In this piece, we’ll use TipRanks’ Comparison Tool to look at three Strong Buy-rated Dow Jones stocks — DIS, MCD, and MSFT — that may already have the worst baked in, with the means to rally in the face of a recession.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

After such an impressive run off June lows, the Dow Jones Industrial Average seems to be in a spot to give up a chunk of the gains. While nobody knows how low the current post-rally breather will drag down markets, I do think analysts are less inclined to lower their price targets on the more resilient firms that have stood their ground this year.

Understandably, a recession (or anticipation of an economic downturn) will eat away at the impressive growth numbers posted when the economy was red-hot for most of 2021. With the Fed pulling the brakes on the economy, many firms are bound to crumble amid mounting macro pressures and a more selective consumer.

Still, not all firms are created equally. Many large-cap blue-chip companies may be positioned to make the most of the relatively mild recession that could be in the cards. The Dow Jones is a rather weird price-weighted index, with a relatively small sample (30) of well-established companies.

While the Dow may not be a good representation of the broader stock market, it does hold many intriguing “value” options that could persevere in this rate and growth-driven market sell-off.

Disney (DIS)

Disney has already been through one of the worst headwind hailstorms in its history. COVID-19 lockdowns crushed the parks and amusements business as the company scrambled to bring entertainment to locked-down households with its video-streaming platform Disney+.

As lockdowns lifted and America returned to normal, excitement in video-streaming eventually faded. Streaming isn’t cutting-edge anymore. It’s just another medium to reach the consumer, and an expensive one at that.

While streaming hype has died down, Disney’s streaming growth has not. With subscriber growth momentum, the trio of Disney+, Hulu, and ESPN+ makes Disney the new king of streaming. In any case, investors seem to think the streaming wars are over as we approach a recession.

Though streaming is no longer innovative, I do think the streaming market has been overly punished. As we exit the recession, consumers will begin spending money on subscriptions again. Streamers like Disney will become more creative at reducing industry churn rates, whether that be through ultra-long series or “stacked” content pipelines; I do think the negativity surrounding streaming is overdone.

With Disney+ continuing to grow while parks continue to flex their muscles, it’s hard not to be upbeat on Disney stock as it look to rebound from one of its worst plunges (around 53%) since the Great Recession.

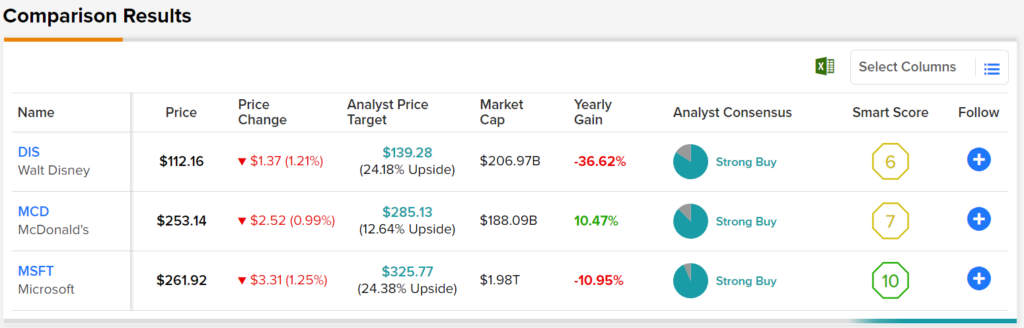

Wall Street thinks Disney is a strong buy, with 16 Buys and three Holds assigned in the past three months. At 2.6 times sales, DIS stock may very well prove a misunderstood bargain, as parks and streaming continue to exhibit strength for a change. The average DIS stock price target of $139.28 implies 24.2% upside potential.

McDonald’s (MCD)

McDonald’s is an American icon with a stock that’s proven to be a great hiding place for recession-rattled investors. Shares of MCD have held their own far better than the market averages, helping the Dow hang onto some relative outperformance versus the tech-heavy Nasdaq.

At writing, the fast-food pioneer trades at a hefty 31.7 times trailing earnings and 8.1 times sales. That’s more expensive than many high-growth tech stocks. Though McDonald’s is an old-school, recession-resilient firm with an easy-to-understand business model, CEO Chris Kempczinski has shown an old dog can learn new tricks.

With intriguing celebrity collaborations and the willingness to experiment with new menu items (think the Chicken-based Big Mac), McDonald’s is increasingly relevant to young and hip audiences.

McDonald’s isn’t just ready to continue generating ample free cash flow as recession tides move in; it’s ready to take market share. The stock is expensive from a historical perspective, but it deserves to be.

