Earlier this month, the January jobs numbers came in unexpectedly strong. According to the BLS report, 353,000 new positions were created during the month, surpassing forecasts by over 80%. This impressive performance adds another piece of economic good news to the pile.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

That pile already includes a moderating trend in inflation, as the rate of price increases continues to slow down, and a continually increasing belief that the Federal Reserve will act to pare back interest rates later this year. Altogether, it’s been enough to keep economists happy and boost investor sentiment.

For Morgan Stanley analyst Betsy Graseck, these factors open up a series of opportunities, especially in financial stocks. Regarding two particular names, Graseck suggests that it’s ‘time to hit buy.’

We’ve opened up the TipRanks database to assess Wall Street’s opinion on Graseck’s picks. Let’s take a closer look.

Discover Financial Services (DFS)

The first stock we’ll look at is Discover Financial Services, best known as the issuer and backer of the Discover Card. This was the first credit card to come with a ‘cash back’ reward; you may remember its early TV commercials featuring the slogan ‘It pays to Discover…’ In addition to the cash back reward on all purchases, the Discover card had no annual fees for the cardholder. These perks for the customers helped push Discover Financial to a successful launch following the card’s 1985 introduction, and today the company has a $27 billion market cap and is one of the established credit card companies.

In addition to the several versions of the Discover card on offer, Discover Financial Services also makes available a wide-ranging set of financial and banking services. Customers can access checking, savings, and retirement accounts, and take out personal, home, or student loans. The company describes its mission as helping its customers spend smarter, manage debt better, and save more.

While Discover has a sound niche in the consumer credit market, the financial results for 4Q23 were considered disappointing. Specifically, the company’s $1.54 EPS was 93 cents per share below the forecast, and the company reported provisions for $1.91 billion in credit loss. The credit loss provision, essentially a company projection of future ‘bad loan’ damage, was well above the $1.66 billion that had been expected – and almost double the $883 million from 4Q22.

On a positive note, Discover’s revenue was solid. The company’s top line of $4.2 billion was up almost 13% year-over-year and came in $90 million above the forecasts.

Also seen as a positive for the company, Discover announced in December the appointment of Michael Rhodes as the new CEO. The company had been under interim leadership since August of last year, and the announcement was viewed as a shift toward stability. Rhodes’ appointment will be effective no later than March 6.

Looking ahead, Morgan Stanley’s Graseck acknowledges some challenges but sees potential as consumer delinquency slows down.

“As consumer delinquency formation slows, we prefer exposure to stocks further down the credit spectrum or with recent credit underperformance vs peers. DFS’s credit performance has lagged peers over the past few quarters, with card DQ & NCO rates now 48%/43% above 2019 vs peers at 9%/12%. But in our view, DQ formation at DFS is starting to turn the corner, and should lag the improvement COF has already been seeing for several months,” Graseck opined.

Graseck sees reasons for optimism, and says of Discover, “Further, the near-term catalyst path is more compelling to us at DFS: a new CEO is in place as of last week, and we should be gaining further clarity into the likely sale of the $10bn student loan portfolio by 1H24, which should help drive a return to share repurchases post stress test results in June.”

These comments back up the analyst’s upgrade of DFS from Equal-weight (i.e. neutral) to Overweight (i.e. Buy) and her $133 price target suggests a one-year upside potential of 22%. (To watch Graseck’s track record, click here)

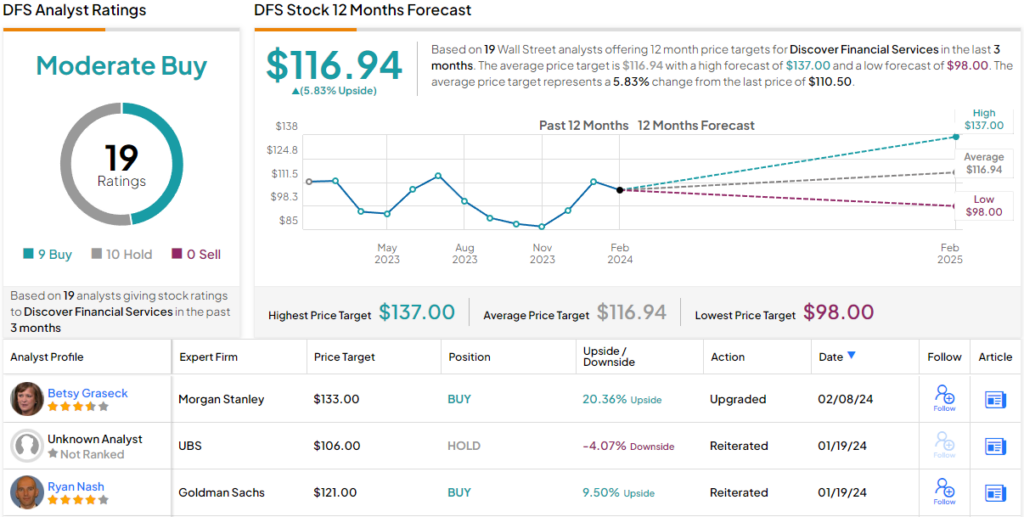

Overall, DFS’ Moderate Buy consensus rating comes for a near-even split in the 19 recent analyst reviews: 9 to Buy, 10 to Hold. The shares are trading for $110.50 and the $116.94 average target price indicates room for a modest 6% increase this year. (See Discover’s stock forecast)

