No matter how you slice it, our world runs on energy. While the social and political pressures are pushing toward a transition to a green economy, with an emphasis on renewable energy sources such as wind and solar power, the fact is that we are still dependent on fossil fuels – and will be for the foreseeable future.

For investors, that makes energy stocks a solid choice. These companies deal in an essential product, and technological advances in geology, drilling, and pumping permit them to target their operations for the maximum returns.

J.P. Morgan’s energy stock expert, Arun Jayaram, has taken a clear-eyed look at the energy sector, noting a switch from an earlier focus on ‘hyper growth’ and well productivity. He writes, “While well productivity still remains important, we think the ability to harness efficiency gains by compressing cycle times is a critical factor for success, particularly given the shift to maintenance capex programs across the industry.”

Following this line, Jayaram says it is ‘time to upgrade’ several energy players, and we’ve got the lowdown on two that stand out. We also used TipRanks’ database to find out what the rest of the Street has to say about them. Here’s what we found.

Don’t miss

- TipRanks’ ‘Perfect 10’ Picks: 2 Top-Scoring Stocks for 2024

- BMO Optimistic About Fintech Stocks in 2024; Here Are 3 Top Picks to Keep an Eye On

- Mobileye, Goodyear Among Top Picks as Deutsche Bank Assesses Auto Stocks

Ovintiv (OVV)

The first stock on our list of JPM picks is Ovintiv, an oil and gas exploration and production company in the North American scene. Ovintiv takes a multi-basin approach and has built up a portfolio of world-class production assets based on ‘large, contiguous’ holdings in several major production regions, including the Anadarko and Permian basins of Oklahoma and Texas, and the Montney formation on the Alberta-British Columbia border.

The quality of these holdings can be shown by the company’s proven reserves. As of the end of 2022, Ovintiv had proved reserves, both oil and gas, totaling 2.3 billion barrels of oil equivalent. Of this total, 50% was in liquids, and 57% was described as ‘proved developed.’ The company’s reserve life index, an approximate measure of how long the proven reserves will last, at the end of 2022, came to 12.2 years.

Building on that quality, Ovintiv reported solid production numbers in its last quarterly release from 3Q23. The average total production was 572,000 barrels of oil equivalent per day, a total that included 214,000 barrels of oil daily, 87,000 barrels of natural gas liquids, and 1.625 billion cubic feet of natural gas per day. Responding to these numbers, Ovintiv raised its full-year 2023 production guidance to a range of 550,000 to 560,000 barrels of oil equivalent per day.

Backing the higher guidance, Ovintiv has also stated that it expects to have all acquired Permian wells in full operation by the end of this year. We should note here that the Permian basin is one of the richest oil and gas production regions in North America and, in the past two decades, has put the state of Texas back on the map as a major global energy supplier.

Despite high production and solid reserves to back it up, Ovintiv’s 3Q report missed on earnings. The company’s EPS came to $1.47 by GAAP measures, missing the forecast by 27 cents per share.

Ovintiv’s sound prospects are the key point for the JPM view here. Jayaram is upbeat on the company’s potential to increase its Permian basin output, seeing that as the start of the company’s path forward. The 5-star analyst writes, “We upgrade OVV to Overweight from Neutral given the differentiated valuation on FCF as well as potential upside to 2024 expectations on the company’s new frac recipe in the Permian Basin.”

