It’s the most basic question investors face: What stocks to buy? The markets are tossing up a huge volume of data from millions upon millions of daily transactions, involving thousands of traders, dealers, and brokers, and thousands of public stocks. The data makes an imposing edifice – and is tailor made for data sorting tools like the Smart Score.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The Smart Score is an AI-powered natural language algorithm, sophisticated enough to scan, collect, collate, and analyze all those reams of data – and then to compare every stock’s latest stats to a set of factors known to match up with future share outperformance. The result is distilled down to a simple, easily readable score, a single number on a scale of 1 to 10, showing investors at a glance the likely main track for any stock. And the ‘Perfect 10’ stocks are the shares that clearly deserve a closer look.

So let’s do that, give some of these ‘Perfect 10s’ that closer look. We’ve used the TipRanks platform to pull up the details on 3 stocks that have earned the Perfect 10; these are shares that have hit all the right marks, and checked all the right boxes – and investors should give them a closer scrutiny. Here they are, along with comments from the Street’s analysts.

Don’t miss

- Buy these 2 solar stocks, analyst says, forecasting at least 90% upside potential

- ‘Time to Upgrade,’ Says Oppenheimer About These 2 AI Stocks

- Goldman Sachs Says These 2 Healthcare Stocks Have up to 130% Upside Potential

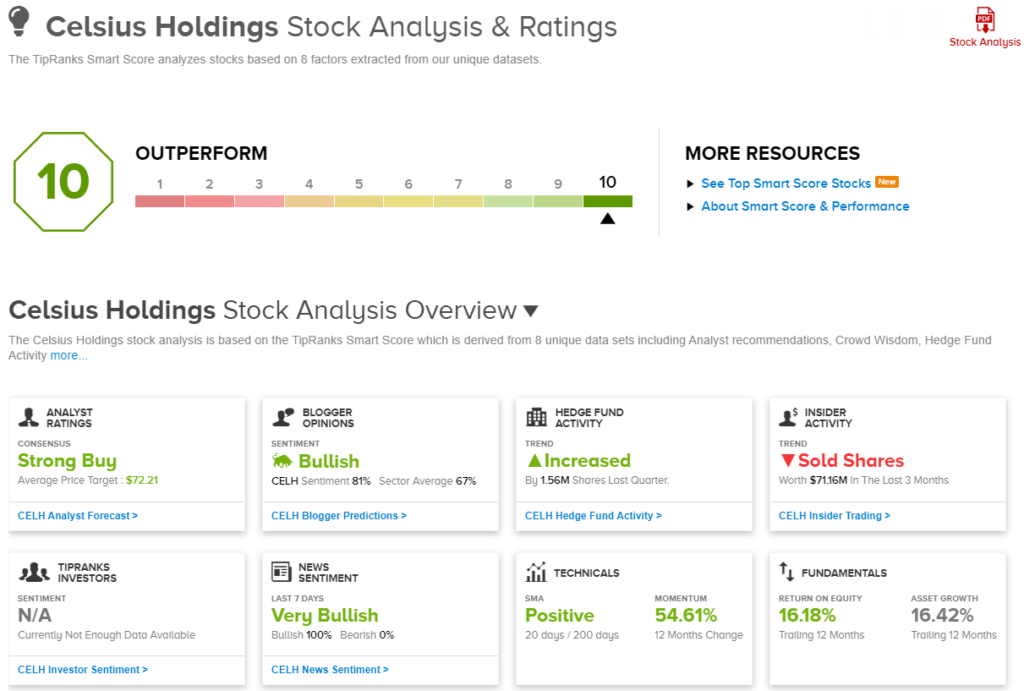

Celsius Holdings (CELH)

First up is Celsius Holdings, an energy drink and nutrition company founded in 2004. Celsius focuses on the active lifestyle niche, offering a line-up of products that includes energy drinks, quick-boost energy supplements, and protein bars.

Celsius bills itself as a partner for consumers’ active lifestyles. The company boasts that its drinks and supplements provide a full range of essential energy to boost metabolism and burn body fat. While designed to give consumers the extra lift they may need at the gym or during outdoor exercise and activities, the products are also useful during the ordinary workday, offering a combination of good taste and a power bump without recourse to artificial flavoring or preservatives. Celsius is proud that its products do not contain aspartame or high-fructose corn syrup.