Ally Financial (ALLY)

The second stock on our list of Morgan Stanley financial picks is Ally Financial, a Detroit-based bank holding company offering a wide range of financial services to its customers. These include online banking, corporate lending, and mortgage loans. Until 2010, the company was known as GMAC, or General Motors Acceptance Corporation, and was the financing arm of the GM auto company. Ally retains a link to its automotive origins, offering car financing and vehicle insurance policies, and is one of the nation’s largest auto financers.

Last month, Ally entered into an agreement with Synchrony Financial, under which Ally will sell its point of sale (POS) financing business to Synchrony. The transaction will also include $2.2 billion in loan receivables, and is expected to close during 1Q24.

Also during January, Ally reported its 4Q23 results, and beat the forecast on revenues while matching expectations on earnings. The top line, at more than $2 billion, was $72 million better than had been anticipated, while the 45-cent non-GAAP EPS was in-line with expectations. The company also saw notable gains in net financing revenue and net interest margin.

In another positive note, for return-minded investors, Ally declared its dividend at 30 cents per common share. The dividend, to be paid on February 15, annualizes to $1.20 per share and gives a yield of 3.3%.

Morgan Stanley’s Graseck is generally upbeat about ALLY, seeing its business model as an advantage given changes in the credit market. Graseck says of the stock, “ALLY is the best way to play lower rates in our coverage, given its exposure to slower moving loan yields (74% of loans are in fixed-rate loans, largely auto) and faster-moving funding costs (~90% of funding is in deposits, 63% of which are in OSA, checking accounts, and MMA). Yes, market expectations for rate cuts over the near term have somewhat moderated recently, but are still in line with our model assumptions: 4 cuts in 2024 and 2 in 2025.”

The comments above lead into some solid forecasts for the near- and mid-term: “We are forecasting a 27% increase in quarterly NIM by YE25, from 3.20% in 4Q23 to 4.00%/4.07% in 3Q/4Q25e. This, in turn, drives an expected 39% EPS CAGR over 2023-25e, highest in our Consumer Finance coverage (median 10% in the group.”

All in all, this is another stock that gets an upgrade from Graseck, from Equal-weight (i.e. neutral) to Overweight (i.e. Buy). Her price target is now set at $47, and implies that ALLY shares will gain ~27% over the next 12 months. (To watch Graseck’s track record, click here)

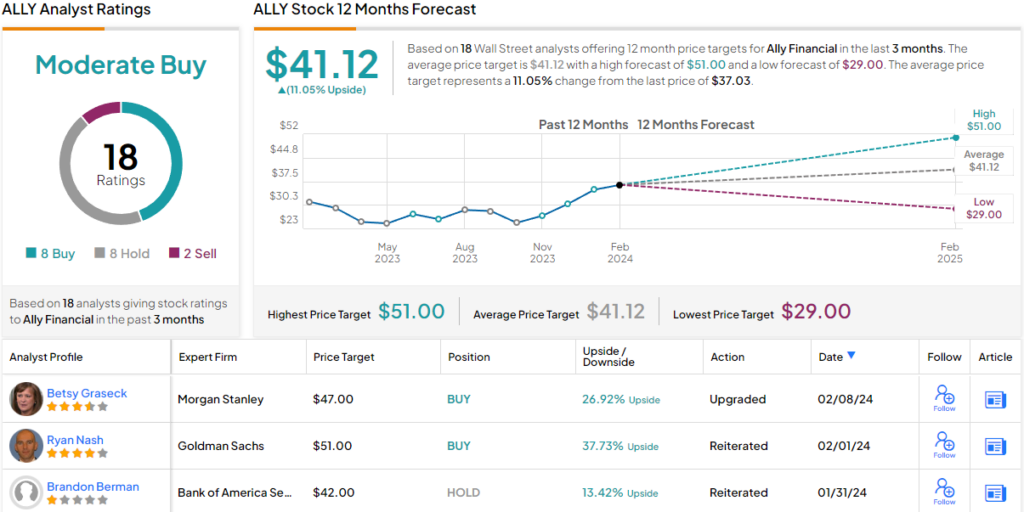

Once again, we’re looking at a stock with a Moderate Buy consensus rating. ALLY shares have 18 reviews on file, including an even split – 8 each – in Buys and Holds plus 2 to Sell. The stock’s current trading price is $37.03 and its $41.12 average price target suggests that a 11% gain is waiting in the wings. (See Ally’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.