Investors are constantly looking for stocks that will yield massive returns. That being said, finding these stocks can seem like an overwhelming task. Not to mention it can be expensive. Some of the most well-known names like Amazon and Alphabet can put you out thousands of dollars for just a single share. However, snapping up stocks with strong long-term growth prospects doesn’t have to cost you your entire savings.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Defined these days as stocks priced under $5 per share, the penny stocks offer a fascinating – and frequently lucrative – combination of attributes, advantages, and risks. The advantages come from the low price; even a very small increment in price gain will quickly translate into a high percentage return on the original investment.

This potential for great returns has the analysts at Canaccord picking out possible winners from the market’s lineup pennies – and they have found two stocks that offer investors possible gains of 200% or better, giving them an undeniable appeal at a time of 8% and rising inflation.

Running the tickers through TipRanks’ database, we found out that other analysts are also fans, with each name scoring a “Strong Buy” consensus rating. Let’s take a closer look.

ObsEva SA (OBSV)

We’ll start with an interesting penny stock in the biopharmaceutical sector. ObsEva is focusing on women’s health, and is working on the development of a new therapeutic agent to treat health issues of the female reproductive system. Specifically, the company has developed linzagolix, a new drug candidate for the treatment of endometriosis and of uterine fibroids, two potential serious conditions that can have long-lasting impacts on patients’ health and ability to reproduce.

In recent months, ObsEva has announced several important milestones in the development and commercialization pathway for linzagolix. In February, the company announced that it has entered into a licensing agreement with the British biopharma company Theramex for the commercialization of linzagolix outside of the US, Canadian, and Asian markets. The agreement will commit Theramex to paying high royalties on the drug candidate, upwards of 30%.

In a related notice, ObsEva announced at the end of April that it had received a positive decision from the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP) on the use of linzagolix in the treatment of uterine fibroids. This positive includes a recommendation for approval.

It is important to note here that the company has also submitted a New Drug Application to the FDA for the uterine fibroid indication, and expects action by the PDUFA date of September 13 in this year.

Finally, this past March, ObsEva announced efficacy results from the Phase 3 trial of lingazolix in the treatment of moderate-to-severe pain related to endometriosis. The study followed patient cohorts taking two different doses of the drug, and recorded a meaningful reduction in pain and symptom within 1 to 2 months of the start of treatment, with improvements lasting up to 6 months. The company expects to release further data from the study in 3Q22.

All of this caught the eye of Canaccord analyst Edward Nash, who writes of ObsEva’s chief product: “We believe linzagolix differentiates significantly from the two commercially available GnRH receptor antagonists. The differentiation lies in a superior PK/PD profile, increased bioavailability and greater optionality in the use of add-back hormonal therapy. Uterine fibroids affect an estimated 70% of women of child-bearing age. By pricing in line with currently approved treatments and offering a superior overall efficacy and usage profile, we believe linzagolix for the treatment of uterine fibroids could conservatively generate $364M in sales and royalty revenue in 2032. We project a launch for linzagolix for endometriosis in 2025 after conducting a second Phase III trial with total expected revenue in 2032 of $124.4M.”

The analyst summed up, “ObsEva is currently trading not far off from its 52-week low. We believe shares are significantly undervalued.”

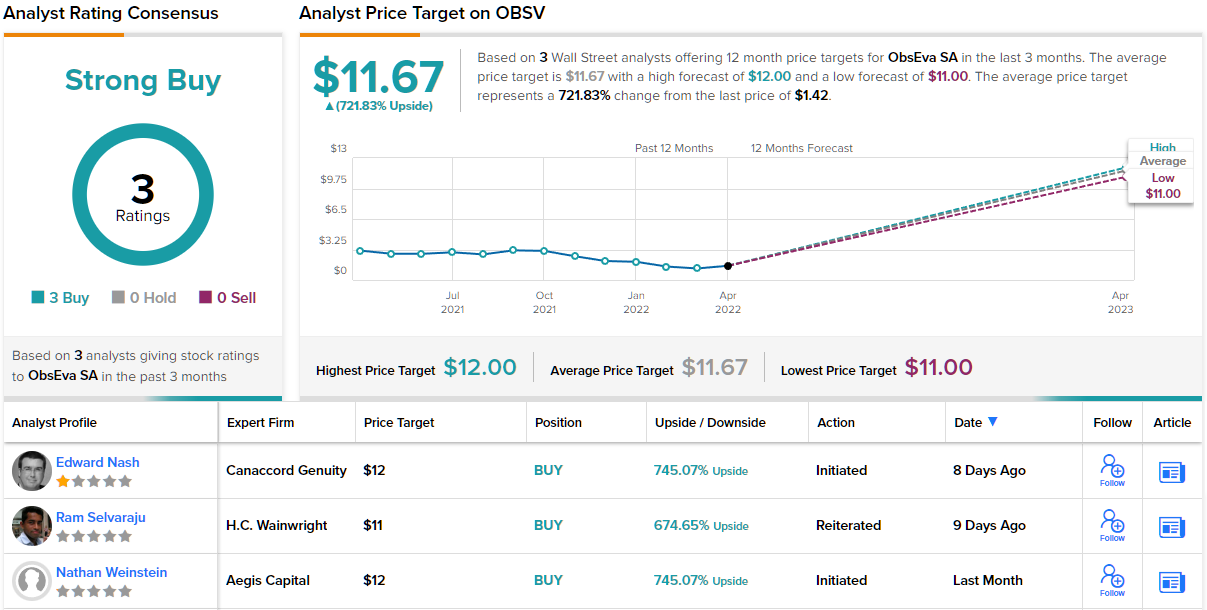

Currently going for $1.43 apiece, OBSV could see major gains, according to Nash. The analyst rates the stock a Buy along with a $12 price target, which implies a robust upside potential of 733% for the next 12 months. (To watch Nash’s track record, click here)

