The election is behind us, and we’re looking ahead. A new Trump Administration will take office in January, and a few things are starting to become clearer. On the economy, Trump has already expressed a preference for raising tariffs – especially on Chinese goods – while also reducing income taxes and promoting a deregulation regime. These policies will push in multiple directions, so it may take some time to see exactly where things will go.

Most likely, neither the best nor worst cases will come to pass. UBS chief global equity strategist Andrew Garthwaite points out that reduced regulation and a possible lower corporate tax rate will provide a boost for multiple sectors, including real estate, energy, finance, and construction. These sectors are somewhat interconnected and will each impact other areas of the economy.

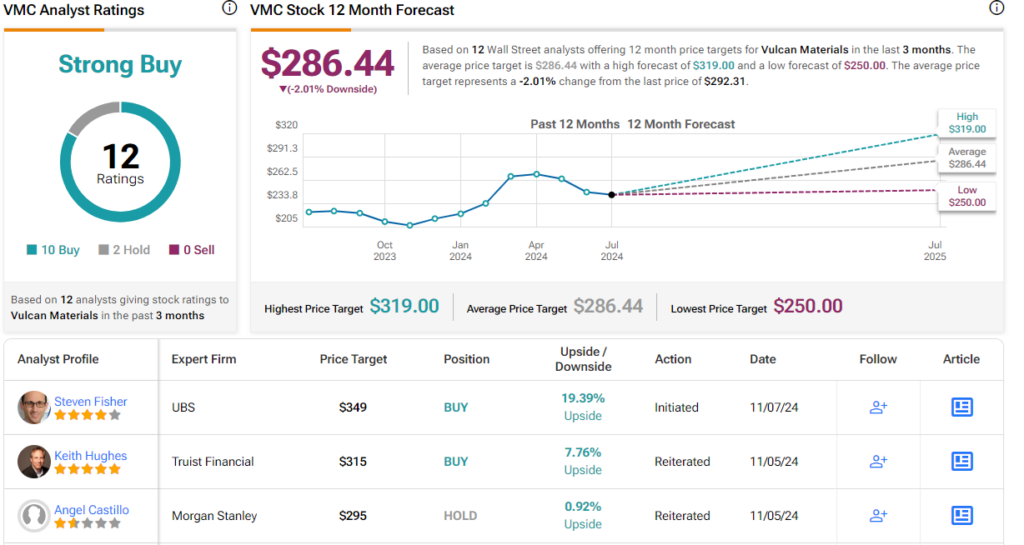

Against this backdrop, UBS analyst Steven Fisher has been examining the construction sector and sees opportunity emerging in two construction stocks. According to the TipRanks database, both of his picks have Strong Buy consensus ratings. Let’s take a closer look and find out why.

Vulcan Materials (VMC)

We’ll start with the nation’s largest producer of aggregate materials for the construction industry, Vulcan Materials. The company, based in Birmingham, Alabama, offers a long list of products, including but not limited to crushed stone, sand and gravel, as well as asphalt and ready-mixed concrete. Vulcan operates across the southern tier of the US – Pennsylvania, and New York. In all, the company is active in 22 states, plus DC, Canada, Mexico, the Bahamas, and the US Virgin Islands.

Vulcan’s core operations are in some of the highest-growth areas in the US, including Florida, Texas, and Arizona. Zooming in a bit, we see that Vulcan employs approximately 11,000 people. Its operations include 71 hot mix asphalt facilities, 142 ready mix concrete facilities, and 404 aggregates facilities.

The company’s quality locations and strong product list are backed up by superior distribution and logistics systems – and a reputation for proven expertise. In the full-year 2023, Vulcan generated $7.78 billion in total revenues, up more than 6% from the prior year.

All of that said, Vulcan’s 3Q24 report showed misses at both the top and bottom lines. Quarterly revenue came in at $2 billion, down 8.7% year-over-year and missing the forecast by $20 million, while earnings-per-share, in non-GAAP measures, came to $2.22, or 9 cents lower than had been expected.

UBS’s Steven Fisher is not worried by the recent misses, and sees Vulcan in a good position to reap gains from an improving construction market as the overall economy starts to benefit from slower inflation and lower interest rates. Fisher writes, “We see VMC as a beneficiary of an improving non-residential construction market in 2H25-2026, and believe the accompanying earnings uplift is underappreciated. We expect this will support 3-4% aggregates volume growth in ’26 (vs. consensus +2.5%) and also bolster VMC’s pricing power. This, coupled with ongoing operational initiatives focused on enhancing pricing and managing costs (i.e. Vulcan Way of Selling & Operating), should drive a ~9% CAGR for aggregates cash gross profit/ ton for 2024-26E. Solid cash flow over the next 12 months should enable continued accretive M&A, presenting further upside to earnings.”

Getting into detail about the stock, Fisher adds, “At the current stock price, and using a ~18.3x EV/EBITDA multiple (slightly above normal trading range), the stock is implying EBITDA of ~$2.3b vs. our estimate of ~$2.7b. In 12 months, we will be applying that multiple on our estimate, which implies ~20% upside to the stock. We also see potential for modest multiple expansion as VMC continues to grow and leverage its aggregates portfolio and expand its competitive moat over time.”

These comments support the analyst’s initiation of a Buy rating on Vulcan, a rating that is backed up by a $349 price target. That figure implies a 19.5% share price increase for the year ahead. (To watch Fisher’s track record, click here)

VMC shares have a Strong Buy consensus rating from Wall Street, based on 12 recent reviews that include 10 to Buy and 2 to Hold. (See VMV stock forecast)

Martin Marietta Materials (MLM)

Next up is Martin Marietta, a name with a long history in American industry. The company’s roots go back to 1939, and for many years, after mergers with Martin and Lockheed, the company was well-known in the aviation industry. After its 1996 spin-off from Lockheed Martin, the modern Martin Marietta Materials has focused on the production and supply of heavy construction materials and aggregates for the building industry. The company is known for providing base materials and supplies used in building roads, sidewalks, and building foundations.

Martin Marietta has locations and facilities across the United States, with the notable exceptions of the Northwest and New England regions. The company’s footprint includes production facilities for aggregates, cement, ready-mix concrete, and asphalt; the ready-mix business is particularly prevalent in Texas. The company is headquartered in Raleigh, North Carolina, and generated almost $6.8 billion in total revenues last year.

Looking at MLM’s recent financial performance, we see that, like Vulcan above, this company missed expectations for both revenues and earnings in 3Q24. The top-line figure of $1.89 billion was down 5% year-over-year and missed the forecast by $50 million; the bottom-line EPS of $5.91 was down 15% y/y, and was 19 cents per share below the estimates.

Nevertheless, checking in again with analyst Fisher, the UBS industry expert believes that MLM’s share price is not lining up with the company’s potential. He writes of MLM, “We think the stock does not fully reflect the earnings growth potential from a supportive construction market combined with MLM’s SOAR strategic framework (Strategic Operating Analysis and Review). We see upside for the stock as investors gain confidence in the earnings growth we assume through 2026. We expect a reacceleration in nonresidential construction activity in 2H25 into 2026 will drive 4% aggregates volume growth in ’26, and expect strong execution on pricing and cost control will drive a ~11% CAGR for gross profit per ton for 2024-26. M&A is also core to MLM’s strategy, and solid cash flow over the N12M should enable continued accretive aggregates-focused M&A.”

Fisher goes on to open his coverage here with a Buy rating, and his $730 price target points toward a one-year upside of 18%.

The Wall Street view gives this stock a Strong Buy rating based on 10 ratings that include 9 to Buy and 1 to Hold. (See MLM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.