It’s no secret that tech stocks have been powering the market gains over the past few years, and software stocks were among the biggest drivers of this growth.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Multiple factors are propelling the software industry forward, such as the rapid advancement of AI technology, high demand for IT solutions, and the ongoing expansion of the global digital economy.

Wedbush tech expert Daniel Ives has been watching the tech industry, and his take on it points to continued strength supported by AI and cloud expansion.

“Solid enterprise spending, digital advertising rebound, and the AI Revolution will drive tech stocks higher into year-end in our view,” Ives opined. “We believe 70% of global workloads will be on the cloud by the end of 2025, up from less than 50% today.”

Keeping that in mind, Ives goes on to add that the time has come to hit buy on two software stocks. They may not be household names, but according to the TipRanks data, both stocks are Buy-rated – and Ives sees significantly more upside to each than the consensus on the Street. Let’s take a closer look.

Couchbase (BASE)

We’ll start with Couchbase, a modern database platform provider that offers users and developers everything they need to support a wide range of applications – from cloud, to edge, to AI. Couchbase bills itself as a one-stop-shop for data developers and architects, making its services available through its powerful database-as-a-service platform, Capella. Organizations using the service can quickly create applications and services that deliver premium customer experiences, giving top-end performance at affordable prices.

The Capella platform brings the popular as-a-service subscription model to the database industry. The company can support database services for a wide range of AI applications, including the latest gen-AI tech, as well as database search, mobile access, and analytic functions. Customers can also choose self-managed services through Couchbase’s servers, with on-premises management for both multicloud and community apps.

Couchbase’s database service has found success in a wide range of fields, including the gaming, healthcare, entertainment, retail, travel, and utility sectors. The company’s customer base includes such major names as Verizon, UPS, Walmart, Cisco, Comcast, GE, and PayPal.

Turning to the financial results, we see that Couchbase reported its fiscal 2Q25 figures at the start of last month. The top line of $51.6 million was up almost 20% year-over-year and came in just over the forecast, beating expectations by nearly a half-million dollars. At the bottom line, the company ran a net loss of 6 cents per share in non-GAAP measures, but that was 3 cents per share better than had been anticipated.

Analyst Daniel Ives likes what he sees in this database software firm. The tech expert runs through several factors that should attract investors to this stock, writing, “The company sees strength across net new logos while the launch of its new products will reaccelerate its growth over the coming quarters… Couchbase estimates their TAM to grow to ~$150 billion by 2028 with high performance and scalable modern applications driving the market with AI accelerating further opportunity for high-performance applications as the company is aligned to meet demand for growing DBMS market sub-segments across cloud and on-premise environments.”

Looking ahead, Ives goes on to explain how the Capella platform has potential to boost Couchbase’s performance: “Although still early in terms of its contribution to revenues or ARR, the company noted that it plans to disclose Capella metrics going forward with Capella acting as a ‘game changer’ for BASE with easy adoption or deployment compared to alternative customer managed offerings while helping reduce adoption friction leading to an acceleration in its net new customer adds, some driven by Capella, and existing customers with on-prem products migrating and expanding on Capella.”

Along with a recent upgrade from Neutral to Outperform (i.e. Buy), Ives has a $26 price target on BASE shares, suggesting a one-year gain of 60%. (To watch Ives’ track record, click here)