Overall, the bulls have it. OBSV’s Strong Buy consensus rating breaks down into 3 Buys and no Holds or Sells. The $11.67 average price target implies shares could climb ~722% higher in the coming year. (See OBSV stock forecast on TipRanks)

Clene (CLNN)

Let’s stick with the biopharma sector. Clene, the second penny stock we’ll look at, is a clinical-stage research company, investigating the use of nanotechnology in the treatment of bioenergetic failure. Clene’s nanotech is the basis of the company’s bioenergetic nanocatalyst drug candidates, a new class of biopharmaceutical therapeutics designed to promote neurorepair through ‘hot wiring’ bioenergetic catalysis and improving cellular-level neurofunctions.

The real action on Clene’s pipeline has come in the recent announcements about its therapeutic agent CNM-Au8, a gold nanocrystal suspension with multiple applications and several concurrent, which is in mid-stage clinical trials.

Starting back in February, Clene announced positive data from its Phase 2 VISIONARY-MS and REPAIR-MS clinical studies of CNM-Au8 in the treatment of multiple sclerosis (MS). The company reported that both studies demonstrated clinically significant responses in the patient population under treatment, with noted improvement in symptoms.

In March, Clene followed up with updated data from the Phase 2 RESCUE-ALS trial of CNM-Au8 in the treatment of amyotrophic lateral sclerosis (ALS), a dangerous and degenerative neurological disease. The updated data showed a 70% reduction in the risk of death for patients who participated in the RESCUE-ALS long term open label extension.

Looking ahead, the next major milestone for CNM-Au8 is the release of the unblinded topline results from the Healey ALS Platform trial, expected in 2H22. If successful, the results from this trial will be used to seek FDA approval for CNMAu8 as a treatment for ALS. The company also plans to provide unblinded interim results from the VISIONARY-MS Phase 2 trial in 2H22.

These varied trials, showing that the lead product candidate offers multiple ‘shots on goal,’ led Canaccord analyst Sumat Kulkarni to look into the details of Clene’s research program.

“We are especially intrigued by the early promise that CLNN’s CNM-Au8 has shown in its chosen indications. We note the stock is at a very interesting point in time with significant data due to come. Specifically, Healey platform results in ALS, are slated in 3Q22. We also await Phase 2 data in MS in 2H22E. Both the ALS and MS datasets are important in that they could shape future views on CLNN’s differentiated approach toward neurodegeneration. In terms of relative importance, we view the Healey results as potentially more central to the discussion as a positive result in the trial could lead to the filing of an NDA for CNMAu8 in 1H23,” Kulkarni wrote

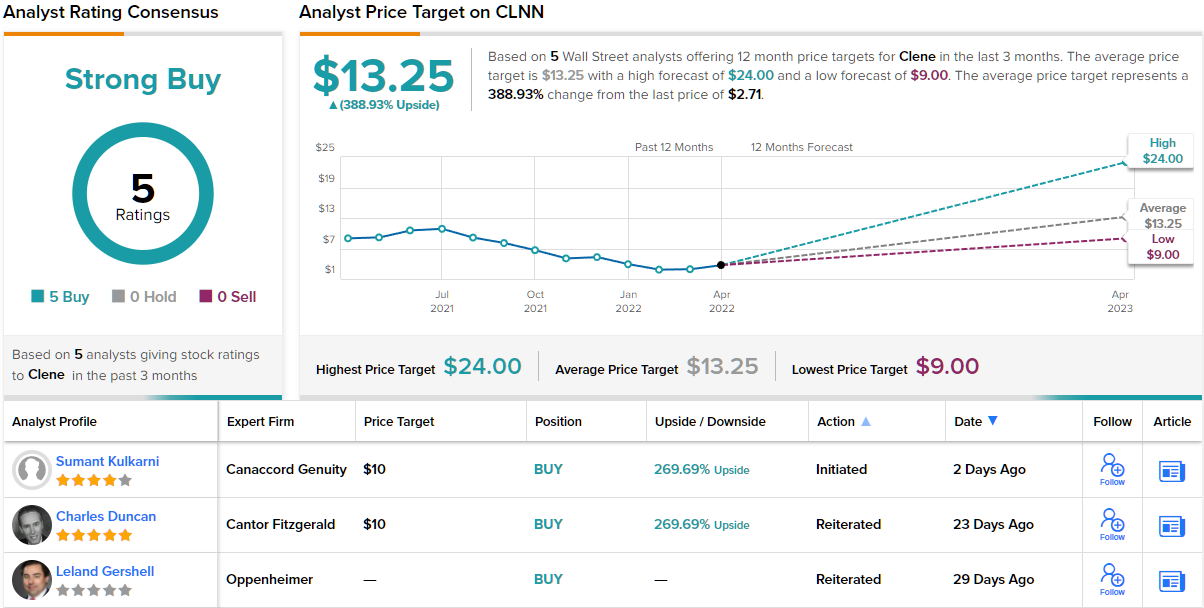

In line with these comments, Kulkarni rates CLNN a Buy, and his price target of $10 suggests a 274% upside in the year to come. (To watch Kulkarni’s track record, click here.)

All 5 of the recent share reviews here equally bullish, making the Strong Buy consensus rating unanimous. The stock is selling for $2.71 and its $13.25 average target implies an upside of ~389% in the next 12 months. (See CLNN stock forecast on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.