There’s a case to be made for China. Yes, the Asian giant has become a favored punching bag of the political class, with some arguing for sanctions and confrontation while others argue for closer relations and open trade. ut whatever position you take, there is a case to be made for Chinese investments.

In recent years, we’ve seen ‘trade war’ between the US and China, with ‘phase one’ trade agreement putting direct economic confrontation in abeyance early this year – and just in time, for the coronavirus struck shortly afterwards. It’s not likely that Joe Biden’s incoming Administration will continue confrontational trade policies, but that doesn’t mean China’s in the clear.

Paul Colwell, head of Asia advisory portfolio group at Willis Towers Watson, sees these tensions as a natural step in a process away from globalization, and as an opportunity for investors. He describes his position, saying that investors should put up to one-fifth of their portfolios into Chinese companies.

“If you believe that the world is moving away from globalization, if you believe that the major economies in the world, particularly the U.S. and China will decouple from each other, then we believe there’s a strong case for allocation into China and more than you would have expected otherwise,” Colwell noted.

While a controversial position, considering the confrontational attitude China has taken towards potential rivals on the global scene, Colwell’s point is well made.

Wall Street’s analysts are underscoring the point, highlighting Chinese stocks which they foresee rallying by over 30% in the coming year. Here are the details on three such stocks, from the TipRanks database.

Youdao (DAO)

Youdao is a search engine on the Chinese internet, established in 2007 by the Chinese internet company NetEase. Youdao is the featured search app on its parent company’s web portal, and allows visitors to search and browse website, news, music, images, blogs, and more. In addition to web searching, Youdao also offers dictionaries, for both the Chinese language and Chinese-English translations, along with a cloud-based notepad service and a shopping assistant.

DAO shares have strongly outperformed the S&P 500 this year, registering 83% – as compared to the index’s 14%. It’s a gain powered by solid earnings growth through the year, and the forward estimates of 5.86 billion yuan (895 million USD) for 2021 revenue represents continued growth, on the order of 137%. This is significantly higher than the estimates for peer companies, averaged at 23%.

Covering Youdao stock for HSBC, analyst Binnie Wong writes, “Looking into 2021, Youdao will remain committed to growth over profitability, by strategically raising its marketing spend and improving unit economics.”

This is a key point, as the company regularly runs serious EPS losses. Wong acknowledges the losses, but notes that they are strategic for the company.

“At this stage, Youdao is focusing on accumulating users and user data for future monetisation through online course cross-selling. As of today, Youdao has over 100k users of its dictionary pens, and the margins are competitive according to management.” Wong added.

In line with these comments, the analyst gives DAO a Buy rating with a $42 price target, indicating a 62.5% growth potential for the coming year. (To watch Wong’s track record, click here)

Overall, Youdao gets a Strong Buy rating from the analyst consensus, based on a unanimous 3 recent Buys. The stock’s average price target matches Wong’s, at $42. (See DAO stock analysis on TipRanks)

China Online Education (COE)

Next up is China Online Education, an online education platform serving a Chinese customer/student base and offering courses and educational services in the English language. The key selling point is an online and mobile educational platform, permitting students from all over China to take on-demand, live-stream, interactive lessons, in English, with foreign-based teachers.

It’s an attractive business model, and one that’s gaining students – especially in this ‘corona’ year. COE’s revenues have risen steadily through 2020, from $68.8 million in Q1 to $79.3 million in Q3. Share price has shown even stronger performance, gaining 151% year-to-date.

Strong revenues and a rising share price have given China Online both the cash and incentive to repurchase shares, and this past fall the company announced plans to do just that. The company’s board authorized a repurchase of $20 million worth of ‘Class A ordinary shares’ between September 2020 and September 2021. The company will be using existing cash holdings to fund the repurchase program, a sign of a solid balance sheet.

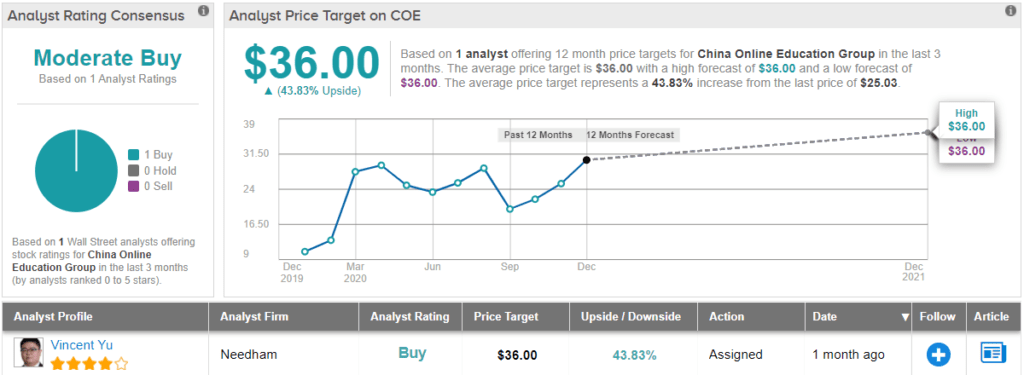

Writing from Needham, analyst Vincent Yu notes several factors that point to a sound foundation for COE in the English language online market. Among factors he notes, two stand out: “1) The company is focusing on student growth as competitive pressure slowly eases, setting up for future top-line growth 2) higher-tier cities and lower-tier cities experienced similar growth during 3Q20, meaning COE is taking market share across the board…”

To this end, Yu puts a $36 price target on COE shares, implying a 44% one-year upside. Along with this target, he rates the stock a Buy. (To watch Yu’s track record, click here)

Some stocks fly under the radar, and COE is one of those. This is the only recent analyst review of this company, and it is decidedly positive. (See COE stock analysis on TipRanks)

Hutchison China MediTech (HCM)

Last but not least is a $4 billion holding company in China’s drug manufacturing sector. Hutchison China MediTech, doing business as Chi-Med, owns a group of subsidiaries engaged in the manufacture and distribution of pharmaceuticals. HCM’s products include over the counter medications and consumer healthcare items, as well as sophisticated therapeutics and immunotherapies for the treatment of cancer and autoimmune disorders.

As with many pharmaceutical companies, HCM’s share price is driven by the company’s approved products and development pipeline. In this area, HCM has two advantages.

First advantage is Elunate, a drug approved by Chinese regulators as a treatment for colorectal cancer. The company has been working with Eli Lilly, one of the giants of Big Pharma, to fast-track marketing and patient access; earlier this year, that agreement was amended to improve commercialization efforts on Elunate to include all of China.

The second advantage is Savolitinib, a drug developed as a treatment for some types of non-small cell lung cancer. The company’s New Drug Application (NDA), a key milestone in regulatory approval, has been accepted by China’s National Medical Products Administration.

Both drugs are being investigated for additional indications, and are part of an active pipeline at the company, which includes nine medications in various stages of development.

Among the fans is Deutsche Bank analyst Rajan Sharma who rates HCM a Buy. His $40 price target shows the extent of his confidence, implying ~37% upside for the coming year. (To watch Sharma’s track record, click here)

Defending his bullish stance on HCM, Sharma writes, “We believe Chi-Med is well on track in its evolution from a Chinese pharmaceutical/OTC company into a fully integrated, innovative global oncology company […] We see the next steps of Chi-Med’s evolution as being approval of its first solely developed drug and launches outside of China, particularly in the US. The company is on track to achieve both of these in the next two years.”

All in all, HCM has earned a Moderate Buy consensus rating, with 2 Buy reviews in the past three months. Shares are priced at $29.28 and the $40 average price target matches Sharma’s. (See HCM stock analysis on TipRanks)

To find good ideas for Chinese stocks trading at attractive valuations, visit TipRanks’ Chinese stock comparison, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.