Since early this century, the high-tech sector has picked up headlines and accolades – and rightly so. Our world is evolving into a technology-driven landscape, with tech making significant contributions to diverse fields such as finance, communications, and aerospace. Yet, it’s worth noting that the medical field has also been influenced by tech, even though its impact often receives less recognition in the headlines.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

But less publicity hasn’t meant fewer investment opportunities, and investment bank Morgan Stanley, in a recent sector note, draws our attention to a number of medtech stocks that are just too cheap to ignore after sharp year-to-date losses.

Leading the research into the medtech sector, analyst Patrick Wood writes: “Back in May we were somewhat more cautious on US MedTech with valuation sitting 10-15% above the 10 year S&P relative range. But, a combination of rising 10 year rates and GLP-1 pressures have pushed valuation down to a relative c. 1% discount. Frankly, we think the pressure from GLP-1s is overdone, with limited impact to most of our sub-industries over the next decade. Indeed, smoking offers a natural parallel, where rates of connected surgeries and healthcare consumption increased materially over the period of a precipitous decline in smoking. Given the industry derating (c. 15%) vs strong fundamentals, we’re getting more positive on the industry overall.”

Wood doesn’t leave us with a macro view of the industry. The analyst goes on to give a drill-down to the micro level and picks out two stocks that he sees as potential winners for the long haul. We used the TipRanks database to identify what makes them stand out from the pack.

Don’t miss

- Morgan Stanley Says These 3 Semiconductor Stocks Are Hot Buys Right Now

- ‘Time to Upgrade,’ Says J.P. Morgan About These 2 Energy Stocks

- TipRanks’ ‘Perfect 10’ Picks: 2 Top-Scoring Stocks for 2024

Insulet Corporation (PODD)

The first Morgan Stanley pick, Insulet, was founded in the year 2000 and since then has focused on the treatment of insulin-dependent diabetes. Diabetes is a chronic, serious, incurable, and progressive disease – but modern medicine has provided us with several drugs, starting with injectable insulin, which when properly administered can keep the disease under control and bring dramatic quality-of-life improvements for patients.

That doesn’t mean everything is roses. Diabetic patients with a more severe condition may be dependent on insulin injections, administered several times daily and timed to interact properly with meals. Patients usually must learn how to self-administer subcutaneous injections, and pediatric patients present their own challenges.

And this brings us to the insulin pump, first introduced in the 1970s. Insulin pumps are wearable devices that can deliver a pre-programmed and scheduled insulin dose – and the patient will only need to set up the pump once per day. Insulet is known as the developer of the Omnipod Insulin Management System, a modern pump system that is capable of highly personalized programming to match the patient’s specific needs and changing blood sugar levels.

Insulet keeps up the Omnipod design through a combination of real-world data and patient feedback, applied to device updates and manufacturing. The company’s manufacturing facilities are world-class, based on automated technology, and the company is committed to maintaining quality and safety for the benefit of its patients. The most current version of the Omnipod system can deliver insulin for up to three days, without the patient needing to see or handle a needle during that time.

Sales for insulin pumps are strong, and Insulet, in its third-quarter 2023 financial release, showed a solid increase in its sales guidance for the full-year 2023. The company is expecting to see a year-over-year boost in sales from 26% to 27%, compared to the earlier range of 22% to 25%.

Along with that upbeat sales outlook, Insulet reported quarterly revenue of $432.7 million for a 27% y/y gain – and beating the estimates by $18.5 million. The company’s bottom line, of 71 cents per diluted share, based on $50 million in adjusted net income, was 30 cents per share better than had been expected.

In his note for Morgan Stanley, Patrick Wood notes that the stock has seen heavy share price losses this year, a situation which has put the shares into a discount status. He writes, “For PODD, we think GLP-1 fears are especially overdone, with the stock down [~34%] despite strong numbers and c. 85% exposure to type 1. 2024 has a series of growth drivers, from iOS integration to Libre connection, and at c. 6x sales we think the shares are too cheap vs key peers.”

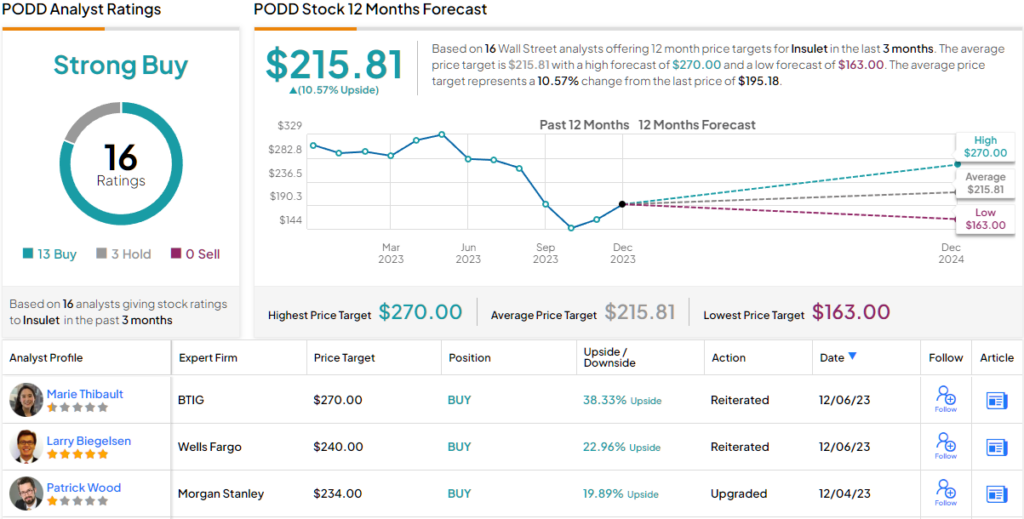

Quantifying his stance, Wood rates PODD as Overweight (i.e. Buy), with a $234 price target to point toward a one-year upside of 20%. (To watch Wood’s track record, click here)