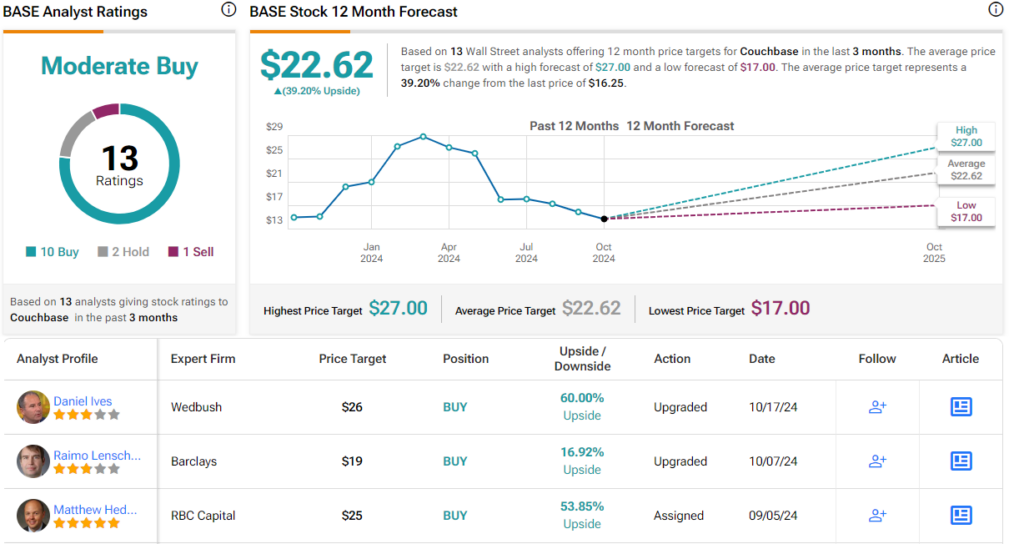

Overall, Couchbase has a Moderate Buy consensus rating from the Street, based on 13 reviews that break down to 10 Buys, 2 Holds, and 1 Sell. The stock is priced at $16.25 and its $22.62 average target price implies a gain of 39% in the coming year. (See Couchbase stock forecast)

Dynatrace (DT)

Next up is Dynatrace, a $16 billion large-cap player in the software field. Dynatrace offers its customers the latest in AI-powered, cloud-based data management technology. The company’s platform supports intelligent automation that puts network management, cloud monitoring, and data analytics to work, in one place, for a unified mission. Dynatrace’s platform can be applied to almost any aspect of the tech and business worlds, allowing its users to tap into AI-powered app automation, business analytics, digital security, infrastructure monitoring, and microservices.

By the numbers, Dynatrace has an impressive business footprint. The company boasts more than 4,000 subscription customers, generating approximately $1.5 billion in annual recurring revenue. An impressive 95% of the company’s top line comes from its subscription services, and the company has a gross retention rate in the mid-90% range, indicating a high level of customer satisfaction. Dynatrace can count some big names among its customers, including Dell Technologies, Air Canada, and the government of Australia.

This past summer, Dynatrace released its financial results for its fiscal 1Q25 (June quarter). The top and bottom lines for the quarter both came in well above the forecasts – revenue, at $399 million, was up almost 20% year-over-year and was $6.56 million better than anticipated; the non-GAAP earnings per share, of $0.33, was four cents per share over expectations.

Drilling down, the company’s headline results on subscription business bode well for the future. Total subscription revenue was $382 million for the quarter, for a 21% y/y gain, and the annual recurring revenue (ARR) hit $1.541 billion, up 19% from the prior-year period.

This company’s use of AI and its strategy of courting large-scale customers caught Ives’ eye, and the analyst writes of it, “Dynatrace is a leader in the Observability space with an expanding portfolio, and long runway for growth with a unique combination of growth and profitability and has the highest operating margins in the space. The company’s focus on large enterprise customers results in higher ARPU metrics vs. its peers as the company’s technology and competitive positioning is positive as it is one of few vendors in the space that supports a hybrid deployment model.”

Also here the Wedbush analyst recently upgraded his rating from Neutral to Outperform (i.e. Buy) while his bumped-up price target of $67 (up from $55), implies a one-year upside potential of 26%.

Looking at the Street consensus, we find that Dynatrace has a Strong Buy rating, based on 20 recent reviews that favor Buy over Hold by 18 to 2. The shares have a current trading price of $53.25 and the average target price of $60.06 suggests that DT will gain 13% by this time next year. (See Dynatrace stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue