Seesaw trading and mixed messages – that’s been the market’s pattern for the past few weeks, and last week was no exception. The week started with four straight days losses, but ended on a winning Friday session after an unexpectedly strong jobs report. Even so, the S&P 500 was down 3.35% for the week, snapping a four week rally. Overall, the index is down 21% for the year, in bear territory, and losses on the tech-heavy NASDAQ are even steeper, at 33%.

The conflicting currents make it difficult to put together a winning portfolio, but a tough-minded, risk-friendly investor can chart a course using proven market gainers. We’re talking about stocks that are coming out of 2022 ahead of the game, with winning records in share appreciation – on the order of 80% to 180% year-to-date – and positive reviews from the analysts for more gains in 2023.

Using TipRanks’ database, we’ve looked up the details on three of these stocks, and found that Street’s pros see substantial upside, starting at 70% and rising from there. Let’s take a closer look.

NexTier Oilfield Solutions (NEX)

We’ll start on the oil patch, and look at NexTier Oilfield Solutions, an oilfield service company, whose shares have gained 188% this year. Oilfield service companies make it possible for the giant hydrocarbon production firms to get the oil out of the ground. The production companies typically focus on exploring for energy reserves, locating likely well sites, and buying up the land and drilling rights; the services firms specialize in the engineering and technical skills of geology, drilling, fluid technologies, and pumping that actually get the oil and gas out of the ground. NexTier operates in this niche.

In addition to these operational activities at the wellheads, NexTier also offers oil producers a range of additional services, including digital control for equipment, logistics, and systems monitoring.

This is big business, and at the end of 2021 the combination of rising oil prices and the post-COVID return of a more normal economic environment pushed NexTier into the black. The company has recorded quarterly net profits since 4Q21; in the last reported quarter, 3Q22, the company showed a bottom line of $129.5 million in adjusted net income, or 52 cents per diluted share. This compared to the $98.5 million and 39-cents diluted EPS in 2Q22, was a strong turnaround from the $24.3 million net loss recorded in 3Q21. At the top line, NexTier showed revenues of $896 million, up an impressive 128% year-over-year.

On the balance sheet, NexTier is in a sound position, with total liquid assets of $621.7 million, including $250.2 million in cash. The company saw $163.8 million in net cash from operations in Q3 this year, a total that included $132.6 million in free cash flow. NexTier does not have any term loans maturing until 2025.

NexTier management felt confident enough in these results to announce, in the quarterly report, the initiation of a $250 million program of share repurchases, to return capital to investors.

Covering the stock for Evercore ISI, analyst James West sees NexTier in a position to continue showing gains – and to continue delivering those gains to shareholders.

“The combination of rising frac demand, NEX’s strategic repositioning, and countercyclical investments have enhanced its earnings power and cash flow generation. The company continues to establish new quarterly records for revenue and EBITDA. NEX remains focused on recapturing all Covid related pricing concessions and further pushing out its vertical integration solutions. The frac market should remain supportive given a nearly sold out market running at high levels of service intensity and a tight supply chain environment,” West opined.

“NEX remains committed to capital discipline, maximizing shareholder returns, and returning a sizeable portion of free cash flow to shareholders,” the analyst added

Based on the above, West believes this is a stock worth holding on to. The analyst rates NEX shares an Outperform (i.e. Buy), and his $18 price target suggests a solid upside potential of ~76%. (To watch West’s track record, click here)

