Anyone following stock market trends in 2022 will be well aware of the widespread drawbacks; apart from some outliers such as energy, most corners of the market have been beaten to a pulp.

The main culprits are easily identified by now; a combination of a slowing economy, rampant inflation, rates hikes to halt it, and Russia’s invasion of Ukraine and the global implications are all responsible factors.

Stock market giants have not been immune either and many have seen huge chunks of their valuations shaved off over the past 12 months.

There is a silver lining, however. Shares of many companies with sound prospects are going for cheap and those taking the long-term view could reap the rewards eventually.

With this in mind, we’ve used the TipRanks database to pinpoint two heavyweights whose shares appear to be at 52-week lows, but which have gotten the backing of some Street experts recently. In fact, the consensus view is that both are Strong Buys. So, let’s see why the analysts are getting behind these names right now.

ServiceNow (NOW)

If it’s market giants you’re after, then ServiceNow certainly fits the bill. This SaaS (software-as-a-service) company has a market cap of $77 billion, and has experienced huge growth over the past decade, as it caters to very – excuse the pun – now needs.

ServiceNow’s cloud-based platform aids businesses in managing their digital operations. There has been a dramatic increase in demand for these services in recent years, with simplified and automated operations substituting unstructured work routines.

ServiceNow has obviously done that very successfully as is evident in the numbers. In 2010, it had only 602 clients, which by the end of last year had ballooned to 7,400, with the company catering to around 80% of names on the Fortune 500 list.

ServiceNow generated revenue of $244 million in 2012 which increased at a CAGR (compound annual growth rate) of 42.5% to $5.9 billion in 2021. Not only that, but the company is also now consistently profitable.

In the latest quarterly report – for 2Q22 – adj. EPS clocked in at $1.62, beating the Street’s $1.55 forecast. Likewise, revenue rose by 30% year-over-year to reach of $1.82 billion, outpacing the analysts’ prediction by $60 million. The bulk of that was generated by subscription revenues, which at $1.66 billion, increased by 25% from the same period last year (by 29.5% adjusted for constant currency). However, the company disappointed with the outlook, lowering its FY subscription revenue forecast from between $7.03-$7.04 billion to between $6.915-$6.925 billion.

The report failed to impress investors and, in fact, that has been the trend all year, with NOW shares falling nearly 42%.

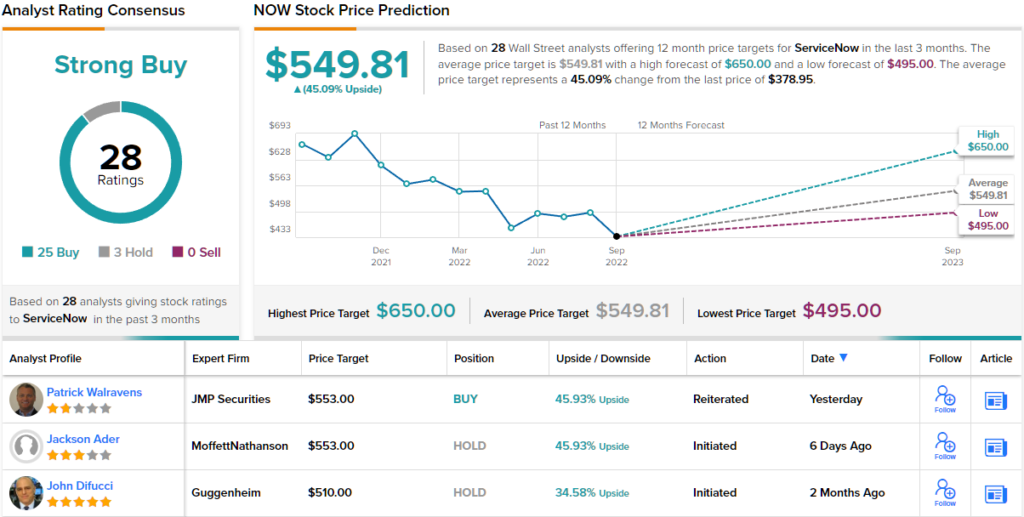

Get hold of the shares while they’re at these levels, appears to be the take of Wolfe analyst Alex Zukin, who said, “With NOW’s combination of efficient growth, best of suite offering, and best-in-class GTM, we see a company that is well positioned to outperform peers in a recessionary environment.”

