Every investor seeks to reap the rewards of their stocks; otherwise, they wouldn’t be involved in the markets. However, discovering the ideal investment, one that will yield profits, can prove to be a challenge, particularly in today’s market environment.

To ensure solid returns, investors can follow two straightforward strategies. The first is to buy low and sell high. That is, find a cheap stock with sound fundamentals and good prospects for growth – and buy in to take advantage of the growth potential. The second strategy is to invest in dividend stocks, which provide regular payouts, allowing investors to earn returns on their investment.

Keeping these strategies in mind, we’ve used the TipRanks database to identify two stocks that offer dividends of at least 11% yield – that’s more than 6x higher than the average yield found in the markets today. Both of these stocks have received Buy ratings and have positive analyst reviews on record. And all that for a cost of entry below $10. Let’s take a closer look.

Nordic American Tanker (NAT)

First up on the list is Nordic American Tanker, a Bermuda-based operator in the shipping industry that specializes in transporting crude oil and other petroleum products. Nordic operates a fleet of 19 Suezmax-sized tankers, the largest vessels that can safely transit the Suez canal. These ships, all weighing in between 150,000 and 160,000 tons, are workhorses of the global tanker fleet, using the Suez route to shorten travel times between the Middle East and Asia to Europe and the North Atlantic.

The global tanker business took a hit earlier this month, when Saudi Arabia announced oil production cuts up to 1 million barrels per day. The cuts are intended to boost prices for the OPEC cartel – but will also reduce volumes on the world’s trade routes, cutting into tanker companies’ revenues. Nordic, however, with its fleet of mid-sized tankers, is well-positioned to capitalize on continued demand for oil along the world’s secondary petroleum trade routes – and to offer a more efficient option for Middle East traders who might have difficulty filling a 300,000 ton Very Large Crude Carrier to full capacity.

So, Nordic American is looking at a unique opportunity going forward. Looking back at the first quarter of this year, we find that the company reported $87.09 million at the top line, more than $5.5 million over the estimates. At the bottom line, Nordic’s 22-cent non-GAAP earnings per share came in 2 cents better than expected. These results were supported by time charter equivalents (TCEs) on the company’s 15 spot vessels that exceeded $60,000 per day per ship. The company’s operating costs come to about $8,000 per day per vessel.

In response to the strong quarter, the company declared a Q1 dividend, which was paid on July 6, of 15 cents per common share. Nordic has a dividend history stretching back to 1998, and has a policy of basing the current payment on the previous quarter’s earnings. The current dividend annualizes to 60 cents per share, and gives a sky-high forward yield of ~16%.

In his coverage of this stock for B. Riley, 5-star analyst Liam Burke notes how the current Saudi production policy will impact Nordic, writing, “Although VLCC vessel demand will be weaker as a result of the Saudi supply cuts, there will be an increased need for smaller crude carriers and favor operators such as Nordic American. It is anticipated that the Saudi supply gap will be filled by other Middle East producers as well as the U.S., Brazil, and Mexico and shift trade patterns towards producers that are traditional markets for smaller crude carriers such as Nordic American’s Suezmax vessels. The production shift further increases overall crude vessel ton-mile demand. The company has also capitalized on a strong spot rate environment to reduce earnings volatility by fixing a percentage of its fleet on longer-term fixed-time charters.”

Burke goes on to rate Nordic shares as a Buy, and his $5.50 price target suggests a one-year upside of 45.5%. Based on the current dividend yield and the expected price appreciation, the stock has 61.5% potential total return profile. (To watch Burke’s track record, click here)

Overall, there are 3 recent analyst reviews of this stock, and they are all positive – for a unanimous Strong Buy consensus rating. The shares are selling for a $3.78 with an average price target of $4.63, pointing toward a 22.5% upside on the one-year horizon. (See NAT stock forecast)

BrightSpire Capital (BRSP)

Shifting focus, we turn to BrightSpire Capital, an internally managed Real Estate Investment Trust, or REIT. There’s no surprise finding a REIT listed in a space about high-yield dividends; these companies, which buy, manage, operate, and lease various forms of real properties, use dividend payments to comply with regulatory requirements on capital return.