It’s a value proposition that has helped the company deliver beats on both the top-and bottom-line int its recent quarterly readout. Not only that, Celsius has a record-level quarter in 3Q23, with a top line of $385 million. This represented a 104% increase from 3Q22, and was $33.5 million above market expectations. At the bottom line, the firm’s GAAP earnings of 89 cents per diluted share came in 38 cents per share better than had been anticipated.

For Jefferies analyst Kaumil Gajrawala, the key to this stock lies in the company’s overall niche potential. He writes, “Celsius’ opportunity should be framed in the context of a much bigger Energy+ category, versus Energy, which includes sports drinks, coffee, tea, and functional water. Energy+ is a $81b category (retail) in 2022 and is expected to grow 6% to $107b by 2027. For context this equates to $5b/year or $2.5b wholesale. Celsius should generate ~$1.3b in sales this year). Against this backdrop, Celsius’ only has 4% of Energy+ vs. 9% of the traditional energy drinks category. We think Celsius’ positioning as a fitness/lifestyle brand enables the company to benefit from overall category tailwinds. We expect sales to grow +39% through 2027 (5Y CAGR), equating to just 6% of Energy+.”

For Gajrawala, this adds up to a Buy rating for the stock, and a solid price target of $72.33, suggesting a one-year gain of 35%. (To watch Gajrawala’s track record, click here.)

The Strong Buy analyst consensus on CELH is based on 13 recent reviews, including 11 Buys and 2 Holds. The stock’s selling price of $53.56 and current average target price of $72.21 together indicate potential for a 35% gain on the one-year horizon. (See Celsius Holdings’ stock forecast.)

Brookfield Renewable Partners (BEP)

For the second stock on our list, we’ll turn to the energy sector – where Brookfield Renewable Partners holds an interesting niche position. The Bermuda-based firm is part of Brookfield Asset Management, one of the largest alt-investment firms operating in Canada and the owner of a 60% interest in BEP. This gives Brookfield Renewable Partners a solid backing, allowing the company to build a portfolio of energy projects, including distributed energy and sustainable energy operations, and conventional green energy projects, such as wind, solar, and hydro-electric power generation systems.

Brookfield’s approach is to leverage asset classes from the backbone of the economy, and energy fits that bill perfectly. The company moves carefully before investing, gathering operational intelligence on its investment targets and then turning its intelligence insights into actionable investment moves. The result, for BEP, is a portfolio that now includes over 8,000 power generating facilities capable of producing 31,000 megawatts of usable power output. This is power generation at a utility-grade scale, and allows Brookfield to sell power for a stable cash flow.

The company’s power portfolio is broken down into five categories, including: hydroelectric power, wind power, solar power, distributed generation, and sustainable solutions. For green-minded investors, there is sure to be something of interest here; Brookfield aims to demonstrate that responsible ‘green’ investing can walk hand-in-hand with profitability. Overall, the company’s energy portfolio is estimated at approximately $78 billion.

This activity brought BEP $1.18 billion in revenue in 3Q23, along with a normalized funds from operations (FFO) of 45 cents per share. These figures were, respectively, in-line with the forecast and 6 cents per share better than expected.

Nelson Ng, of RBC Capital, covers this energy investment firm, and he likes its ability to deploy its usable funds into projects capable of generating returns. He says, “We believe BEP is very well positioned to deploy capital at attractive returns that meet or exceed management’s 12–15% target. We think that even though public and private market renewable valuations are depressed, some peers have scaled back M&A activity and are preserving capital due to their limited access to capital and weak share prices. BEP ended Q3/23 with $4.4 billion of available liquidity, and together with institutional partners, it has the flexibility to execute large multifaceted transactions.”

With inflation starting to decelerate, Ng foresees the interest rate regime turning favorable for this stock, and adds, “We believe interest rates and inflation expectations have mostly peaked, and the depressed public and private market renewable valuations provide BEP an attractive opportunity to deploy capital at potentially premium returns.”

The analyst goes on to give these shares an Outperform (Buy) rating, with a $29 price target that points toward a 17% gain in the coming months. (To watch Ng’s track record, click here.)

The 8 recent analyst reviews on BEP break down 6 to 2 in favor of Buys over Holds, giving the shares their Strong Buy consensus rating. The stock’s $28.68 average price target suggests a 16% upside from the $24.75 current trading price. (See Brookfield Energy Partner’s stock forecast.)

