Macro headwinds have taken a bite out of the top e-commerce stocks over the past year. However, despite recession fears and retail woes, Wall Street analysts are still upbeat about some of the larger players in the space. As the Federal Reserve does its best to put a “soft landing” pad into place, digital retail may be the corner of the tech sector with the most room to run.

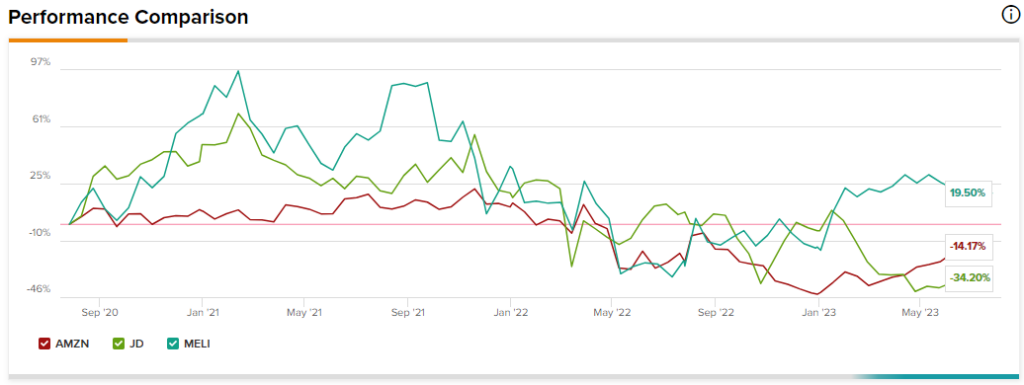

Therefore, let’s use TipRanks’ Comparison Tool to check in on three Strong-Buy-rated e-commerce stocks, AMZN, JD and MELI, to see how the risk/reward stands.

Amazon (NASDAQ:AMZN)

Despite mega-cap tech’s impressive run, Amazon stock remains down just over 30% from its all-time highs of around $186 hit back in mid-2021. Undoubtedly, the “roaring 20s” spending spree seems to be over, but Amazon has other drivers that could help it keep the recent momentum going for a while longer before cloud and retail have a chance to heat up again.

As the market continues rewarding AI stocks, I do think Amazon could have a pathway to new highs, given its skin in the AI game. Further, Amazon looks like a company with the most to gain from the rise of automation robotics. All things considered, I’m staying bullish on Amazon stock.

The company is slated to reveal its second-quarter results on August 3. Should AWS (Amazon Web Services) and e-commerce growth top the modest slate of estimates, I’d look for the stock to extend its rally. That said, I wouldn’t get my hopes up going into the number, as it could take another few quarters for meaningful growth re-acceleration.

In the meantime, expect generative AI services, like Amazon Bedrock (a tool for developers), to drive the share price higher as pre-recession headwinds work their course. If Amazon drops more news on its AI innovations and perhaps more info on the pricing front, the stock may be able to score more AI upside.

Nevertheless, at over 300 times forward price-to-earnings, Amazon stock trades at a huge premium to the internet retail industry average of around 81 times, so this is something to consider.

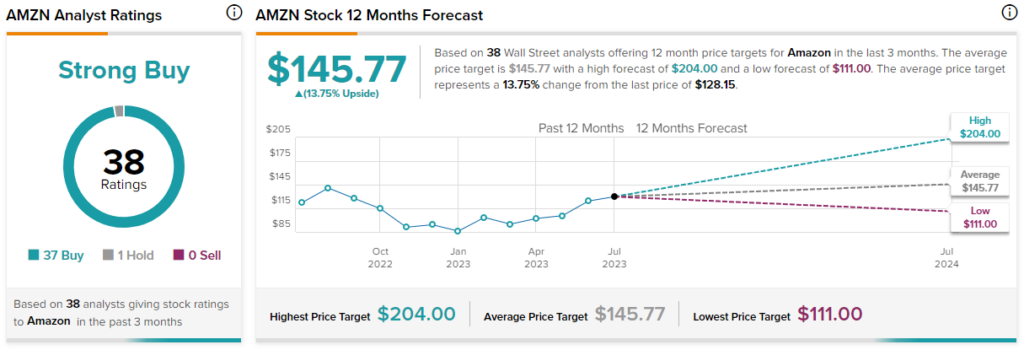

What is the Price Target for AMZN Stock?