BrightSpire, which holds a portfolio made up of 100 loans and having an undepreciated value of $4.8 billion, is a leader in commercial real estate financing. The company works mainly with apartment complexes and office buildings; 40% of its total portfolio is in multifamily dwellings, and 38% is in office space. Another 10% of the company’s investments are in hotels. Currently, 100% of BrightSpire’s portfolio is made up of floating rate loans.

This portfolio brought the company total revenues of $58.56 million in the first quarter of this year, a total that beat the forecasts by $3.26 million. At the bottom line, BrightSpire’s adjusted EPS of 27 cents per share was 3 cents better, or about 12.5%, than the expectations.

The adjusted EPS fully covered the company’s quarterly dividend payment, which was declared in June for 20 cents per common share. This dividend annualizes to 80 cents per share, and gives a yield of 11.1%, far above the market average and nearly 4x higher than the current rate of inflation.

This stock caught the eye of Raymond James’ 5-star analyst Stephen Laws, who likes its diverse portfolio and positive exposure to the current increased interest rate regime. Laws sets out his opinion of BrightSpire in a clear note: “Our Outperform rating reflects the portfolio diversification, attractive loan portfolio characteristics (floating rate senior loans), benefits of increasing interest rates, our portfolio return estimates, and the strong dividend coverage. While there is material upside to our target, we believe our rating is appropriate given our expectation of little, if any, near-term growth and sector headwinds persisting.”

These comments back up Laws’ Outperform (i.e. Buy) rating, while his $8 price target implies ~11% upside potential for the coming year. (To watch Laws’ track record, click here)

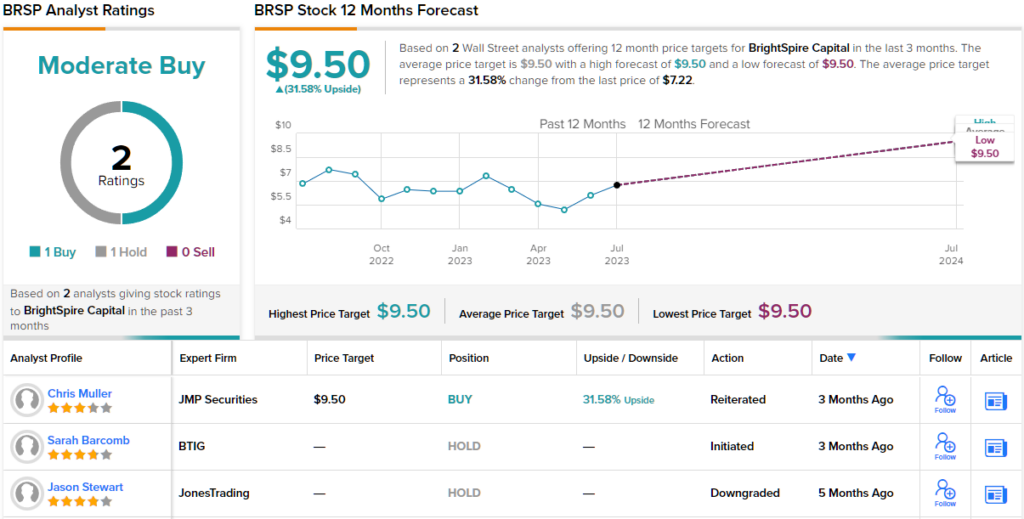

BrightSpire has stayed relatively under-the-radar, with its Moderate Buy consensus rating breaking down into 1 Buy and 1 Hold. The stock is selling for $7.22 and its average price target, at $9.50 per share, suggests it will gain ~32% in the next 12 months. (See BrightSpire stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.