What to do when the conventional wisdom and the market sentiment are tugging in different directions? It’s happening now, with markets registering strong year-to-date gains even though elevated inflation and high interest rates are threatening a credit crunch and starting to crimp consumer spending.

B. Riley’s chief investment strategist, Paul Dietrich, has been watching the markets closely, noting, “The jump in the S&P 500’s big tech stocks is hiding concerns among investors that the U.S. is about to go into recession… The S&P 500 currently looks overvalued. Its performance is higher than both its 50-day and 200-day moving averages. It may be peaking and ready for a steep drop… It is time to be defensive in your investing.”

Defensive investing will naturally turn us toward the high-yielding dividend stocks. These are the classic defensive move when markets sour, bringing a steady income stream and solid returns to the table.

B. Riley 5-star analyst Bryce Rowe has taken that cue, and is going bullish on two dividend stocks in particular. These are dividend payers that offer high yields of at least 10%. In fact, Rowe is not the only ones singing these stocks’ praises. According to the TipRanks platform, they are rated as Strong Buys by the rest of the Street. Let’s take a closer look.

Sixth Street Specialty Lending (TSLX)

We’ll start with a specialty finance company, Sixth Street Specialty Lending. These companies act in the middle-market sector, providing credit and financing to small- and mid-sized enterprises that don’t always have access to the traditional banking sector. Sixth Street’s role in the credit system helps to support the smaller businesses that have long been drivers of US economic activity.

From the company’s start back in July of 2011, through the first quarter of this year, Sixth Street has originated approximately $26 billion in total loans. The portfolio is diversified, and aims for low volatility; Sixth Street wants to ensure a return with a minimum of fuss. The company committed to $176.1 million in new fundings during 1Q23, and finished the quarter with a portfolio fair value of approximately $2.92 billion in 83 separate firms.

This portfolio activity generated $96.5 million in total investment income during 1Q23, a figure that beat the estimates by $2.8 million and grew an impressive 43% year-over-year. Sixth Street’s net investment income, a non-GAAP measure, was reported at 55 cents per share, 1 cent per share better than the forecast.

In addition to remaining profitable during a difficult economic environment, Sixth Street has also been able to generate cash resources. The company exited the first quarter with $25.7 million in total cash and cash equivalent assets on hand – although we should point out that this included $16.2 million in restricted cash.

Turning to the dividend, we find that with its Q1 results, Sixth Street looked ahead and declared a base payment of 46 cents per common share for the second quarter. This base payment was further supplemented by a dividend of 4 cents from Q1. The base dividend alone yields 9.8%, while including the supplemental dividend boosts the yield to 10.7%. We should note that this is the second declaration in a row that the company has included a supplemental dividend payment.

B. Riley’s Bryce Rowe, in his comments on Sixth Street, takes particular note of the company’s ability to generate profits. Rowe says, “Sixth Street has consistently delivered industry-leading profitability, with its 10-year, 5-year, and 3-year returns on equity ranking in the top five of BDCs we track. We believe its fundamental performance is particularly impressive, considering that its investment portfolio is largely comprised of debt investments… Sixth Street’s above-average profitability is a function of stronger-than-peer asset yields and a track record of sound underwriting… In our view, the risk/reward profile favors reward…”

Rowe goes on to initiate his coverage of TSLX shares with a Buy rating and a $21 price target that indicates room for a 13% gain over the next 12 months. Based on the current dividend yield and the expected price appreciation, the stock has ~23% potential total return profile. (To watch Rowe’s track record, click here)

Overall, all 8 of the recent analyst reviews here are positive, giving TSLX stock a Strong Buy consensus rating. The stock’s $18.70 trading price and $20.41 average price target imply a one-year gain of 9%. (See TSLX stock forecast)

Ares Capital Corporation (ARCC)

Let’s stick with specialty lending, and look at Ares Capital Corporation. This firm is a business development company, a BDC, another name given to specialty lenders. Ares Capital is a credit and financing firm that makes capital resources available to small- and mid-market businesses. In all, Ares provides a combination of funding, credit, and other financial instruments for its target client base.