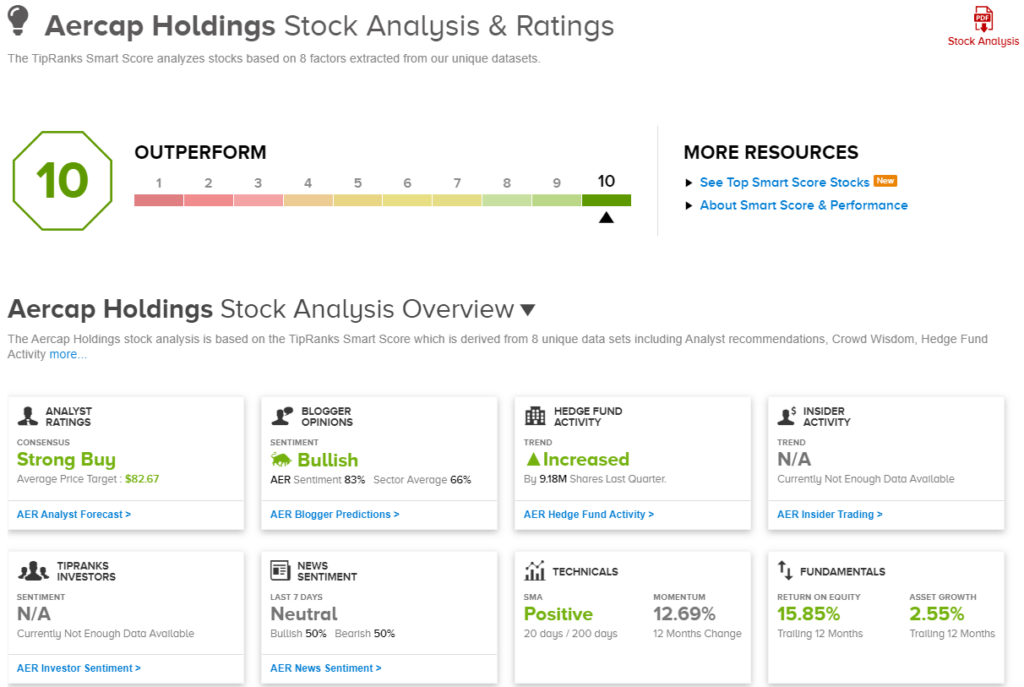

AerCap Holdings (AER)

Last on our list is AerCap Holdings, an aeronautical firm based in Dublin, Ireland. The company occupies a fascinating niche in the world of air travel – it owns commercial aircraft and engines, and leases them to carrier airlines. The company operates worldwide, as befits an important equipment supplier to the airline industry, and is the world’s largest such owner of commercial aircraft. AerCap is also the leading company in the aviation leasing industry.

AerCap boasts an impressive portfolio of aviation assets, including more than 1,700 commercial aircraft, more than 300 helicopters, and approximately 1,000 aviation engines, mainly jets. The company’s order book includes 380 technologically advanced, fuel-efficient commercial planes, and the company can provide fleet solutions to airlines at all scales.

Because – it is a little known, but not exactly hidden, secret in the airline industry that many carriers do not own their aircraft. Rather, they lease the equipment from outside providers, like AerCap, for long-term arrangements. The system works, allowing carriers to keep their planes flying, but giving them flexibility to alter their fleet composition when conditions demand.

And going by AerCap’s recent 3Q23 report, demand has been solid. Revenue came in at $1.89 billion, up 10% y/y and a modest $10 million over the estimates. The bottom-line figure, an adjusted EPS of $2.81, was 42 cents better than had been forecast. The company reported $1.3 billion in quarterly cash from operations, and finished Q3 with $2.6 billion in cash and liquid assets on hand – a 48% increase from the end of 2022. These results reflect the company’s sound position as air travel increases post-COVID.

This stock’s overall bullish outlook attracted Barclays’ Terry Ma, who drawsb investor attention to several appealing facets. “Our positive rating on AER shares is supported by the company’s strong cashflow profile and its unique capital return strategy,” Ma said. “AER has been able to create value for shareholders by selling assets at a double-digit GOS margin and buying back stock at a discount to book value and driving ~20% y/y book value growth. In addition, the lessor model is benefiting from both cyclical and secular tailwinds that should improve leasing returns going forward. AER’s leading market position as the world’s largest lessor should allow it to generate above-average returns over time.”

These comments complement Ma’s Overweight (Buy) rating, and his $80 price target implies a one-year upside potential of 18.5%.

This stock gets a unanimous Strong Buy vote from the Street, with 6 recent reviews all coming in positive. The shares are trading for $67.54 and their $82.67 average price target suggests the stock will gain 22.5% in the next 12 months. (See AerCap’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.