As the age-old saying goes, “everybody is a genius in a bull market,” but what motto is most suitable for such unprecedented, trying times? With inflation at a 40-year high, the Federal Reserve remaining steadfast in increasing interest rates to combat it, and 6 in every 10 Americans forecasting a looming recession, according to a recent survey conducted by the Gallup poll, the street is eerily silent. And the recent string of job cuts and hiring slowdowns already makes one wonder if this is 2008 all over again.

Fortunately, if an investor has time on her side, the gloom and doom can and should be greeted with optimism. Any young opportunist will want to take full advantage of what could be a once-in-a-lifetime, generational opportunity to score high-quality, value stocks at steep discounts. Better yet, such investments won’t even require much of your attention.

To some, such an approach may seem boring, but the goal is not about having fun – it is about building wealth and securing a financially stress-free future.

So, where exactly are these stock market gems? Like most opportunities, they are right in front of us, and we just need to act at the right time!

Technology

The first sector to dive into, which may be the most exciting among them all, is the technology sector. Without having to look too far, Apple (AAPL) and Microsoft (MSFT) (GB:0QYP) present themselves well.

Apple, the world’s most valuable company by market capitalization, is currently down from its 52-week high of $182.27 trading for $141.66 a share which equates to a change in the share price of 22.3% whereas Microsoft plummeted from its 52-week high of $349.67 to $267.70 equating to an even greater change rate of 23.4%.

Of course, share prices alone should never be the determinant to executing an investment so it is noteworthy that Apple’s P/E ratio is sitting at 23 while Microsoft’s P/E ratio is nominally higher at 27.9 – multiples that are in the ballpark of Cola-Cola (KO) and Proctor & Gamble (PG) which is crazy considering the fact that these two technology leaders continue to create our digital futures.

Moreover, the sheer combination of continued superior financial performance and focus on growth by both these names continue to warrant investor attention.

Apple’s recent Worldwide Developer Conference 2022 showcased iOS16, watchOS 9, and the new iPadOS16. Apple confirmed two new laptops and the M2 processor that can handle 24GB. The company’s buy-now-pay-later is arguably one of the biggest moves in the financial domain this season. Further, its moves into the AR/VR space along with Apple glass could open new lucrative markets.

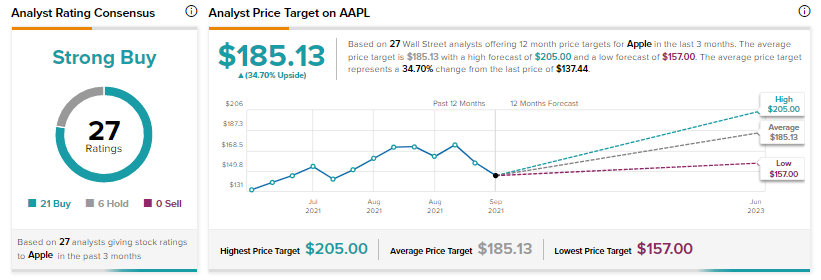

Apple’s top line has grown from $274.5 billion in 2020 to $365.8 billion in 2021. The figure is further expected to balloon to nearly $415 billion in 2023. At the same time, its EPS is expected to expand at a faster clip from $3.28 in 2020 to $6.5 in 2023. This implies a strong moat and a firm grip over margins. Wall Street is already seeing a 34.7% potential upside in the stock with a Strong Buy consensus rating and an average price target of $185.13.

Further, Apple has a return on total assets of 29% and a return on total capital of 38%, whereas the industry median does not score above 5% on either of these metrics. The third important point where the company actually scores high is its net income per employee of almost $650,000, which shows that despite its global presence, Apple is highly efficient in utilizing its manpower.

Microsoft, too, has had a dominant position in its market for decades now and is probably making bigger moves than its peers.

At first glance, the name Microsoft only brings WindowsOS and spreadsheets to one’s mind. But there’s more under the surface.

Its recent Activision Blizzard acquisition makes it the third biggest name in gaming, Azure puts it far ahead in the Cloud space and LinkedIn makes it a major name in social networks, and GitHub, too, is owned by Microsoft. This level of omnipresence is more than hard to replicate.

Microsoft’s top line has expanded from $143 billion in 2020 to $168 billion in 2022 and is expected to reach ~$227 billion in 2023. Concurrently, EPS is expected to jump to $10.7 in 2023 from $5.88 in 2020. Analysts have a Strong Buy consensus rating on the stock alongside a price target of $352.77 which implies a 37.54% potential upside.

Microsoft, too, scores high on return on total capital and return on total assets at 22% and 21%, respectively. Further, its net income per employee at the $400,000 level is far ahead of the industry median of ~8,000 and highlights its scale of efficiency even after decades of ruling its market.

Financials

However, if technology investments aren’t quite your thing, the financial sector has been on sale for quite some time, and until interest rates rise, it may remain at attractive valuations.

An obvious pick that has become the largest bank in the United States and the world’s largest bank by market capitalization is JPMorgan Chase (JPM). As interest rates were knocked to zero at the onset of the COVID-19 pandemic in 2020, JPMorgan’s share price began its descent as one of its key revenue streams from interest-bearing loans was suddenly placed on pause.

Currently, JPMorgan’s current share price is $117.32, which is down from a 52-week high of $172.96, making for a 32.2% change with a P/E ratio at a low of just 8.7.

Looking ahead, as the Federal Reserve begins to steadily raise rates, banks across the board will be one of the main beneficiaries; they will experience stronger margins, resulting in more revenue on the balance sheet, which will likely rally shareholders for JPMorgan’s share price comeback.

Moreover, JPMorgan, which was founded in 1799 has weathered both the 1929 and 2008 crashes. Top-line of this financial behemoth increased from ~$102.5 billion in 2020 to ~$131 billion in 2021. The figure is expected to further rise to $136.2 billion in 2023. Simultaneously, EPS is expected to reach $12.8 in 2023 from ~$8.5 in 2020.

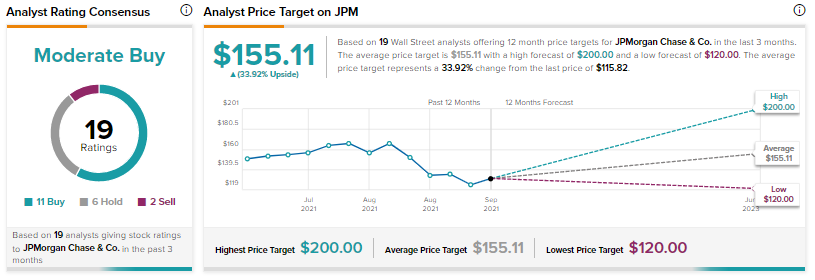

Additionally, the 28.4% share price slide in 2022 so far means the stock now offers a dividend yield of 3.32%. The Street has a Moderate Buy consensus rating on JPMorgan alongside a price target of $155.11 which implies a potential upside of 33.92%.

JPMorgan’s return on equity at 16% is almost 33% higher than the financial industry median and its net income per employee at $150,000 levels is nearly 50% higher than the financial industry’s median. Moreover, the financial giant has a price-to-sales ratio of 2.66 and a price-to-free cash flow ratio of 5.10. This implies, that investors are paying nearly 2.5 times for each sales dollar the company generates.

Closing Note

Earlier this year, Mr. Buffett bemoaned a lack of buying opportunities. The steep decline over the past few months has already made these three names attractive bargains, and if the Fed’s stance continues, more names might be coming up for seekers of value.

Read full Disclosure

Questions or Comments about the article? Write to editor@tipranks.com