Now that the first half of the year is fully behind us, we can take its measure – and what we see illuminates both hopes and risks. On the positive side, the stock markets have posted strong first-half gains; the S&P 500 is up nearly 17% and the tech-heavy NASDAQ has gained 24%. On the negative side, the gains are narrow, and concentrated in the tech sector; semiconductor maker Nvidia, up more than 150% so far this year, alone accounts for approximately one-third of the S&P gains.

The narrow base alone might not spook investors – it’s based on the latest AI technologies, which are rapidly proving their worth in new products and services. But it’s also an election year, and as we all know, anything can happen at the polls in November. The recent debate between President Joe Biden and former President Trump, the presumptive challenger, only served to muddy those waters further.

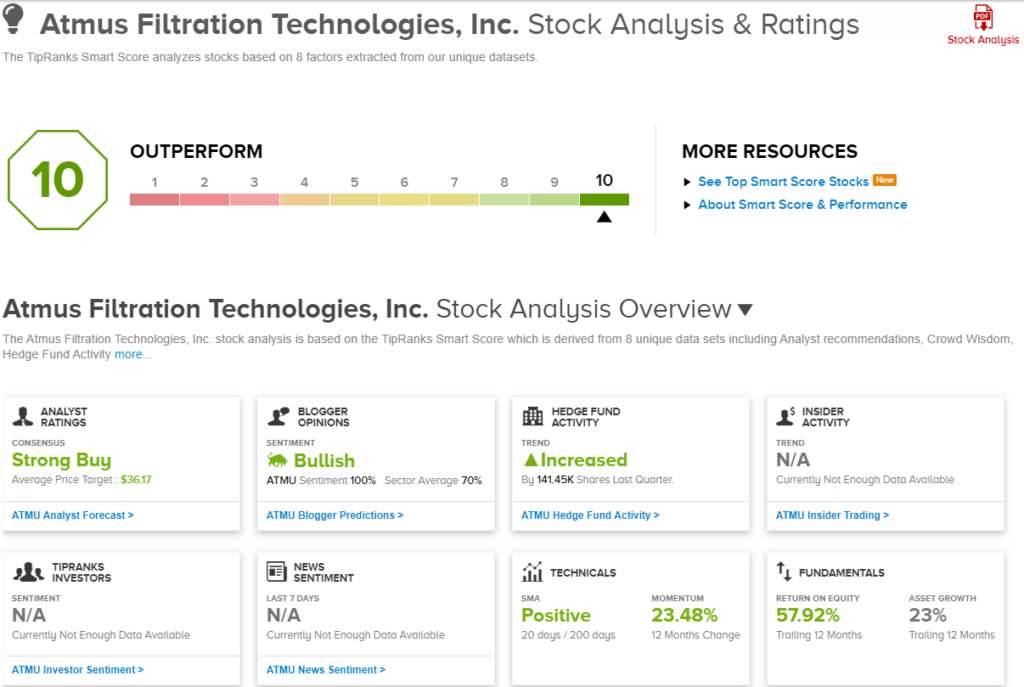

We can filter out some of those muddy waters with the right tool – such as the Smart Score, from TipRanks. This AI-based data collection and collation algorithm gathers and sorts the accumulated data of the stock market – and uses it to rate every stock according to a set of factors that have proven accurate forecasters of future performance. The result is given as a simple score, on a scale of 1 to 10, with the ‘Perfect 10s’ being stocks that deserve a closer look.

So let’s give two top-scoring stocks – ‘Perfect 10s’ – just that close look that they deserve. According to the TipRanks database, the Street’s analysts recognize these shares as Strong Buys and are predicting plenty of upside for both. Here are the details.

Janus International Group (JBI)

We’ll start with a construction-related company, a firm focused on a product that most of us never even think about, although we use it every day: doors. Janus, a design and manufacturing company, provides solutions for doors and entryways to the commercial, industrial, and construction sectors. The company works with builders and contractors, offering a variety of doorway solutions, ranging from basic to high technology. Janus incorporates leading technologies in materials, electronics, and sensors, making sure that its doors are more than simple portals.

Getting to specifics, Janus offers lines of doorways and entry systems for self-storage facilities, light industrial structures, and commercial buildings. These product lines include rolling steel doors, smart entries, hallway systems, and a range of doors made from varying materials and with varying levels of weatherproofing and security protection. Janus typically deals with enterprise clients.

Janus is also noted for its Nokē system, a smart entry system designed to enhance doors and entryways in the self-storage niche. The Nokē system provides benefits for both storage facility owners and customers, including improved security, automated lock checks, and overlocking processes. Janus advertises this system as one of many it can offer to bring new technological innovations to its best-in-class self-storage door systems.

In addition to its commitment to providing the best quality in top-end doorway products, Janus is also committed to expanding its footprint in the business. In late May, the company announced that it had acquired Terminal Maintenance and Construction, or TMC, a leading provider of terminal maintenance services in the trucking industry. TMC operates primarily in the Southeast US, and its acquisition will provide support for the expansion of Janus’ Facilitate business division, which provides a full range of facility maintenance services.

Earlier in May, Janus beat expectations when it reported its financial results for 1Q24. The company’s earnings release showed a top line of $254.5 million. While up only 1% from the prior year period, this revenue total was $1.6 million better than had been anticipated. At the bottom line, Janus’ non-GAAP EPS of 21 cents per share was 2 cents above the estimates – and the total net income of $30.7 million was up more than 18% year-over-year.

This stock has been covered by Jefferies analyst Philip Ng, who sees plenty of potential here for continued growth. He notes that Janus is executing well on its business, and writes, “Despite a mixed backdrop for self-storage REITs, JBI has seen continued momentum particularly in new construction and its backlogs have remained stable. JBI is delivering solid growth & strong margins, and capital deployment provides good optionality. With the stock trading at 7.0x 2025E EV/EBITDA, we see a path for JBI to re-rate higher now that its float has improved, and it becomes discovered by a broader shareholder base.”

The five-star analyst goes on to give these shares a Buy rating, with a $20 price target that indicates room for a 63% share appreciation on the one-year horizon. (To watch Ng’s track record, click here)

While Janus has only 3 recent analyst reviews, they are unanimously positive – for a Strong Buy consensus rating from the Street. The stock is selling for $12.25, and its $20.50 average target price implies a one-year gain of 67%. (See JBI stock forecast)

Atmus Filtration Technologies (ATMU)

Next on our list, Atmus, is an industrial firm offering a portfolio of high-quality, differentiated filtration solutions on the global market. In short, the company offers a full line of filter and filtration products to a variety of industries, including customers in the fields of agriculture; power generation; rail, marine, and truck transport; mining, oil, and gas extraction – it is a long list, as Atmus boasts hundreds of thousands of end users.

Atmus started out, and for a long time remained, a subsidiary of the major diesel engine firm Cummins. In May of 2023, Cummins began the process of spinning Atmus off as a fully independent entity; that process was completed earlier this year, when Cummins sold off its remaining interest in the filtration firm.

As an independent operator, Atmus can boast a market cap of $2.38 billion. The company is a leader in filtration technology, and protects its product portfolio and intellectual property with more than 1,250 patents – active or pending – worldwide, as well as some 600 trademark registrations and applications. The company’s filtration tech is used in a wide range of fuel, lubricant, and air systems, connected to a variety of engines and power plants. Atmus has 5 technical centers and 10 manufacturing facilities, and saw more than $1.6 billion in sales last year.

Atmus recently reported its 1Q24 results, its fourth financial release since its stock first went public last year. At the top line, the company reported $427 million in revenue, while at the bottom line it reported non-GAAP earnings of 60 cents per share.

Northland analyst Bobby Brooks covers Atmus, and he explains why investors should pay attention here: “ATMU’s Fleetguard is the premier brand for emission/efficiency parts in medium/heavy duty, on/off-highway vehicles. ATMU split off from CMI (NR) last year, with CMI exiting its remaining stake this March. Ultimately, we think ATMU’s extremely macro-resilient business, upside to accelerating top-line growth, margin expansion opportunities post-split, and clean BS create a compelling investment case.” (To watch Brooks’ track record, click here.)

To this end, Brooks gives the shares an Outperform (Buy) rating, with a $36 price target that implies a one-year upside potential of 26%.

Zooming out a bit, we find that ATMU shares have acquired 6 recent analyst reviews – and that they are all positive, giving the stock its Strong Buy consensus rating. The shares are priced at $28.55, and their average price target, $36.17, suggests that the stock has room to gain 27% over the next 12 months. (See ATMU stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.