What to do, after a month of market crises and volatility? It looks like bank runs have been averted, but inflation remains high and the Fed is trying to tack a middle course between the risks of high prices and higher interest rates. While the market downturn that followed the failure of SVB has receded, it’s left behind a more volatile market that only underscores the uncertain circumstances facing us.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

In short, what’s needed is some signal that will cut through the clutter and shine on the stocks that offer investors the best prospects for protection or gains. Fortunately, there are two signs that can help here, and both are relevant to current conditions.

First are high dividends. The high-yield dividend stocks have long been go-to defensive plays, attractive for their combination of a steady income stream with a return that can beat inflation. But the TipRanks Smart Score offers another indicator of a stock’s quality. The Smart Score algorithm tracks thousands of publicly traded equities, and rates them all according to 8 factors, all known as accurate predictors of future overperformance. Each stock is assigned a score, an aggregate of the 8 factors, on a simple scale of 1 to 10; the ‘Perfect 10’ stocks, of course, get the highest ratings.

So let’s get started looking at stocks that bring both benefits to the table: high dividend yields, of at least 8%, plus a ‘Perfect 10’ from the Smart Score. We’ve pulled up the data on two such names, using the TipRanks platform.

Plains GP Holdings (PAGP)

First up is a major player in the North American energy scene, Plains GP Holdings. Plains operates as a holding company, and owns both a controlling general partner interest and an indirect limited partner interest in Plains All America, one of North America’s largest midstream energy firms. The company’s asset network includes some 19,000 pipeline miles, 8,000 rail tanker and 2,500 tractor trailers for crude oil and natural gas products, and a maritime interest of 20 river transports and 50 barges. The network extends from northern Alberta along the Rocky Mountains and Mississippi River to the Gulf coast of Texas, and includes extensions to the Great Lakes and Chesapeake Bay regions.

PAGP stock trades on the NASDAQ, and the shares have underperformed vs. the index this year, with the company missing the forecasts on some important metrics in the latest quarterly readout. The recent 4Q22 results showed revenues of $12.95 billion, roughly flat compared to the $12.98 billion reported in the year-ago period but down 7.6% quarter-over-quarter and coming in $2.06 billion below Street expectations.

The net income attributable to shareholders came in at $263 million, more than triple the $84 million generated in 4Q21. The per-share earnings, however, missed the forecasts, coming in at 23 cents per diluted share compared to the 73 cents expected. EPS was also down year-over-year, from 43 cents reported in 4Q21.

Despite the EPS miss, PAGP still had the confidence to boost its dividend in the last distribution announcement. The company raised the common share payment by 5 cents, to $0.2675 – a bump of 23% annualized. The full-year dividend payment now comes to $1.07 per common share and yields an impressive 8.8%, a full 2.8 points higher than the last reported annual inflation rate.

Turning to the analysts, we’ll check in with Justin Jenkins, 5-star stock pro from Raymond James, who writes of the shares, “Our relatively bullish oil macro outlook keeps us somewhat optimistic on the Permian supply-push, which should translate into a favorable macro backdrop for [Plains GP Holdings]. Over time, Plains’ vertically integrated liquids supply chain should enhance the long-term optimization opportunity set and returns. While ‘uncertainties’ remain (e.g., macro volatility, Permian pipe overcapacity, ultimate U.S. production trajectory, etc.), we view the risk/reward as reasonably favorable…”

Jenkins completes his outlook with an Outperform (i.e. Buy) rating and a $16 price target that suggests a one-year upside potential of 27%. (To watch Jenkins’ track record, click here)

