In a market trending down, there are fewer scenarios more appealing to investors than ones outlining bearish sentiment is about to turn positive. And according to Ari Wald, head of technical analysis at Oppenheimer, we’re on the cusp of one such turnaround right now.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

“Our analysis indicates September weakness is marking a final leg lower in the bear cycle, and a bullish opportunity for long-term investors,” Wald recently explained. “In the post-war era, the majority of bear cycles have been long-and-shallow or short-and-sharp. We’ve only counted four long-and-deep declines (1968, 1973, 2000, and 2007), and believe market conditions are stronger now than they were in those outlier periods.”

Keeping this in mind, here are two stocks Wald’s analyst colleagues at the investment firm have marked as appealing right now. With help from the TipRanks platform, we can gauge the rest of Wall Street’s sentiment toward these names. Here are the details.

HashiCorp (HCP)

Let’s first take a look at software specialist HashiCorp – a cloud automation software provider, to be more exact.

HashiCorp provides open-source tools that integrate with and expand upon the services provided by public cloud service providers like Amazon and Microsoft. Terraform, which configures infrastructure, and Vault, which handles password management, are two examples of the company’s nine separate products that cater to diverse segments of the cloud infrastructure industry. The products are right on-trend as given the ongoing digital transformation, enterprises are now leaning toward using more than just one cloud provider.

HashiCorp is relatively new to the public markets, having held its IPO in December 2021, when the company boasted a market cap of around $14 billion. But as has been the case for so many, the stock has been unable to counter bearish market trends and is down by 63% since the debut.

That hasn’t stopped the company from delivering strong quarterly results, as was the case in the recently delivered second quarter of fiscal 2023 (July quarter) statement.

Revenue reached $113.9 million, $11.56 million above Wall Street’s expectations and amounting to a 52% year-over-year increase. The performance was boosted by growth in sales from clients with more than $100,000 in ARR (annual recurring revenue) and a record YoY 134% uptick in NDRR (net dollar retention rate). Non-GAAP EPS of -$0.17 handily beat the Street’s -$0.31 forecast. Adding an extra layer of sheen, For FQ3, the company currently expects revenue between $110 – $112 million compared to consensus expectations of $106.48 million.

These are the kind of results which excite Oppenheimer’s Ittai Kidron, who applauds the display in the face of “macro headwinds.”

The 5-star analyst writes, “HashiCorp continues to show its growing relevance to large enterprises as they shift to the cloud. We believe management’s guidance incorporates a measured take on macroeconomic realities and are encouraged by the new focus on driving operating leverage. We remain bullish and believe HashiCorp is in the early innings of addressing a massive growth opportunity.”

To this end, along with an Outperform (i.e., Buy) rating, Kidron’s $50 price target suggests shares have room for 66% growth in the year ahead. (To watch Kidron’s track record, click here)

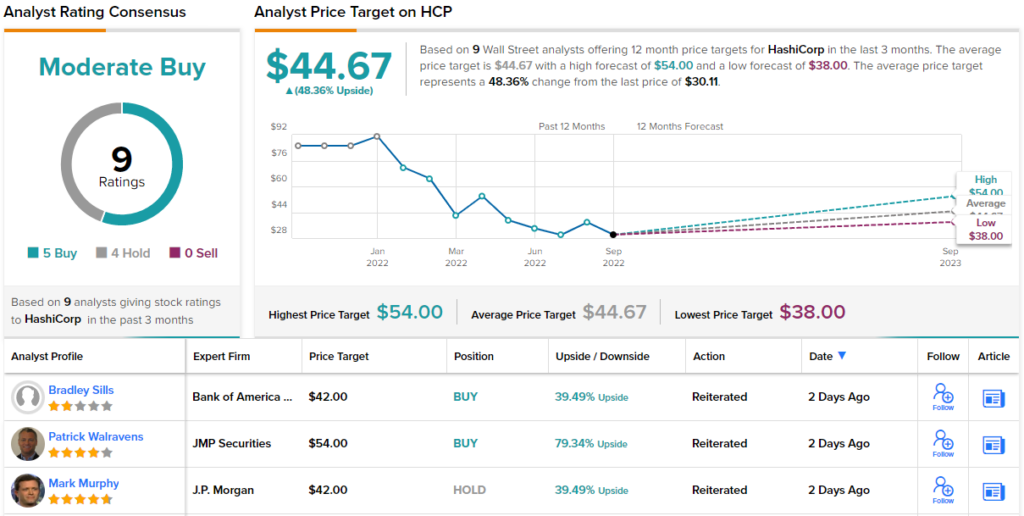

Looking at the consensus breakdown, of the 9 reviews on record, 4 currently prefer sitting this one out but with the addition of 5 positive reviews, the stock claims a Moderate Buy consensus rating. Most feel the stock is undervalued at the current trading price; going by the $44.67 average target, the shares will be changing hands for a 48% premium a year from now. (See HashCorp stock forecast on TipRanks)

