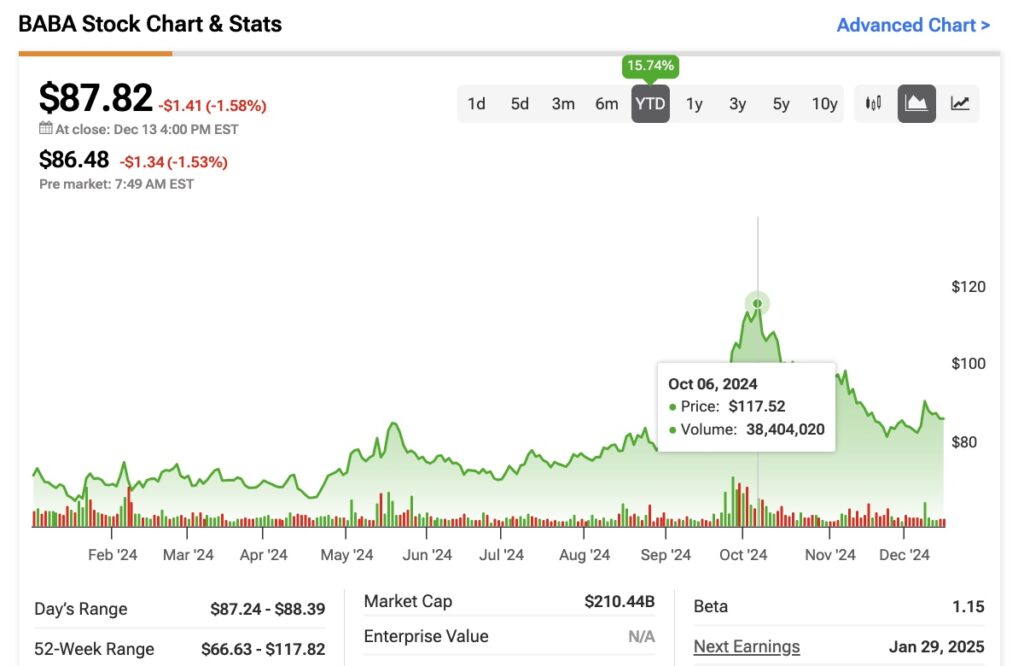

Alibaba’s (BABA) shares have fallen more than double digits since reaching their 52-week highs in early October, following a rally driven by the announcement of a robust stimulus package for the Chinese economy. However, despite being in correction territory, I believe three bullish factors surrounding the Chinese e-commerce giant have been underestimated by the market. These factors are reflected in the company’s valuation, which appears to be sufficiently de-risked for long-term optimism. As a result, I have rated Alibaba as a Buy.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

In this article, I will outline three key reasons why I believe Alibaba, at its current levels, presents a very bullish long-term outlook.

Alibaba’s Journey into AI

The first point I’d like to highlight regarding Alibaba’s favorable long-term outlook is its relatively unappreciated yet explosive journey toward AI, especially through its Alibaba Cloud business. The growth of this segment has been nothing short of remarkable. In the September quarter, the company reported that revenue from AI-related products continued to show triple-digit growth for the fifth consecutive quarter. Alibaba’s dominance in China’s massive market (the second-largest in the world) makes its cloud business one of the leaders globally.

This is especially true given that the cloud market in China is projected to grow at a compound annual growth rate (CAGR) of 36%, reaching $293 billion by 2027. To capitalize on this growth, however, Alibaba needs to continue investing heavily in its cloud business—an effort that has, understandably, weighed on its cash flows. In the most recent quarter, BABA reported free cash flow of RMB 13.7 billion, down 70% from the same period last year, primarily due to investments in cloud infrastructure.

That said, in my opinion, the real concern would be if Alibaba were not investing heavily in this business. E-commerce, while still a core part of Alibaba’s operations, is less profitable than cloud computing, which is a highly scalable business. Cloud should ultimately generate significant operating profits for the company. Just look at Amazon’s (AMZN) AWS, which currently boasts an operating profit margin of 38%—a result that is not out of reach for Alibaba in the future.

Alibaba’s Management Is Aggressively Repurchasing Shares

Another key factor supporting my bullish outlook on Alibaba is the company’s aggressive share repurchase program. Generally, when a company’s management buys back its own shares, it signals that those who know the company best believe the stock is undervalued.

According to the company’s filings for the September quarter, Alibaba repurchased $4.1 billion in shares. When combined with the $5.8 billion repurchased during the June quarter, this brings the total to approximately $10 billion in share buybacks, resulting in a reduction of around 4.4% in its outstanding shares. It’s important to note that this is not a recent strategy for Alibaba’s management. In Fiscal 2024, the company repurchased roughly 5.1% of its outstanding shares.

So, when combining both 2024 and Fiscal 2025 so far, Alibaba has repurchased almost 10% of its shares—a strong indication that the company believes its stock is undervalued. What’s even more surprising is that Alibaba still has $22 billion in share repurchase authorization remaining, which suggests that, as long as its share price continues to underperform relative to the broader market, this buyback program will likely continue in the coming quarters.