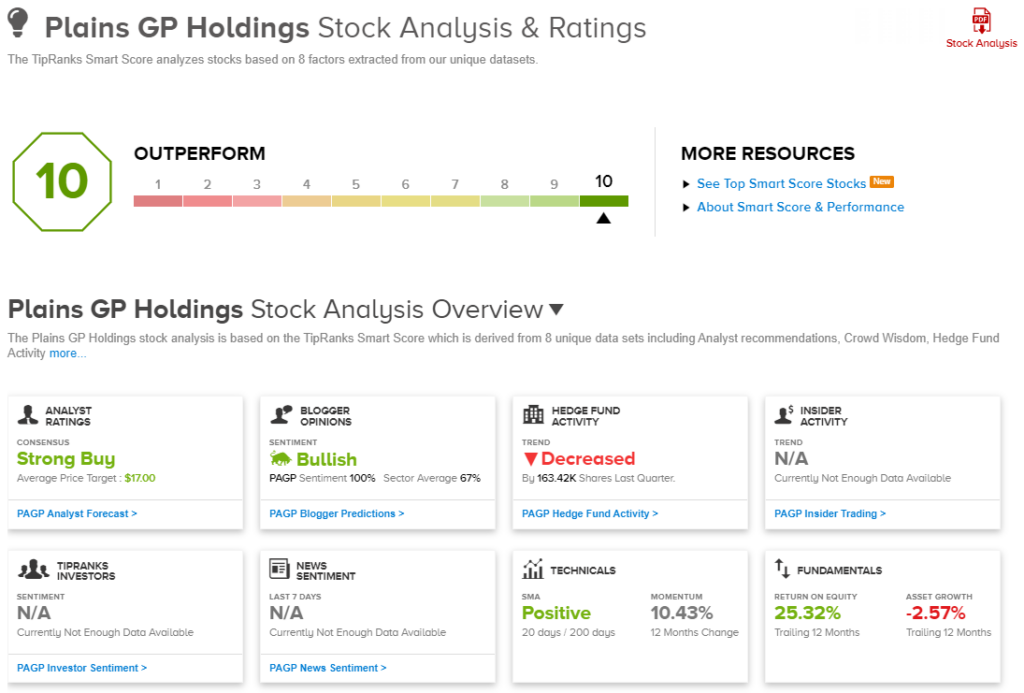

Raymond James is not the only firm to look approvingly on PAGP; the stock has a Strong Buy consensus rating based on 4 recent positive ratings against a single Hold. The shares’ $17 average price target is slightly more bullish than analyst Jenkins allowed, and implies a 35% increase over the next 12 months. (See PAGP stock analysis on TipRanks)

Western Midstream Partners (WES)

Sticking with midstream energy, a stock sector long known for its high dividends, we’ll turn our attention to Western Midstream Partners. This company operates primarily in the American West, in Texas and the Rocky Mountains, where its network includes 23 gathering systems feeding more than 15,000 miles of pipelines, including 15 for crude oil and natural gas liquids and 6 for natural gas, which in turn supply 72 processing and treating facilities.

WES shares have also been under pressure this year, with the company delivering a mixed Q4 report.

At $779.4 million, revenues were up 8.4% year-over-year but missed the forecast by $21 million. On the other hand EPS was reported at 85 cents, well above the 72 cents expected and up from the $0.58 reported in the same period last year.

Given this firm foundation, Western Midstream supported a distribution declaration of 50 cents per common share. This was last paid out on February 13 of this year, and the annualized rate of $2 gives a yield of 8%. Western has been paying out reliable dividends – and gradually raising the payment – for the past two years.

For Stifel analyst Selman Akyol, this adds up to a solid choice for investors. Akyol writes, “We continue to favor WES’ financial profile and capital allocation framework. We are encouraged by an enhanced distribution payout of $140 million in this first year of the program. We estimate 2023 FCF after distributions of nearly $400 million (excluding enhanced payout) … we view the base distribution of $2.00 augmented with special distributions and buybacks as providing the partnership the flexibility to make investments for future growth while insuring minimum capital returns to unit holders.”

These comments support Akyol’s Buy rating on the shares, and his $33 price target implies a 31% upside by the end of this year. (To watch Akyol’s track record, click here)

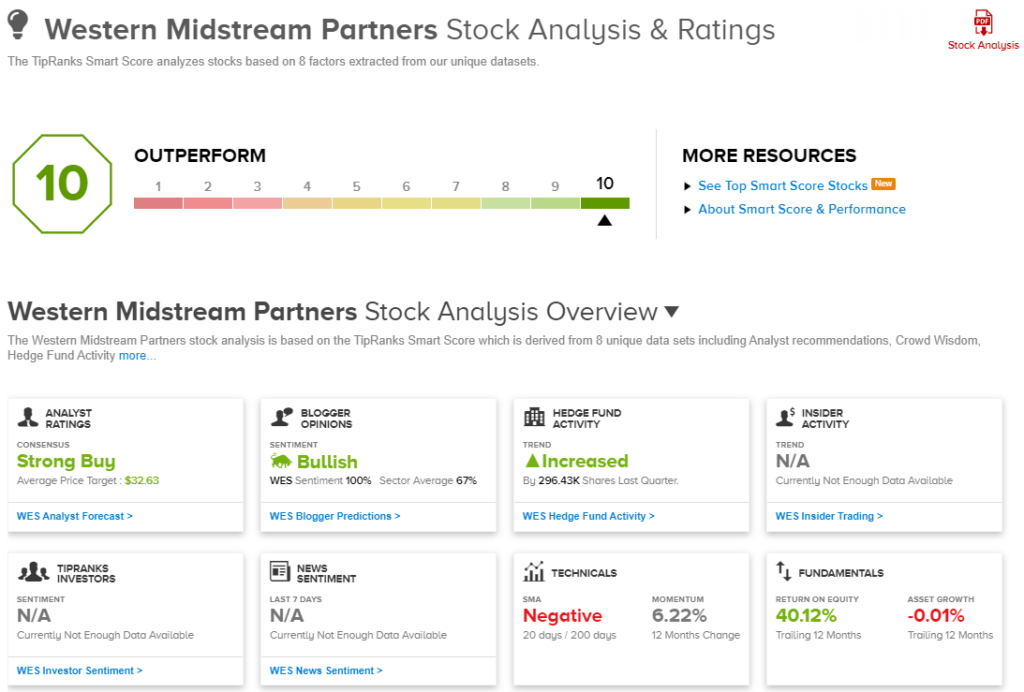

Overall, this stock has picked up 8 recent reviews from the Wall Street analysts, and these include 7 to Buy against just 1 to Hold – for a Strong Buy consensus rating. The stock has an average price target of $32.63, suggesting a 12-month upside potential of 30% from the current trading price of $25.14. (See WES stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.