Thanksgiving is here, marking the start of the 2024 end-of-the-year holiday season – and what better time to get your stock portfolio in order for the coming year?

Investors get into the market for a whole range of reasons, and bring their own array of skills and opinions, but the end goal is always the same: to generate a return and realize a profit.

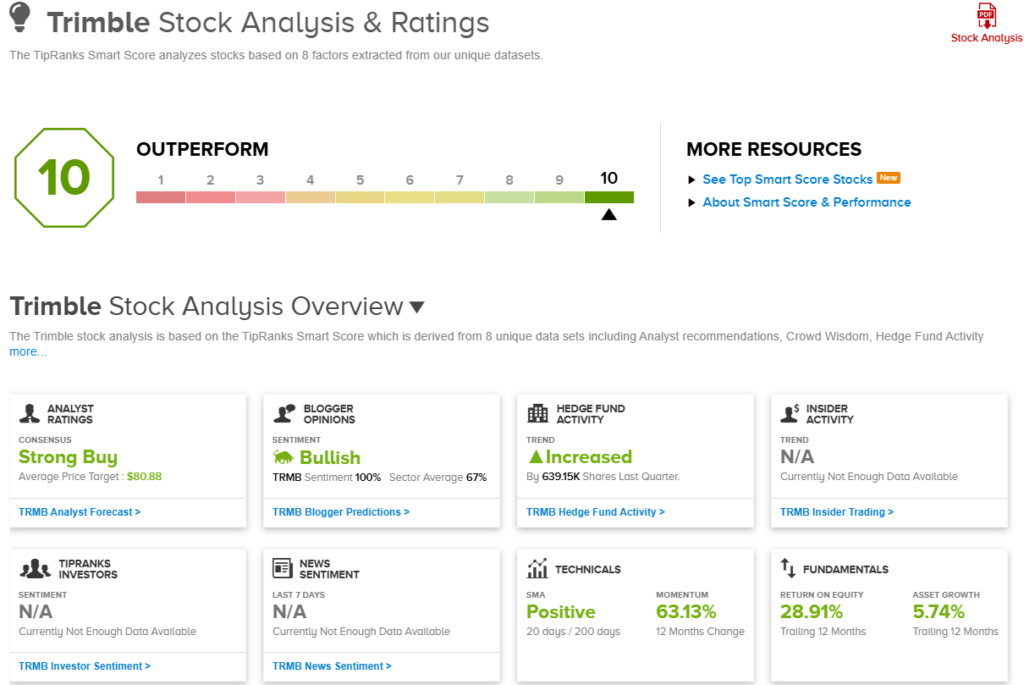

That requires good stock-picking, and the Smart Score tool is available to smooth out that process. The Smart Score is a data collection and sorting tool, developed by TipRanks to make use of AI and natural language processing in gathering and sorting the data generated by the stock market – all of the data, put up by thousands of traders dealing in thousands of stocks, for tens of millions of daily transactions.

The Smart Score uses this data to rate every stock against a set of factors that have proven to be sound predictors of future outperformance. Each stock is given a simple score, on a scale of 1 to 10, with the ‘Perfect 10’ indicating stocks that definitely deserve a discriminating stock picker’s attention.

So, let’s make good use of the Smart Score, and take a look at two top-scoring stocks to watch as 2024 wraps up.

Delta Airlines (DAL)

We’ll start in the airline business. Delta Airlines, with its market cap of more than $41 billion, is the largest player in the industry. The company employs 100,000 people and, from its Atlanta headquarters and hub, it oversees a network that encompasses over 4,000 daily flights to 280 destinations across the globe. Delta connects such major regional and international hubs as Boston, New York, LA, Mexico City, Seoul-Inchon, Tokyo, London, and Amsterdam.

Delta operates a fleet of nearly 1,000 aircraft – 992 as of November 25 this year – on its routes, including some of the airline industry’s largest and smallest commercial passenger jets. The company has a history of preferring Boeing jets, but in recent years has been increasing the Airbus liners in its fleet. In the last reported quarter, 3Q24, Delta took delivery of 27 new airliners. In addition, the company announced that in 2025 it will offer over 700 weekly flights to more than 33 destinations and will inaugurate 7 new routes.