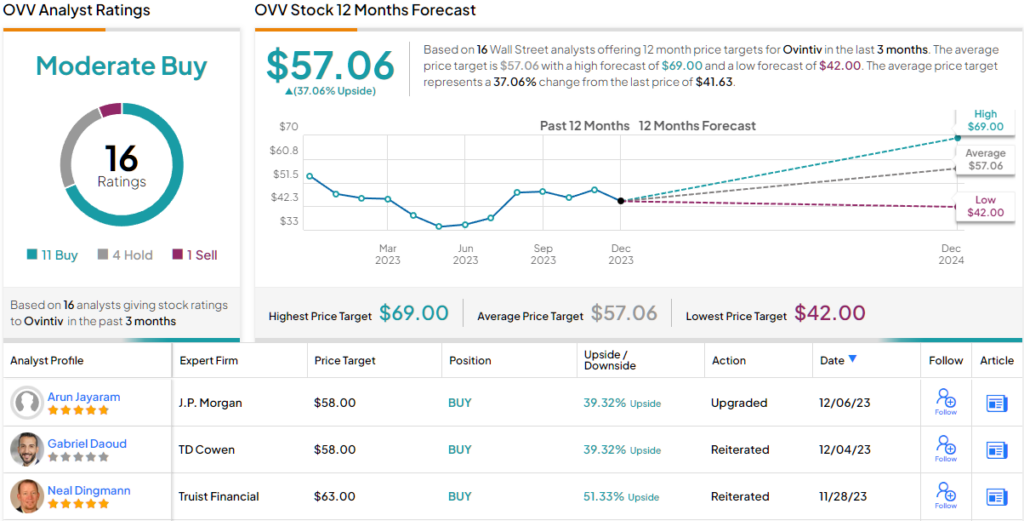

Along with the upgraded Overweight (i.e. Buy) rating, Jayaram puts a $58 price target on the stock, implying a 39% potential upside on the one-year horizon. (To watch Jayaram’s track record, click here)

Overall, there are 16 recent reviews on OVV shares from the Street’s analysts, and they break down to 11 Buys, 4 Holds, and 1 Sell for a Moderate Buy consensus rating. The average target price here is $57.06, suggesting a 37% gain from the current share price of $41.63. (See Ovintiv stock forecast)

Devon Energy (DVN)

Next up is Devon Energy, an independent exploration and production company based in Oklahoma City, focused on the exploitation of onshore assets in the continental US. The company’s largest operations are located in Texas-New Mexico-Oklahoma, where it has extensive oil and gas projects in the Delaware Basin, Eagle Ford, and Anadarko Basin formations. Further north, Devon is also working in the Powder River region in Colorado and the Williston Basin of North Dakota.

Devon’s extensive operations and holdings make it one of the larger independent US oil and gas producers. At the end of last year, the company was producing 315,000 barrels of oil daily, over 1 billion cubic feet of natural gas, and 150,000 barrels of natural gas liquids. By the end of 3Q23, the most recent set of results that Devon has reported, the company’s total production had increased to 665,000 barrels of oil-equivalent per day. This marked a 10% year-over-year increase in quarterly production.

Devon has managed this while also pursuing a strong commitment to water conservation. The oil and gas industry is known for its high water usage, but Devon has made a priority of using produced, non-potable, or brackish water in its operations, reducing its freshwater consumption rates. Since 2015, Devon has reused more than 250 million barrels of water from water treatment facilities.

The company reported revenue and earnings figures for 3Q23 in an early November release. The top line of $3.84 billion was down almost 30% year-over-year, but it beat the forecast by $210 million. The bottom-line figure, the non-GAAP earnings per share of $1.65, was 10 cents per share better than the estimates.

On cash flow, however, Devon somewhat disappointed investors. The company’s operating cash flow was up 23% compared to the second quarter and came in at $1.7 billion. However, the free cash flow of $843 million, while strong compared to Q2, was down 43% year-over-year.

JPM’s Jayaram took a deep look in to DVN, and while he acknowledges the issues that the stock is facing, he still upgrades the shares: “In 2023, DVN shares significantly lagged on capital efficiency concerns as the stock underperformed the peer group by ~20% on a YTD and YoY basis. We upgrade DVN shares to Overweight from Neutral given the combination of low expectations and ‘self-help’ initiatives recently messaged by management, which should boost capital efficiency in 2024.”

Looking forward, Jayaram lays out several factors that will provide support for DVN, saying, “Importantly, we think the company essentially cleared the decks by providing their 2024 guide on the 3Q23 call, which did feature lower than expected FCF. The key ‘self-help’ initiatives include a shift to higher levels of Delaware Basin activity, a rebound in Delaware Basin productivity as well as high-grading in other basins, and lower YoY capex requirements amid industry cost deflation. This appears to parallel PXD’s high-grading efforts from last year, which drove outperformance.”

The end-all, be-all for Jayaram on DVN is that upgrade, a move from Neutral to Overweight (i.e. Buy) on the stock, and a price target of $58 to suggest a 31.5% upside for the year ahead.

The Street generally is somewhat bullish on Devon, giving the stock a Moderate Buy consensus rating based on 20 reviews, which include 11 Buys and 9 Holds. The shares are trading for $44.09, and their $56.28 average price target implies ~28% one-year upside potential. (See Devon stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.