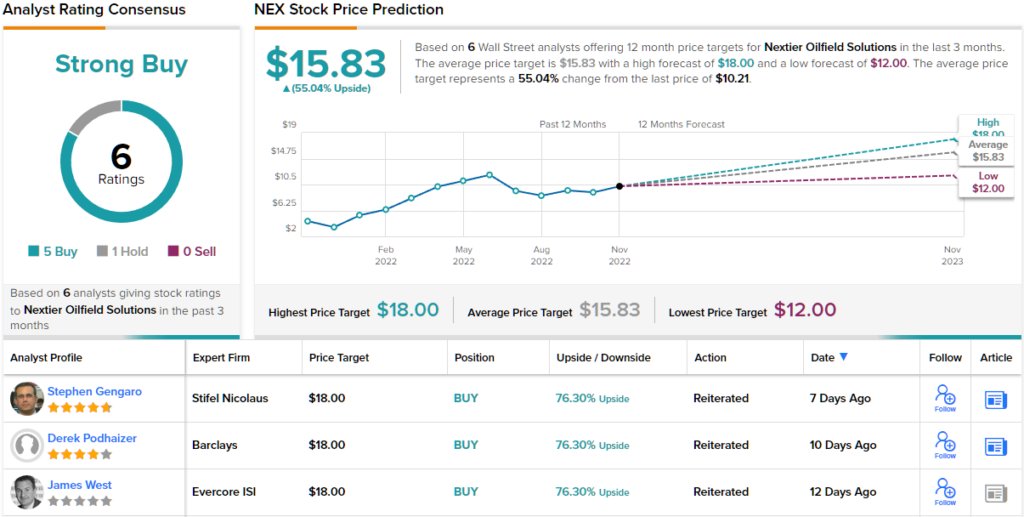

Overall, this oilpatch company has picked up 6 recent reviews from the Wall Street analysts, and these include 5 to Buy against 1 to Hold, for a Strong Buy consensus rating. The stock is selling for $10.21 and has an average price target of $15.83, indicating potential for 55% share gains in the year ahead. (See NEX stock forecast on TipRanks)

Verona Pharma (VRNA)

We’ll now switch gears and move over to the biopharma sector. Verona Pharma, whose shares are up 80% year-to-date, is working to develop and commercialize its drug candidate, ensifentrine, as a treatment for a variety of respiratory disorders. The company has a series of clinical trials ongoing, testing ensifentrine as a treatment for asthma, cystic fibrosis (CF), and chronic obstructive pulmonary disease (COPD). With the exception of asthma, which is long-term and chronic, these are terminal conditions lacking effective treatments; the ensifentrine studies have advanced to Phase 2 and Phase 3.

The most advanced of these studies is the ENHANCE-2 Phase 3 trial of ensifentrine as a treatment for COPD. Last month, Verona announced that, in the study, the drug had reduced exacerbation rates – severity and progression of the disease – by an average of 42% across all subgroups of the study. Ensifentrine is administered through a nebulizer in this trial, and these results will be included in the company’s New Drug Application to the FDA, currently planned for 1H23.

Also of note for investors, Verona is progressing on the ENHANCE-1 trial of ensifentrine nebulizer as a maintenance treatment for COPD, and expects to complete the trial before the end of this year. The company completed enrollment, of more than 800 patients, this past June.

On other tests, Verona has ongoing Phase 2 studies of ensifentrine as a dry powder inhaler/metered dose inhaler for the treatment of COPD, asthma, and CF.

Among the bulls is Wedbush analyst Andreas Argyrides, who takes an upbeat view of Verona. He writes, “With its novel mechanism of action as a PDE3/4 inhibitor, ensifentrine is poised to usher in the next generation of inhaled therapies with dual bronchodilator and anti-inflammatory effects. We view Verona shares as an opportunity to invest in a new class of inhaled treatment for not just COPD but also cystic fibrosis and asthma.”

Argyrides doesn’t just write up upbeat comments on Verona; he backs it with an Outperform (i.e. Buy) rating, and a $27 price target that suggests a robust 122% one-year upside potential. (To watch Argyrides’ track record, click here)

