bullish for the long-term.

Writing that he believes the stock to be within “the early innings of a massive growth story playing out over the coming years,” he sees it as a huge benefactor of metaverse-related advancement. Moreover, he added that Matterport is one of his “favorite ideas heading into 2022,” and that the stock “remains under the radar.”

All it may take to see considerable upside is for “the radar” to pick up this stock, along with other large metaverse tech names.

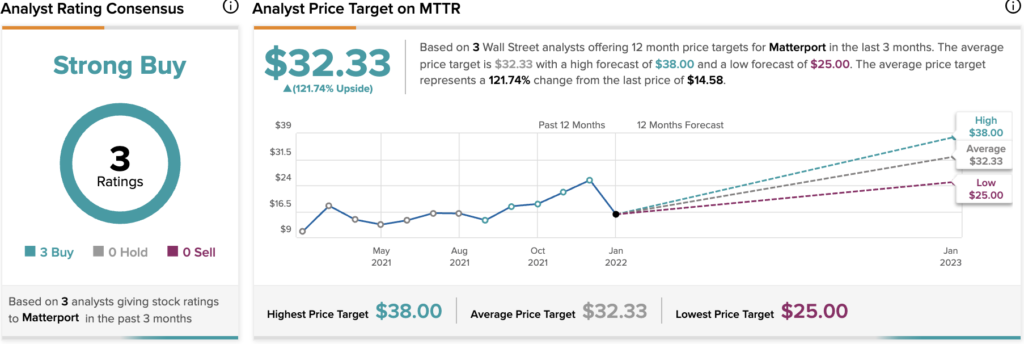

On TipRanks, MTTR has an analyst rating consensus of Strong Buy, based on 3 Buy ratings. The average Matterport price target is $32.33, indicating a possible 12-month upside of about 121.74%.

Download the TipRanks mobile app now

Read full Disclaimer & Disclosure