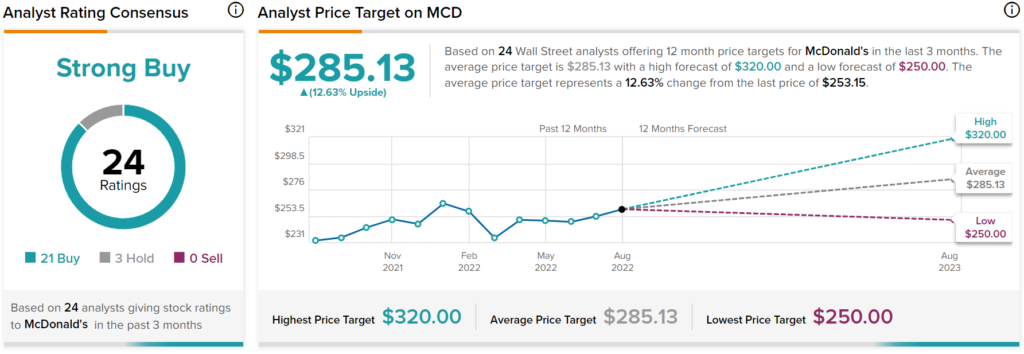

Wall Street’s also lovin’ McDonald’s stock, with 21 Buys and just three Holds. The average MCD stock price forecast suggests 12.6% upside over the year ahead. In a bear market with a recession on the way, such seemingly “average” returns are more than any investor could ask for.

Microsoft (MSFT)

Microsoft is a Dow behemoth with a $2 trillion market cap at writing. The software kingpin has found a way to resist the growth-fading effects of old age, thanks in part to its strength in the cloud. Beyond Azure, Microsoft has a hand in many other pies, many of which could evolve to become new growth drivers once the metaverse is ready for the masses.

Specifically, Microsoft’s Xbox gaming division is something to watch as it moves closer to gaining the green light to acquire video-game developer Activision Blizzard (ATVI). Over the years, the company has stealthily changed the video-game industry with its Xbox Game Pass offering.

Game Pass is a disruptive force that changes how gamers access content. With one subscription, gamers have access to over a hundred quality titles. As Game Pass improves, with Activision and Blizzard titles that may be added to the service if the Activision Blizzard deal goes through, I think the days of buying individual games could be numbered as subscription offerings continue to strengthen.

For now, Xbox is a relatively small slice of the pie. However, if the metaverse goes mainstream in the latter half of the decade, Xbox could power sustainable double-digit growth, as Azure has been doing.

Microsoft is a firm that continues to evolve while using its size (and pocketbook) to its advantage. With a recession looming, economic jabs and hooks will be flying Microsoft’s way, but it’s far better able to roll with the punches than many of its smaller peers.

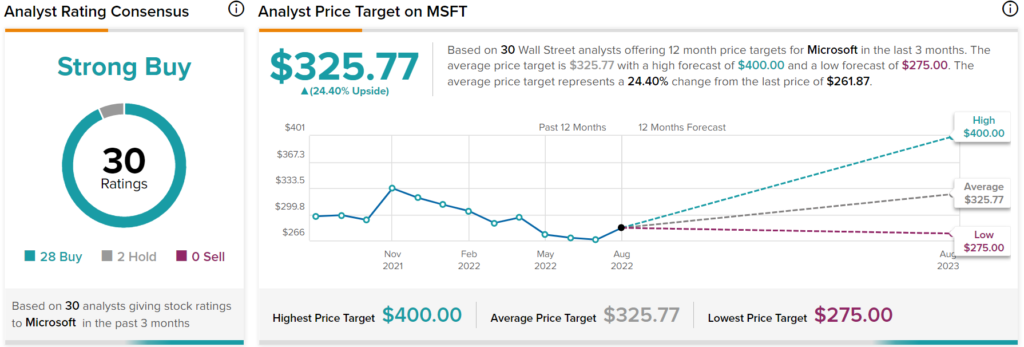

Wall Street remains bullish on Microsoft and its ability to grow through tough times, with 28 Buys and two Holds. Analysts have an average MSFT stock price target of $325.77, which implies 24.4% upside potential.

Conclusion – Analysts Expect the Most from MSFT Stock

Disney, McDonald’s, and Microsoft are some of analysts’ favorite stocks in the Dow. Of the three names, Microsoft seems to have the most year-ahead upside potential, with 24.4% gains expected.