Overall, Insulet has earned a Strong Buy rating from the analysts’ consensus, based on 16 recent recommendations with a breakdown of 13 Buys to 3 Holds. The average target price of $215.81 implies a 10.5% share price increase from the current trading value of $195.18. (See Insulet stock forecast)

Teleflex, Inc. (TFX)

Next up is Teleflex, an American medical device company. This company designs, manufactures, markets, and distributes a range of high-end tools for various procedures in both critical care and surgery. The company employs more than 15,500 people worldwide and boasts over 80,000 customers across 135 countries.

These customers can choose from an extensive catalog of medical products and devices, totaling around 23,000. Teleflex’s portfolio includes devices in seven clinical areas – Vascular Access, Interventional Cardiology, Radiology, Anesthesia, Emergency Medicine, Surgical, and Urology. The company has designed its products to address ‘high unmet medical needs’ in all of these areas.

Last year, the company realized $2.79 billion in total sales and reported an adjusted diluted full-year EPS of $13.06. While last year’s revenue and EPS both showed slight year-over-year declines (0.7% and 2%, respectively), the company maintained its large-scale commitment to its research and development program. Teleflex’s R&D spend for 2022 came to $153.8 million, up more than 17% year-over-year.

In the last reported quarter, 3Q23, Teleflex showed that it’s on a growth path. The company’s quarterly revenue was reported as $746.4 million, up 8.7% from 3Q22 and $12.6 million above the forecasts. The bottom line, non-GAAP earnings, were reported as an adjusted diluted EPS of $3.64, up more than 11% year-over-year, and beat the estimates by 37 cents per share. R&D expenses for the quarter came to $37.58 million, in line with the previous year’s Q3 result.

Teleflex’s stock has dipped ~7% this year, compared to the S&P 500’s return of 20%. However, Morgan Stanley’s Patrick Wood is quite upbeat about Teleflex’s financials. He notes that the company had a solid Q3 and adds: “TFX’s core base business is in strong shape. Looking at the big picture, the company is likely to deliver organic sales growth of c. +6.5% in 2023, despite UroLift being down c. 4%, meaning growth in the rest of the business was closer to c. +7%… Trading at c. 15x for >6% organic growth, we see TFX as too cheap vs the quality of the base business, while we see upside risk to Palette on international expansion and shifting landscape across radiotherapy reimbursement in the US.”

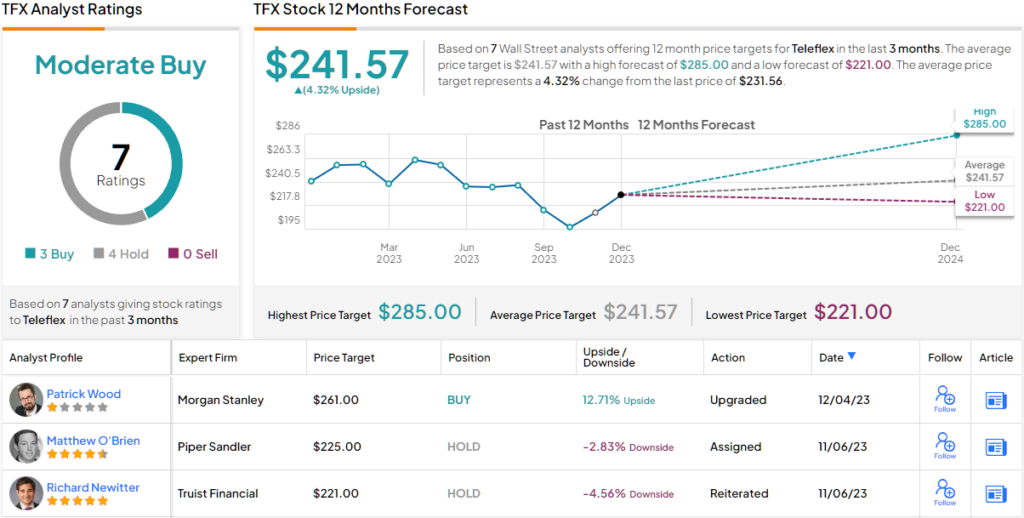

Putting this stance into a recommendation, Wood gives the stock an Overweight (i.e. Buy) rating, with a $261 price target that implies a one-year upside potential of ~13%. (To watch Wood’s track record, click here)

All in all, the 7 most recent analyst reviews on this stock are split to 3 Buys against 4 Holds, for a Moderate Buy consensus rating. The shares have a current selling price of $231.56 and their $241.57 average price target suggests the stock can increase by a modest 4% on the one-year time horizon. (See Teleflex stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.