Amazon stock’s a Strong Buy on Wall Street, with 37 Buys and one Hold assigned in the past three months. The average AMZN stock price target of $145.77 implies 13.75% upside potential.

JD.com (NASDAQ:JD)

JD.com is a Chinese e-commerce company that’s really felt the weight of the weakening Chinese economy. At writing, shares are down more than 63% from their 2021 all-time highs. The latest slip followed the release of some sluggish Chinese economic data.

As shares of JD fluctuate at multi-year lows, I do see deep value for those brave enough to step into a name that possesses more risks than that of a domestic e-commerce play. At these depths, I view JD as one of the best bargains in global e-commerce. For that reason, I am staying bullish on the stock.

If the weak Chinese economy isn’t enough, there’s the geopolitical risk involved with betting on any Chinese-listed company. For many, the risks are too massive, even given the potentially astronomical reward to be had. Though I wouldn’t encourage anyone to take on more risk than they can handle, I do think moves made by The Big Short’s Dr. Michael Burry are noteworthy.

Reportedly, Burry’s Scion Asset Management held 250,000 JD shares as of the end of the first quarter. Though it could take some time for Burry’s bold bet to pay off, a rebounding Chinese economy could be more than enough to send JD rocketing higher. Of course, investors will need to brave the wreckage like Burry is to make the most of any such surge.

At 12.8 times forward price-to-earnings, JD stock certainly appears to be one of the cheapest of the internet retail batch.

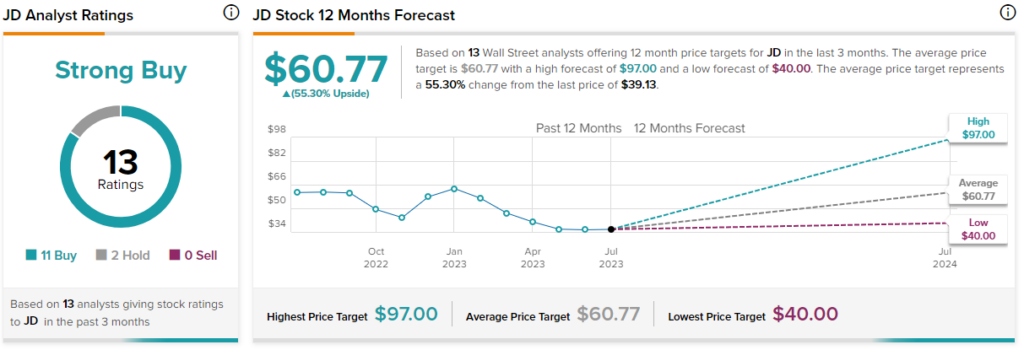

What is the Price Target for JD Stock?

On TipRanks, JD is a Strong Buy, with 11 Buys and two Holds assigned in the past three months. The average JD stock price target of $60.77 implies a massive 55.3% upside potential.

MercadoLibre (NASDAQ:MELI)

MercadoLibre is a Latin American e-commerce company that’s also well off (around 40%) its 2021 highs. However, this year, the stock experienced considerable relief, thanks in part to recovering sales and payment volumes. Management is upbeat about growth prospects from here, noting its plans to hire 1,700 more engineers this year.

Undoubtedly, it’s a good sign that MercadoLibre is hiring in an era of widespread tech layoffs. Though shares aren’t cheap, I’m inclined to maintain a bullish stance as the company looks to beat on earnings for the fifth-straight quarter.

Up ahead, Bank of America (NYSE:BAC) warned that Brazil’s new cross-border tax could impact the company’s coming results. Whether the headwind puts a stop to the streak of earnings beats remains to be seen, however. Following the bank’s latest downgrade (to $1,350 from $1,680), I believe expectations are a tad too low going into the second quarter reveal slated for August 1.

The stock goes for 96.6 times trailing price-to-earnings, just slightly higher than the internet retail average. Still, for investors seeking growth in Latin American retail, MELI stock appears to be a great pick.

What is the Price Target for MELI Stock?

MercadoLibre comes in as a Strong Buy, with seven Buys and two Holds. The average MELI stock price target of $1,536.11 implies a 30.6% gain from here.

Conclusion

E-commerce stocks still hold a lot of upside potential as the market looks past a potential recession. Currently, analysts expect the most gains (~55%) from the JD stock.