There’s no secret that markets experienced a decline from August to October, but November has proven to be a fruitful period for investors. The S&P 500 has surged by 7% this month, while the tech-focused Nasdaq has shown even stronger growth, with gains of approximately 10%.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Watching the scene from Bank of America, chief investment strategist Michael Hartnett believes that there are compelling reasons to remain optimistic about the near-term outlook.

Noting that investors have been worried about the surge in Treasury yields and the Fed’s position of ‘higher for longer’ on interest rates, both factors that tend to depress stocks, Hartnett sees current prices at a generally positive entry point – and recommends buying ahead of a year-end rally, which he describes as ‘expected’ by everyone.

Hartnett’s colleagues among the Bank of America stock analysts are running with it, and choosing stocks that investors should buy ahead of that predicted rally. We’ve pulled the details on two of these picks from the TipRanks database, stock choices that the the investment giant is bullish on. Let’s take a closer look.

Don’t miss

- Oppenheimer Expects the S&P 500’s Advance to Continue Into 2024 — Here’s Why These 2 Stocks Might Be Worth Buying

- Insiders Load Up on These 2 ‘Strong Buy’ Stocks — Here’s Why You Should Pay Attention

- Morgan Stanley Says China’s Education Industry Looks Appealing Right Now — Here Are 2 Stocks to Bet on It

Weatherford International (WFRD)

For the first Bank of America pick, we’ll look at the oilfield services sector. This is a vital sector in the energy industry, and Weatherford International has been in it for 80 years. The company has operations in 75 countries and brings high-end digital automation technology to bear on the heavy industry of oil patch activities. Weatherford’s services are essential for its customers, in everything from installing specialized well equipment to bringing oil and gas up to the surface to storing hydrocarbon products before transport.

Among Weatherford’s unique services and advantages offered to its customers are its use of RFID technology to secure wells for improved precision and security, and a single-trip completion system for offshore wells that allows completion of both the upper and lower installations on the same venture. The key to Weatherford’s approach is increased efficiency at all levels of oilfield operations.

Weatherford has delivered solid results for its customers and seen solid results in return – in the form of increasing revenues, earnings, and share price over the past several years. The company’s stock is up 94% so far this year, outperforming the broader markets by a wide margin.

Turning to the most recent 3Q23 quarterly result, we find that the company beat the expectations across the board. On revenue, the quarterly total of $1.31 billion was a modest $20 million over the forecast and came in at 17% year-over-year growth. The firm’s bottom line, an EPS of $1.66, compared favorably to the $0.39 from 3Q22 and the $1.12 from 2Q23; it was also 55 cents per share better than had been anticipated.

Analyst Saurabh Pant, covering this stock for Bank of America, notes that Weatherford saw some serious hard times during the COVID shutdown periods – but has made a solid comeback. He writes of the company: “WFRD has staged a remarkable turnround from a Chapter 11 restructuring in 2019, and a near repeat in 2020. It’s now generating very strong Adj. EBITDA margin (23.0% in ’23E, second only to SLB among Big 3 Diversified OFS). Its FCF conversion (as % of EBITDA) is now similar to the Big 3. WFRD’s new CEO Girish Saligram has refocused the company on its core technology strength with operational rigor & financial discipline while moving ahead on customer focus and digital transformation. This has turned WFRD into a lean & highly profitable Int’l-levered diversified OFS company.”

Looking forward at Weatherford’s prospects, Pant states, “We see upside from 1) continued revenue & margin expansion led by Int’l markets, 2) B/S optimization, 3) our expectation of WFRD initiating shareholder distributions in 2H24.”

Pant goes on to give the stock a Buy rating with a $120 price target that indicates potential for ~22% upside over the next 12 months. (To watch Pant’s track record, click here)

