Barring selected periods of relief, the inherent trend of the stock market has been resolutely negative in 2022. For investors searching for ways to boost the portfolio’s performance, there have generally been slim pickings.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

But if you look on the bright side of a market situation where stocks are continuously pushed further down, what you get are some low and enticing entry points.

Roth Capital’s tech and communications expert Scott Searle certainly thinks that with a bit of digging, investors can find some ‘oversold gems.’ “We believe there are multiple investable opportunities within our IoT and broadband universe,” the 5-star analyst recently said.

So, let’s take a look at some of these “oversold gems” which Searle thinks are ripe for the picking at present. In fact, the analyst reckons a couple of stocks are set to more than double in the year ahead. With help from the TipRanks platform, we can see how Searle’s recommendations fare amongst his colleagues in the analyst community.

Lantronix, Inc. (LTRX)

We’ll start with Lantronix, a leader in the world of networking and connectivity hardware. The company offers secure turnkey solutions for global customers in the worlds of Internet of Things (IoT) and Remote Environment Management (REM). The company’s offerings include intelligent hardware to power connectivity services, engineering support, and cloud-based Software-as-a-Service. The company’s products have found application in the fields of automotive, data centers, industrial, logistics, medicine, wearables, video conferencing, retail, and smart city tech.

Lantronix’ product lines are heavily weighted toward wireless connectivity, including network device servers, network switches, IoT gateways, and media converters. The company also offers a full range of support services, for software, installation, and design.

Last month, Lantronix reported its fourth and final quarterly results for its fiscal year 2022. The headline number was a quarterly top line of $35.9 million, a gain of 74% year-over-year. This brought with it a non-GAAP EPS of 8 cents. While this EPS came in just under the 9-cent forecast, it was up 33% from the 6-cent result reported in the year-ago quarter.

For the full fiscal year 2022, Lantronix reported $129.5 million in total revenues, up 81% from the $71.3 million reported in fiscal 2021. Looking forward, the company is guiding toward $149 million to $162 million in revenues for fiscal 2023; at the midpoint, this would represent a 20% increase from the ’22 total.

However, shares took a beating in the subsequent session as the company’s earnings outlook for FY2023 came in below expectations; Lantronix expects non-GAAP EPS in the range between $0.39 to $0.44 but consensus was looking for $0.50. Since then, the shares have continued their downward trend, and are now down 41% on a year-to-date basis.

However, Searle points out the stock’s potential for a rebound, saying: “Given the expanding product breadth from internal development and M&A, increasing scale, and management with a defined track record of success, we believe that shares of LTRX are overly discounted. With positive EBITDA, EPS and cash flow, which we expect to fuel further acquisitions, we believe it is only a matter of time before investors recognize the ongoing transformation.”

To this end, Searle rates LTRX a Buy, while his 12-month price target of $12 suggests ~161% upside from current levels. (To watch Searle’s track record, click here)

Overall, Wall Street is generally sanguine about Lantronix’s forward path. With 5 Buys and no Holds or Sells, the word on the Street is that LTRX is a Strong Buy. The shares are trading for $4.74 and their $12.20 average target suggests ~163% upside in the next 12 months (See Lantronix stock forecast on TipRanks)

Universal Display Corporation (OLED)

The second stock we’ll look at is Universal Display, a leader in the market for organic light emitting diodes, or OLEDs. This is the tech behind the next generation of electronic displays, for devices of all types, from mobile smartphones and tablets, to laptops, to desktop monitors, to wall-mounted flatscreen smart TVs. OLEDs stand at the top of the high-end market for displays, and are clearly where LED systems are headed. They can also be found in lighting systems – and give Universal Display a neat stock ticker into the bargain.

After seeing generally increasing revenues from late 2020 through 2021, this company has been facing a more difficult market environment in 2022. Business has been slowing globally, which suppressed demand for Universal Display’s OLED products, and have put near-term weakness on the company’s prospects. While the company reported a 5.4% year-over-year gain in revenues, from $129.7 million in the year-ago quarter to $136.6 million in 2Q22, the figure missed expectations by $14.61 million.

Universal Display’s earnings for Q2, while profitable at 87 cents per diluted share, based on a net income of $41.5 million, represented another disappointing result. The EPS missed the forecast of $1.01 by almost 14%.

The shares might be under the cosh in 2022, showing year-to-date losses of 41%, but the Roth Capital analyst faces the demand headwinds head-on, and comes down as a long-term bull for Universal Display.

“Overall, we view the near-term weakness as no surprise and a limited blip on the road to OLED adoption. With smartphones at ~45% penetration (640M units), TVs at < 2% penetration (laptops, tablets, monitors, etc), it remains early days in the OLED adoption cycle. We estimate that required OLED square meters to support existing smartphone, TV and IT growth still translates to a 75%+ increase by 2025, or a 15%+ CAGR,” Searle wrote.

In-line with this upbeat outlook, Searle gives OLED shares a Buy rating and a price target of $208 for the year ahead, implying an upside of 114% for the coming year. (To watch Searle’s track record, click here)

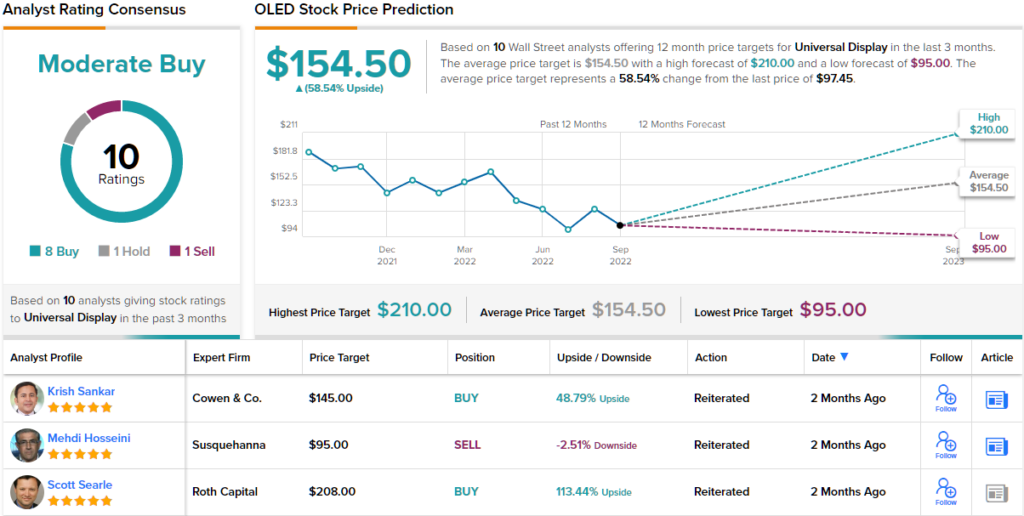

Most of Searle’s colleagues agree. Based on 8 Buys, and 1 Hold and Sell each, OLED has a Moderate Buy consensus rating. All in all, the analysts expect shares to appreciate by 59%, as indicated by the $154.50 average price target. (See OLED stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.