A look at Ares’ portfolio shows that the company has preferences – and has somewhat diversified its loan mix. While 41.1% are first lien senior secured loans, a substantial portion, 18.4%, are second lien senior secured. Of the company’s clients, 21.6% are in the software industry, 11.3% are in the healthcare services sector, 9.8% are commercial and professional services. Geographically, Ares focuses most on the West (25.3%) and Midwest (23.8%) in its portfolio composition. In all, Ares has $21.1 billion in total investments, in 466 companies, over the years.

In the last quarter, 1Q23, Ares did not meet the Street’s expectations. Its top line, $618 million in total net investment income, was up 40% y/y, but it missed the forecast by $15.1 million. The bottom line figure, 57 cents per share in non-GAAP EPS, was 2 cents below the estimates.

Despite missing the target on earnings, Ares was still able to declare a generous dividend, of 48 cents per common share, for a June 30 payout. The $1.92 annualized rate gives a strong yield of 10.3%.

Missing the target and paying a high dividend gives this stock an interesting combination of risk and reward – and that attracted top analyst Rowe. In his comments, Rowe said, “We see the risk/reward profile as favoring reward given the supportive earnings environment, ARCC’s strong track record of underwriting/NAV growth, and its leadership position among direct lenders… ARCC has, in our opinion, thoughtfully managed its capital structure by extending maturities early, maintaining a reasonable balance between fixed- and floating-rate debt, and raising equity accretively via at-the-market and public offerings.”

Taking it forward, the analyst puts a $20.50 price target and a Buy rating on the shares. His target price suggests a one-year upside potential of 10%.

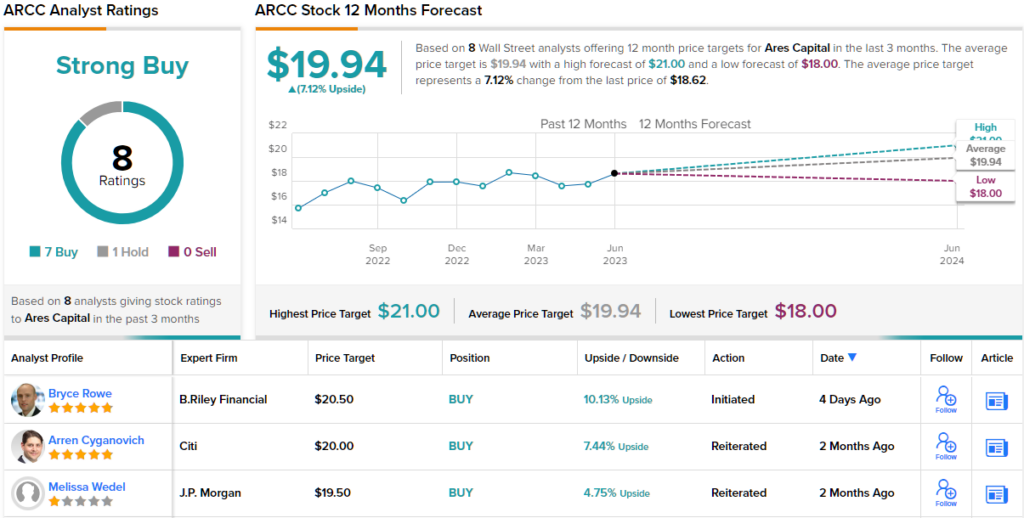

Overall, the analysts are decidedly bullish for ARCC. The 8 recent analyst reviews include 7 Buys against 1 Hold, for Strong Buy consensus, and the $19.94 average price target implies a 7% gain from the current trading price of $18.68. (See ARCC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Questions or Comments about the article? Write to editor@tipranks.com