Interest in artificial intelligence (AI) has been surging since the November release of ChatGPT, and Chinese tech giant Baidu (NASDAQ:BIDU) could be a key beneficiary of this. Reports note that Baidu is readying for the launch of its own answer to ChatGPT in March. I’m bullish on Baidu stock as a way to invest in a potential AI leader at an undemanding valuation.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Interest in Artificial Intelligence Surges

ChatGPT has gained incredible traction in a short time since its release less than three months ago. People are asking it to answer questions and even asking it to do their homework and write essays for them. ChatGPT even famously passed the bar exam.

While many investors would line up for the chance to invest in this technology, ChatGPT’s parent company OpenAI is private. OpenAI’s investors include Microsoft (NASDAQ:MSFT) and a star-studded list of top private equity investors and Silicon Valley luminaries. The company was founded by Elon Musk and Sam Altman and is backed by LinkedIn co-founder Reid Hoffman. But for now, investing in OpenAI is out of reach for the average investor.

However, there are other ways to gain exposure to the growth of artificial intelligence, and China’s search giant Baidu is an attractive way to gain exposure to this exciting space. The stock could be the next beneficiary of the wave of investor enthusiasm for all things AI that’s sweeping over the market.

For example, C3.ai (NYSE:AI) stock has surged over 120% year-to-date as investor interest in artificial intelligence continues to build, but the reasonably-valued Baidu looks like a sensible way for interested investors to gain exposure to AI.

Baidu is No Newcomer to AI

Reports note that Baidu’s artificial intelligence solution will be integrated into its own search engine in March. Baidu would be one of just a handful of tech companies worldwide that has unveiled this type of technology to the public. It would also be the first company to bring this technology to China, where the government blocks access to ChatGPT and takes what some observers call a strong-handed approach to regulating internet usage in the country.

Baidu’s growth has fallen behind that of its Chinese tech rivals in recent times, but its well-timed shift towards AI several years ago could soon begin to bear fruit. The company has spent the last few years investing in self-driving cars, deep-learning models, and even image-generation technology similar to Open AI’s Dall-E. The chatbot is being trained in both Chinese and English, so the potential market is huge.

Beyond the Hype

Beyond the hype, unleashing its own version of ChatGPT could open new revenue streams for Baidu. After gaining cultural relevance, ChatGPT subsequently capitalized on this interest by introducing ChatGPT Plus, a subscription service that will cost users $20 a month.

ChatGPT Plus gives members priority access to ChatGPT (which often becomes inaccessible due to high demand), faster response times, and access to new features. It’s too early to say how successful OpenAI’s monetization efforts will be, but it shows that the potential to monetize this technology is there.

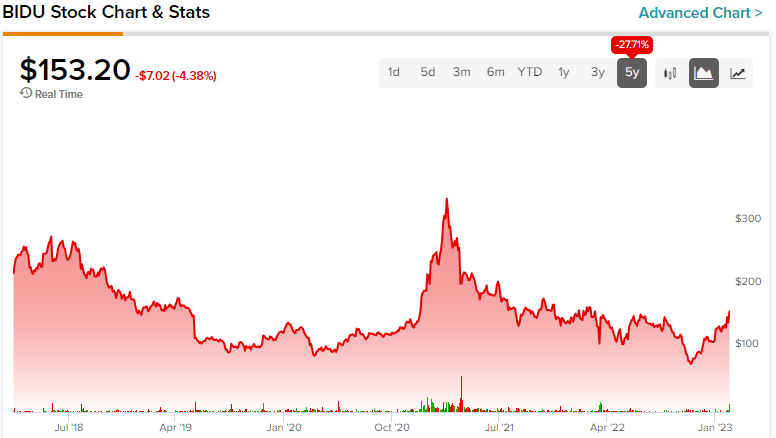

Right now, advertising from its Search business accounts for the vast majority of Baidu’s revenue, but it has faced increasing challenges in this area in recent years from ByteDance and other competitors. Growth in its core Search business peaked several years ago, and the stock has fallen almost 30% over the last five years.

This necessitates the ability to commercialize other businesses, and artificial intelligence represents a way to make this pivot. Successfully monetizing its artificial intelligence offerings would be a boon for Baidu.

A Comparatively Inexpensive Valuation

Baidu looks fairly attractive from a valuation perspective. The stock trades at under 17 times 2023 earnings, which is a discount to the S&P 500’s (SPX) forward P/E of 20.9x. It also trades at 3.2 times sales, which is attractive compared to many of its tech-sector peers.

For example, other companies associated with artificial intelligence, such as Alphabet (NASDAQ:GOOGL), trade at about 21 times 2023 earnings and just under 5 times sales. Pure-play AI company C3.ai is not yet profitable and trades at a steeper price-to-sales multiple of around 10x.

Is BIDU Stock a Buy, According to Analysts?

Analysts currently view Baidu as a Moderate Buy. Of the 21 analysts covering the stock, 15 call it a Buy, five have a Hold rating on it, and one analyst says that it’s a Sell. The average BIDU stock price target of $159.93 implies 4.4% upside potential from the stock’s current price.

The Takeaway

In conclusion, Baidu looks like an interesting, under-the-radar way to get exposure to AI technology. The stock trades at a reasonable valuation, giving investors a good way to invest in this exciting space.