Zukin believes the company is set up for several key catalysts, including: “1) ITSM Pro & Enterprise adoption, 2) verticalization, and 3) multi-product uptake across the customer base supported by a product portfolio that has dramatically expanded over the last few years and now includes customer workflows, employee workflows, creator workflows, and the NOW platform.”

These comments form the basis for Zukin’s Outperform (i.e., Buy) rating while his $600 price target suggests shares will climb 58% higher over the one-year timeframe. (To watch Zukin’s track record, click here)

Overall, almost all of Zukin’s colleagues agree. Barring three skeptics, all 24 other recent analyst reviews are positive, providing this stock with a Strong Buy consensus rating. At $549.81, the average target is set to generate returns of 45% in the months ahead. (See NOW stock forecast on TipRanks)

Zoetis (ZTS)

Let’s turn now to another giant in its field. Zoetis is the world’s leading animal healthcare company, boasting a market cap of $70 billion. The company is a developer, manufacturer and distributor of animal healthcare products, which span across medications, vaccines, and diagnostics. Spun off from Pfizer in 2013, the company directly takes its products to market in around 45 countries and, in total, are sold in over 100 countries.

According to Technavio, the companion animal healthcare market is anticipated to increase at a CAGR of 9.25% between 2021 to 2026, growing by $9.82 billion during the period. Being a market leader, Zoetis stands to reap the rewards of that growth.

The company just exceeded that expected industry growth in the most recent quarter. In Q2, revenue rose by 10.5% year-over-year to $2.1 billion, coming in $70 million above the Street’s forecast. Non-GAAP EPS of $1.20, however, fell $0.02 short of the $1.22 anticipated on Wall Street. For the full-year, Zoetis expects revenue between $8.225 and $8.325 Billion, practically the same as consensus at $8.27 billion.

Like many others, the stock has been unable to counter 2022’s bearish trends and has lost 38% on a year-to-date basis, now resting just above its 12-month low.

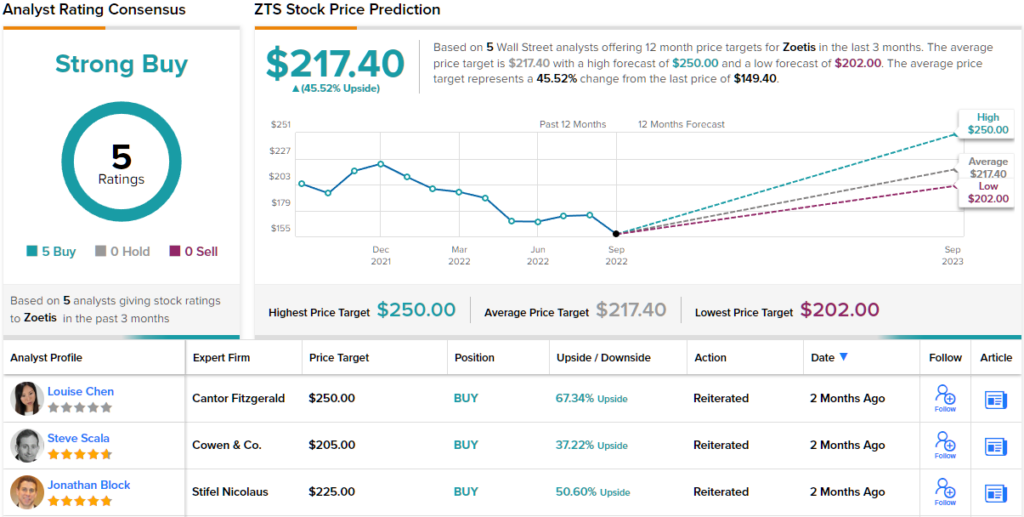

But assessing the latest print, Cantor analyst Louise Chen thinks Zoetis is primed for more success.

“Post the company’s 2Q22 results, we continue to like ZTS for its durable and diversified business model,” the analyst said. “We think the earnings potential for ZTS’s underlying business is still underappreciated and upside to expectations could come from: 1) higher-than-anticipated peak sales for new launches, 2) better-than-expected operating margin improvements, and/or 3) M&A.”

Accordingly, Chen reiterated an Overweight (i.e. Buy) rating along with a price target of $250, leaving room for one-year upside of 67%. (To watch Chen’s track record, click here)

Are other analysts in agreement? They are. 5 Buys and no Holds or Sells have been issued in the last three months. So, the message is clear: ZTS is a Strong Buy. The shares are selling for $149.40 and the $217.40 average price target implies an upside of ~46% in the year ahead. (See ZTS stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.