High-quality consumer stocks are a fine middle ground for investors who don’t want to overextend themselves on the risk front as this tech-fuelled rally takes the Nasdaq 100 (NDX) ever so closer to its December 2021 peak. Though we’ve heard various folks using the word “bubble” to describe the run in AI-focused names, I do think it’s a tad too early in the game to say the Nasdaq 100 is partying like it’s 1999.

In this piece, we’ll check in with three consumer stocks that continue to earn the praise of Wall Street analysts. Even if the Nasdaq’s run ends in tears, I find it hard to believe that the following names will hurt nearly as much.

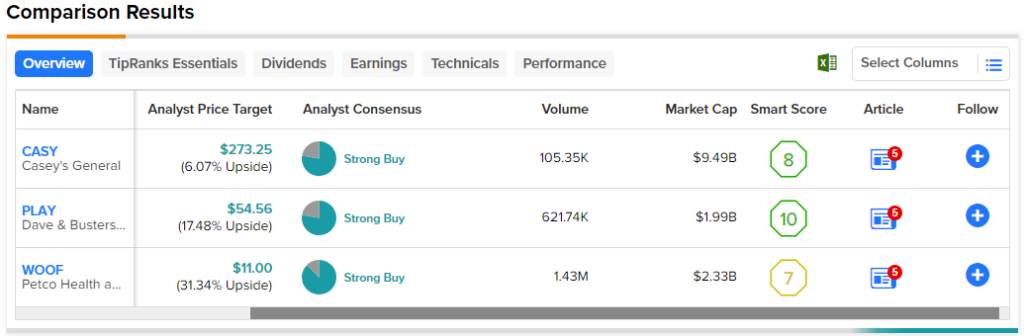

Therefore, let’s use TipRanks’ Comparison Tool to tune into three consumer plays that may have what it takes to move higher over the year ahead, even without help from the broader market.

Petco Health and Wellness (NASDAQ:WOOF)

Petco is a pet retailer whose shares have been under pressure since its first-day boom on the Nasdaq back in 2021. The stock is now down around 70% from its all-time high, just north of $27 per share and a far cry away from its $18 per-share IPO price. After a few less-than-impressive quarters, shares of Petco went from top dog to underdog. Undoubtedly, Petco’s collaboration with popular rapper Snoop Dogg could give its brand a nice jolt. Still, until consumers experience greater relief, I’m inclined to stay neutral on the name.

In the latest quarter, Petco felt the pinch of “a more cautious consumer.” As a potential recession approaches, it will be interesting to see how the resilient consumables business helps to keep the results afloat. Undoubtedly, I do view some defensive aspects of the company, given how many people treat their pets as family members to be spoiled rotten.

As inflation and economic pains mount, though, the more discretionary side (nice-to-haves) could continue to weigh down the firm. In any case, I continue to view Petco as one of the cheaper stocks to play a rebound in consumer spending. When economic circumstances change, I expect it will not take long before pets feel the spoils again.

For now, Petco and the rest of the retail crowd seem to like risky bets over the medium term. At just 0.3 times price-to-sales, well below the specialty retail industry average of 2.9 times, the stock may be cheap enough to make up for the recession risks.

What is the Price Target for WOOF Stock?

Analysts have a Strong Buy rating on the name, with seven Buys and one Hold assigned in the past three months. The average WOOF stock price target is $11.00, implying 31.1% upside potential.

Dave & Buster’s Entertainment (NASDAQ:PLAY)

Entertainment-focused restaurant chain Dave & Busters has seen its shares trade in a wide range ($30 to $48) for around two years now. Today, the stock’s going for $46 and change, thanks to its magnificent June surge aided by new plans to jolt sales while trimming costs under its new CEO Chris Morris.

Now, Mr. Morris hasn’t been the top boss for very long (just over a year), but his plan clearly has the confidence of investors and the analyst community, which touts a “Strong Buy” on the name. After such a double-digit percentage pop, I’m in no rush to scoop up shares. As such, I’m staying neutral for now but would be inclined to go bullish if management can deliver on its plans in an uncertain economic environment.

The company expects it could save upwards of $15 million by investing in tech while trimming labor expenses. Indeed, such efforts could be met with outstanding results. However, let’s not forget that Dave & Busters is one of the consumer names that may be more economically sensitive than you’d think.

Even after an impressive first quarter that saw record revenue, I worry that a recession could keep shares range-bound for longer. At 15.4 times trailing price-to-earnings, well below the restaurant industry average of 33.2 times, PLAY stock looks good based on relative value, but be mindful of the company’s economic sensitivity.

What is the Price Target for PLAY Stock?

Dave & Busters is well-liked on Wall Street, with seven Buys and two Holds assigned in the past three months. The average PLAY stock price target of $54.56 implies 17.5% upside potential.

Casey’s General Stores (NASDAQ:CASY)

Casey’s General Stores shares are at a fresh all-time high, near $260 per share. The $9.8 billion convenience store company is doing a lot of things right. Still, the choppy environment seems less hostile to convenience retailers than specialty retailers like Petco or entertainment-infused dine-in restaurant plays like Dave & Busters. As the company looks to grow via strategic expansion, I find it hard to be anything but bullish.

At writing, CASY stock trades at around 21 times trailing price-to-earnings, well below the 31.6 times sported by the food distribution & convenience store industry average.

Earlier this year, Northcoast Research praised the company for its “extraordinarily strong fuel profitability.” Undoubtedly, fuel margins have been impressive, and the trend could carry onward, even if the economy gets hit with a mild recession.

What is the Price Target for CASY Stock?

Casey’s is a Strong Buy, with six Buys and two Holds from analysts. The average CASY stock price target of $271.57 entails 5.5% upside potential from here in the 12 months.

Conclusion

Even if the Nasdaq 100 is getting overextended, it’s never a bad idea to shift capital towards areas of the market that may be richer with value. Of the following consumer plays, analysts are most bullish on WOOF, with 31% upside expected from here.