IDEAYA Biosciences (IDYA)

Let’s turn now to something completely different for Oppenheimer’s second pick. IDEAYA Biosciences is a synthetic lethality-focused precision medicine company. It is focused on discovering and developing targeted oncology drugs for patient populations identified with the use of molecular diagnostics. In order to choose the patient populations most likely to benefit from the company’s medicines, its method combines skills in identifying and validating translational biomarkers with small molecule drug discovery.

IDEAYA has several drugs in pre-clinical development and two that have already advanced to clinical trials.

These include darovasertib, a protein kinase C (PKC) inhibitor, designated to treat genetically-defined cancers showing GNAQ or GNA11 gene mutations. This drug is in a Phase 2 study targeting metastatic uveal melanoma (MUM), in combination with Crizotinib, a Pfizer-developed cMET inhibitor. Data from the study is anticipated shortly, and should the readout be positive, there’s potentially a registrational trial in MUM coming up next.

The other asset making headway is IDE397. This therapy is indicated for patients with methylthioadenosine phosphorylase (MTAP) deletion – a patient group representing around 15% of total solid tumors. This investigational, potentially best-in-class, small molecule MAT2A inhibitor is being evaluated in an ongoing Phase 1/2 clinical trial.

Oppenheimer’s Matthew Biegler’s thesis for IDYA has centered on the latter’s potential, but the analyst is increasingly confident the former could bring the goods too, despite admitting darovasertib is a bit of a “dark horse” following underwhelming monotherapy results. However, Biegler thinks the crizotinib combination could surprise the doubters.

“We spoke with management ahead of updates from PKC inhibitor darovasertib’s combo trial, expected in September,” the analyst said. “We are warming to the program, helped by a better appreciation for the market opportunity in uveal melanoma and the strength of the initial dataset from December… We believe strong data, alongside concrete regulatory guidance, can help to win over lingering skeptics—and we are increasingly bullish on the prospects.”

Accordingly, Biegler rates IDYA as Outperform (Buy) backed by a $22 price target. The implication for investors? Upside of a hefty 134%. (To watch Biegler’s track record, click here)

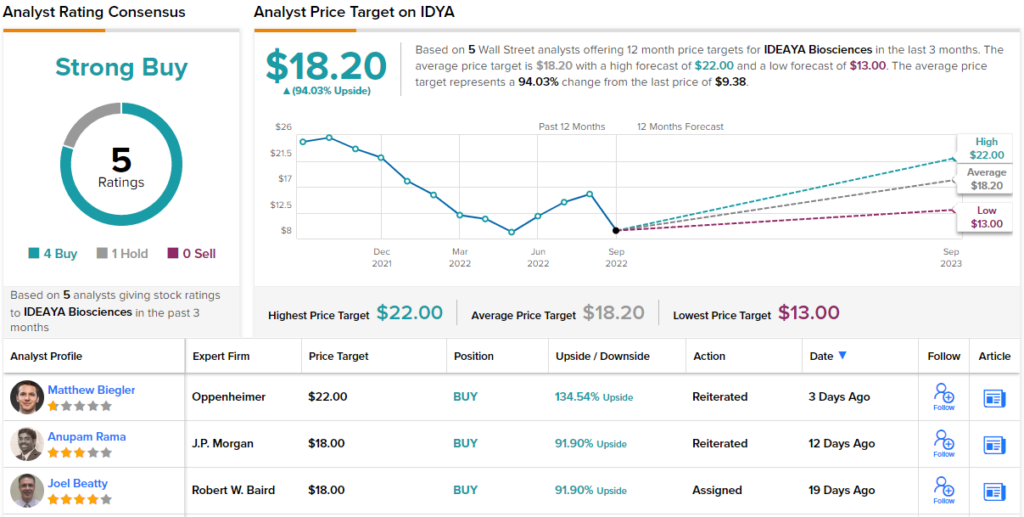

Most of Biegler’s colleagues agree. While one analyst remains on the sidelines, the other 4 reviews are positive, making the consensus view here a Strong Buy. The forecast calls for one-year gains of 94%, considering the average price target clocks in at $18.20. (See IDEAYA Biosciences stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.