That said, looking at the last quarter’s financial results, we find that Delta missed at both the top and bottom lines. Revenue came in at $14.59 billion, relatively flat year-over-year and $700 million below the forecast. At the bottom line, Delta’s non-GAAP EPS came to $1.50, missing the estimates by a nickel. On a more positive note, Delta had an operating cash flow in the quarter of $1.3 billion, and the quarterly free cash flow of $95 million fed into the year-to-date FCF total of $2.7 billion.

This stock has caught the eye of Morgan Stanley’s Ravi Shanker, an expert on the airline industry, who sees plenty of potential here for investors, especially in the long-term free cash flow.

Following the Q3 results and recent Investor Day, Shanker wrote, “We believe the stock has a long way to go. While the LT EPS guide came in modestly below the Street and comfortably below MSe, we view this guide as extremely conservative… The stock… is still very attractively valued vs. history at ~8x our 2025 EPS. While some investors may not have received the fireworks that they had been looking for (ie. detailed loyalty disclosure or big buyback announcement), the fact that DAL is expecting to generate over 1/3rd of its market cap in FCF over the next 3 years (potentially up to 40%) should draw Long-Only investors toward the story anyway, whether this goes into deleverage or buybacks (or eventually both).”

For Shanker, this stance adds up to an Overweight (i.e. Buy) rating on DAL, with a price target of $100 to indicate room for a one-year upside of 57%. (To watch Shanker’s track record, click here)

Delta’s stock has a Strong Buy consensus rating, based on a unanimous 18 positive Wall Street reviews set in recent weeks. The shares are trading for $63.62 and their $75.19 average price target suggests a gain of 18% on the one-year horizon. (See DAL stock forecast)

Trimble (TRMB)

Next up on our list of Perfect 10s is Trimble, a tech firm with a niche in high-tech manufacturing processes. That’s not quite as redundant as it sounds – what Trimble does is provide specialty technology services, in such fields as inertial navigation, aerial drones, laser rangefinding, and even global navigation satellite systems. The company’s products and services are found in everything from agriculture to utilities, with the construction, government, and transport sectors in between. In addition, Trimble also provides software platforms and services to tie all of this together, in a unified package designed to bring out the best in modern manufacturing.

Trimble’s history is in high-tech hardware, but the company has been shifting its emphasis toward software, data analytics, and AI. The company offers several product suites, designed to bring solutions to bear on particular sectors. These include the Construction One suite, designed to simplify construction technology projects with an emphasis on staying on time and on budget; the Unity suite, designed to centralize data and workflows, for enhanced outcomes and lower asset ownership costs; and the TMW.Suite, to merge operational, administrative, and safety tools into a single solution in the transportation sector. The company is also leveraging AI technology in its software systems, to generate the best results from data analytics and reporting.

The company’s recent 3Q24 results were seen as strong – and the shares spiked almost 18% after the release. The company’s revenue came to $875.8 million. While this was down 8.5% year-over-year, it beat the forecast by over $11 million. At the bottom line, Trimble’s earnings hit 70 cents per share by non-GAAP measures, and were 8 cents per share better than had been anticipated. Looking ahead, the company revised its full-year revenue guide upwards, into the range of $3.625 billion to $3.665 billion, better than the $3.63 billion expected on Wall Street.

For 5-star analyst Jerry Revich, of Goldman Sachs, this stock simply offers a solid prospect for further gains – and that gets his full attention. Revich says, “We maintain our Buy rating on the stock as we see scope for sustained subscription adoption across TRMB’s software portfolio, and as a result continued strong growth for the company’s highest multiple and margin businesses… We note TRMB has consistently beaten the high end of its EPS guidance over the past three years…”

Along with that Buy rating, Revich puts a price target of $87.40 on TRMB shares, showing his confidence in a potential one-year gain of 20.5%. (To watch Revich’s track record, click here)

The Strong Buy consensus rating on Trimble’s stock is based on 5 recent analyst reviews, including 4 to Buy and 1 to Hold. The shares have a current trading price of $72.43 and their $79.88 average target price implies an upside of 10% for the coming year. (See TRMB stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Questions or Comments about the article? Write to editor@tipranks.com