Alibaba’s Valuation Appears to Be De-Risked

While the share buyback program signals that Alibaba’s stock is undervalued, the next key point in my bullish thesis is to explain just how attractive the company’s current valuation is.

In my opinion, Alibaba’s valuation has been very appealing throughout the year, even after the recent rally that began in mid-September following the announcement of additional fiscal stimulus for the Chinese economy. At present, Alibaba trades at a forward P/E ratio of 10x. In comparison, some of its leading e-commerce peers, such as Amazon and MercadoLibre (MELI), are trading at multiples valued at four to five times higher while also operating beyond e-commerce.

However, I believe Alibaba’s discounted valuation multiple is a result of several factors:

- Geopolitical risks in China – heightened tensions between China and the United States, along with the potential for tariffs, could further strain the Chinese economy;

- Slowing growth – Alibaba has seen its growth stabilize over the last two years as the Chinese economy has slowed. Revenues dropped significantly, from 52% annual growth in 2021 to 23% in 2022, followed by a -6% decline in 2023 and just 3% growth in 2024.

The silver lining, however, comes from the bottom line. Despite decelerating revenues, Alibaba has managed to maintain stable net income, which rose from $9.8 billion in 2022 to $11.1 billion in 2024. Looking ahead, projections suggest that EPS will continue to grow at a CAGR of 15.5% over the next three to five years. If this forecast holds true, and considering the company’s forward P/E ratio of 10x, Alibaba would be trading at a PEG ratio of just 0.65x—potentially a once-in-a-lifetime opportunity for growth investors.

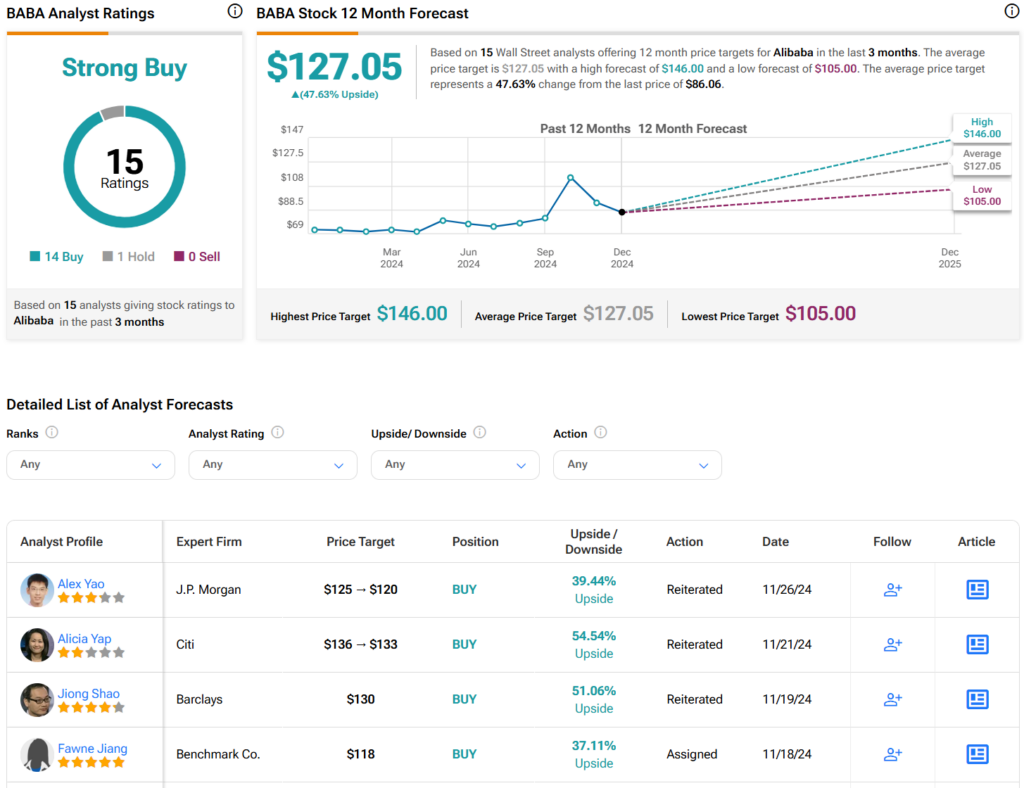

Is Alibaba a Good Buy, According to Wall Street Analysts?

Turning to Wall Street, analysts have a Strong Buy consensus rating on BABA stock backed by 14 buys and one Hold rating. The average BABA stock price target of $127.05 implies about 47.63% upside potential.

Final Take: The Case for Alibaba Stock

As I rate Alibaba as a Buy, I believe the upside potential for Alibaba stock is clear, given its de-risked valuation compared to peers, its aggressive push into AI, and the immense opportunity in China’s cloud market, which is still in its early growth stages. Additionally, the company’s management is sending a strong signal by aggressively repurchasing shares, further indicating that the stock is undervalued.

While there are risks, particularly related to the recovery of the Chinese economy and growth prospects, I find the risk-reward profile—based on these three key factors—highly attractive.