Tesla (TSLA) investors will no doubt be happy 2023 is upon us. The EV leader endured an awful 2022 with the shares shedding a hefty 65% throughout the year.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

While the culprits for pushing valuations down significantly in 2022 are well-known, Tesla’s issues are more company specific. Namely, CEO Elon Musk’s never-ending Twitter saga and its impact on Tesla sentiment.

Sentiment, though, is not set in stone, and can change fast on Wall Street. For that to happen, however, Wedbush’s Daniel Ives thinks Musk must come good on what he calls the “investor wish list.”

So, what does that involve? Well, first off, with Musk declaring – after polling his Twitter followers on the matter – that he will leave his CEO post at Twitter, it is imperative a new one is installed pronto. By the end of January, more accurately, so that Musk can refocus all his energies back on Tesla. Staying off Twitter will also be a welcome development, as the more political he gets on the platform, the harder it gets selling EVs “to the masses.”

Next up, after selling roughly $40 billion of TSLA stock over the past year, Musk must put an end to the selling spree and “adopt a 10b5-1 plan so investors know there is no major selling block around the corner.”

On to the shaky macro backdrop, for which “conservative” 2023 targets will also help. “The 50% growth target is not happening in our opinion,” says the 5-star analyst, “with 35%+ delivery growth a more hittable and realistic goal for 2023.”

Some changes at the Board level will also be welcome, especially new additions with deep knowledge of tech and the EV landscapes.

One simple act will also help sentiment. “Buybacks, Buybacks, Buybacks,” says Ives. “Announcing a major stock buyback program is important/key for the Street’s confidence and with the stock at these levels a no brainer strategic move in our opinion for Tesla given its massive treasure chest.”

All told, then, Ives stays bullish on TSLA, but foresees things getting “even uglier,” should none of these changes be forthcoming. For now, however, the Outperform (i.e., Buy) rating stays as is, and so does the $175 price target, which makes room for one-year gains of 42%. (To watch Ives’ track record, click here)

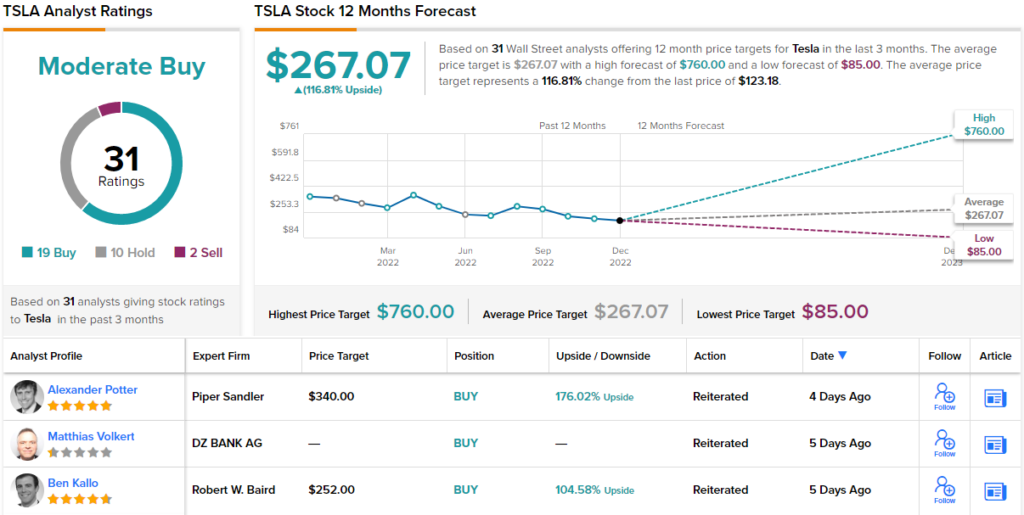

Over the past 3 months, 31 analysts have reviewed TSLA’s prospects, with the ratings breaking down to 19 Buys, 10 Holds and 1 Sell, all culminating in a Moderate Buy consensus rating. The average target stands at $267.07, suggesting upside of 117% for the year ahead. (See Tesla stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.