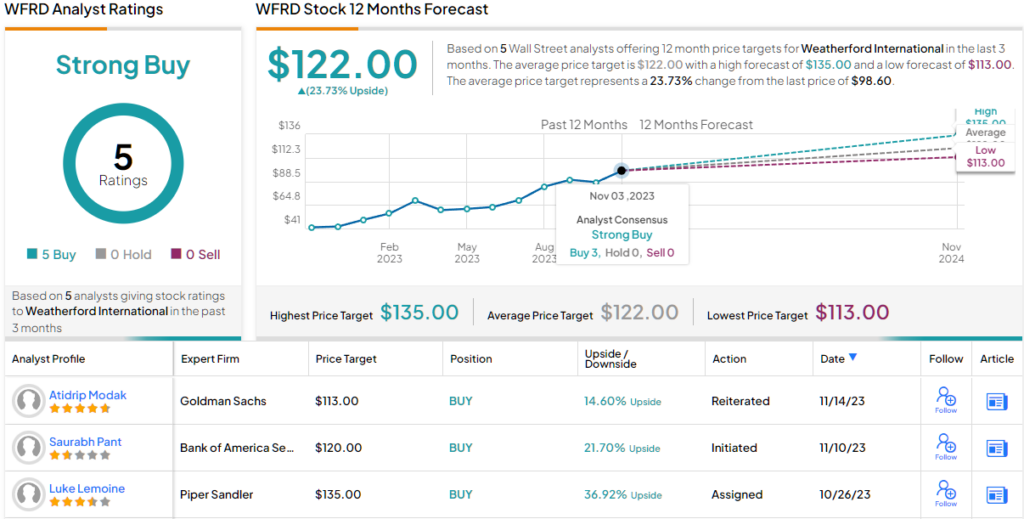

Overall, there are four recent analyst reviews on WFRD shares, and they are unanimously positive – giving the stock its Strong Buy consensus rating. The share are priced at $98.60, and their $122 average price target suggests a gain of ~24% on the one-year time horizon. (See Weatherford stock forecast)

Granite Ridge Resources (GRNT)

Let’s stick to the oil patch for the second stock on our list. Granite Ridge is an oil and gas company, a hydrocarbon exploitation firm working five major hydrocarbon basins in the US: the Permian, Eagle Ford, Bakken, Haynesville, and DJ. These are rich production regions, and their exploitation has, over the past 15 years, made the US a major world producer of oil and natural gas.

Granite Ridge is non-operator, owning the acreage and extraction well assets in its portfolio while the actual production is handled by third-party partners. This mode allows the company great flexibility in adjusting its portfolio, as non-operated assets are easily sold or traded while avoiding long-term drilling contracts and excessively high overhead costs.

This company is relatively new to the public markets, having entered Wall Street’s trading floors in October of last year. The GRNT ticker got its start through a SPAC transaction, between the Dallas, Texas-based Grey Rock Investment Partners and the special purpose acquisition company Executive Network Partnering Corporation. Since its public debut, the stock has fallen 41.5%. At least in part, the fall in share price has come due to a secondary offering of stock in September of this year. Granite Ridge put 7.1 million shares on the market at $5 each, and the overall stock price fell by more than 20% in response.

Taking a look at the company’s recent 3Q23 earnings report, we find that Granite Ridge had $108.4 million in revenues for Q3, a total that was down 20% year-over-year – although it did best the forecast by $6.74 million. The company’s bottom line was a non-GAAP EPS of 21 cents per share. This missed the estimates by 3 cents per share and compared poorly to the $0.47 result from 3Q22.

These quarterly misses came even as the company’s production figures expanded by 20% y/y, from 22,015 Boe/d to 26,433 Boe/d.

This company’s relatively low share price presents an attractive entry point, and Bank of America’s John Abbott discusses that in his recent note on the stock.

“YTD, the shares have underperformed the Russell 3000 Energy Index in part due to a secondary offering by founding partner and majority owner Grey Rock (50.3%) priced at a ~33% discount to the prior close. However, we think this provides a tactical entry point supported by a current dividend yield of 7% and potential upside,” Abbott opined.

To this end, Abbott rates GRNT shares a Buy, while his $9 price target implies a robust one-year upside of 50%. (To watch Abbott’s track record, click here)

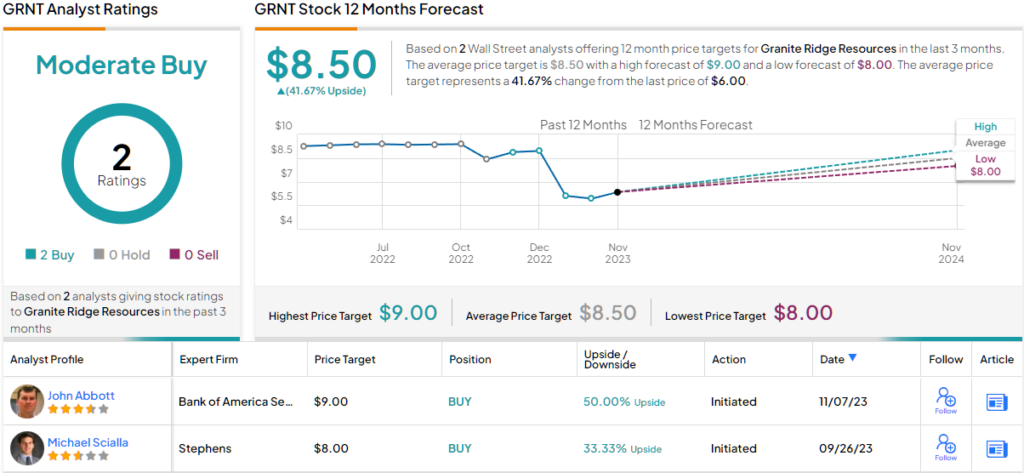

Overall, this stock has only picked up 2 recent analyst reviews, but they are both positive. The shares have a Moderate Buy consensus rating, and the $8.50 average price target points to ~42% increase from the $6 current trading price. (See GRNT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.