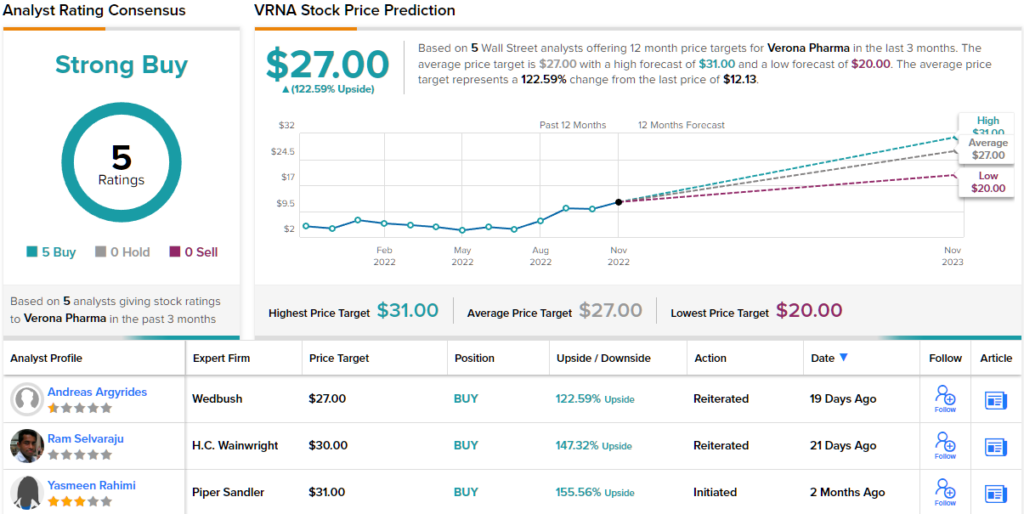

Overall, this emerging biotech firm has caught the attention of 5 Wall Street analysts and their reviews are all positive, giving VRNA shares a Strong Buy consensus rating. The stock is selling for $12.13 and its $27 average price target matches the Wedbush view, for a 122% upside potential in the year ahead. (See VRNA stock forecast on TipRanks)

Lantheus Holdings (LNTH)

The last 2022 winner we’ll look at is Lantheus, a biopharma company that develops and commercializes a series of products in the imaging, diagnostic, and treatment of a variety of oncological and cardiac conditions. In addition, the company maintains an active research pipeline, with new products at the preclinical, early clinical, and late clinical stages.

Lantheus’ leading product is Pylarify, a radiopharmaceutical treatment for prostate cancer. According to the company’s recently released 3Q22 financial results, sales of Pylarify came to $143.75 million, well over half of the total quarterly revenue. The company’s other main revenue generator was Definity, an injectable ultrasound enhancement used in cardiovascular echocardiography. Definity sales came to $60.74 million in Q3, up 5.4% from the year-ago quarter.

Overall, Lantheus posted Q3 revenues of $239.29 million, up 134% from the third quarter of 2021. For the nine months ending September 30, 2022, the company’s top line hit $671.89 million, for a 127% year-over-year gain.

On the earnings side, Lantheus posted adjusted fully diluted net income of 99 cents per share. This was up from just 8 cents reported in the year-ago period. Lantheus had $93.6 million in cash from operations in Q3, of which $87.5 million was free cash flow.

Given those results, it should come as no surprise that the stock has attracted investors. Shares in Lantheus are up 110% this year. But would you believe it could go up another 80%?

SVB Securities’ Roanna Ruiz does. The analyst rates LNTH shares an Outperform (i.e. Buy), along with a $110 price target. (To watch Ruiz’ track record, click here)

Seeing the profitable product line and rising revenues as the key points for this company, Ruiz says: “We reiterate our view that Lantheus could sustain a ~45% 2020-23E rev. CAGR as it leverages its diverse portfolio of diagnostic image enhancing solutions, all of which cover unique and sizable cardio/oncology market opportunities. After a 3rd beat/raise quarter in a row and a new competitor on the market, investors continue to scrutinize Pylarify’s growth trajectory into 2023, and good news is management remains confident in their ability to maintain a leadership position with Pylarify in the prostate cancer imaging space.”

All in all, this profitable biotech firm has outperformed the market, and it has also picked up 4 recent analyst reviews. These all agree that the stock is a buy – for a Strong Buy consensus rating. The average price target of $105.25 suggests ~74% upside from the current trading price of $60.60. (See Lantheus’ stock forecast at TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.