The October inflation numbers came out last week, and sparked solid gains in the markets. Investors were buoyed by better-than-expected price data when the Bureau of Labor Statistics’ Consumer Price Index came in at 7.7% annualized. This was below the 7.9% forecast, and a half-point lower than the September number – and it was widely taken as evidence that stubbornly high inflation of the last year or more may be starting to ease.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Scott Minerd, chief investment officer from Guggenheim, doesn’t believe we’re at the start of a new bull market. However, Minerd does note that the post-CPI market rally may act as a floor for further short-term gains – and he sees the S&P 500 rising as high as 4,100 over the next month or so. And, if this bear rally does have the legs that Minerd is predicting, it will open up some opportunities for investors.

“I do think we’re going to continue to rally into the beginning of the year, and then we’ll get a chance to take a fresh look at things… I would stay fully invested at this point, as I encouraged people a month or so ago to be, and just let the data tell us if the bear market will continue or are things really at a turning point,” Minerd opined.

Against this backdrop, we’ve dipped into the TipRanks database to pull the details on two stocks that Guggenheim has picked out as potential winners for the near term. According to the data, both are rated as Strong Buys by the analyst consensus and projected to deliver over 50% gains in the coming months.

Arcellx, Inc. (ACLX)

The first Guggenheim pick we’re looking at is Arcellx, an early clinical-stage biopharmaceutical firm focused on developing new treatments in the field of oncology. Arcellx is working with a proprietary technology, the D-domain, which is a stable, small, and fully synthetic binding agent with a hydrophobic core – and potential to improve target specificity in anti-cancer CAR-T cell therapeutics.

This small bio pharma firm is relatively new to the public markets, having held its IPO just this past February. At the time, Arcellx offered 8.25 million shares at $15 each; on closing the IPO, the company has sold 9,487,500 shares and raised $142.3 million in gross capital. Since entering the public markets on February 4 of this year, the ticker has strongly outperformed the broader markets and gained 31%.

Arcellx has four pre-clinical research tracks, along with several clinical stage programs. The leading clinical program, CART-ddBCMA, is a new treatment for patients suffering from relapsed or refractory multiple myeloma. Clinical data released over the summer, from the Phase 1 expansion trial, showed ‘deep and durable responses in patients with poor prognostic factors.’ The company reported clinically significant positive effects of the drug candidate in 71% (22 of 31) patients.

Weighing in on Arcellx for Guggenheim is biopharma expert Kelsey Goodwin, who agrees that ddBCMA is the key catalyst for this company in the near-term.

“Initial Phase I clinical data from lead program CART-ddBCMA (autologous anti-BCMA CAR-T therapy) in multiple myeloma in our view highlights the potential of ACLX’s technology to generate highly competitive clinical data relative to approved therapies…. We see an opportunity for CART-ddBCMA as a potential best-in-class fast-follower to capture meaningful share in the large multiple myeloma market if promising early data are confirmed in the larger, registration-enabling trial set to be initiated by YE22,” Goodwin opined.

“We think additional, more mature CART-ddBCMA Phase I data later this year could further incrementally de-risk the program and also ACLX’s technology, if positive,” the analyst summed up.

Looking forward, Goodwin rates ACLX shares a Buy, with a $36 price target to suggest a one-year upside potential of 65%. (To watch Goodwin’s track record, click here)

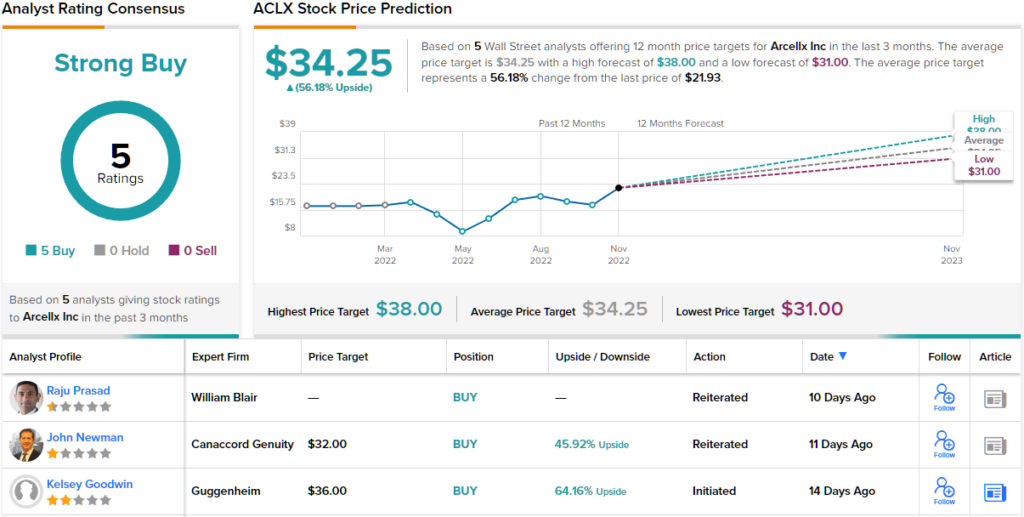

Overall, Arcellx has picked up 5 analyst reviews so far in its short time as a public firm, and they are all positive, for a Strong Buy consensus rating. The stock is selling for $21.93 and its $34.25 average price target implies a gain of ~56% in the coming year. (See ACLX stock forecast on TipRanks)

2seventy bio (TSVT)

Now we’ll turn to 2seventy bio, a company that entered the public domain last year after spinning off from an established parent. 2seventy inherited parent firm BlueBird’s investigational approach to cancer medications, an approach that features new cell therapies in the pipeline – and Abecma, a cell-based gene therapy treatment that was launched in mid-2021 after receiving FDA approval as a treatment for multiple myeloma.

Having an approved drug is something a ‘Holy Grail’ for a clinical stage biopharma firm, and 2seventy’s recent 3Q22 results show why. Abecma generated $75 million in commercial revenue in the US alone, and is well on its way to hit the upper end of the previous published $250 million to $300 million revenue guidance for the full year. That’s a solid achievement for a relatively new drug in a crowded field.

Also on the financial end, 2seventy ended Q3 with over $324 million in cash and other liquid assets, and management estimated that the company had a cash runway sufficient to see it into 2025.

Turning to the clinical side, 2seventy in October entered into a strategic partnership with JW Therapeutics. The move will establish a transnational and clinical cell therapy development platform for the exploration of T cell-based immunotherapy drug candidates.

For the Guggenheim view on this stock, we’ll check in again with analyst Kelsey Goodwin, who writes of 2seventy bio: “We don’t think TSVT’s current valuation reflects the full commercial potential of Abecma given investor concerns around its competitive positioning vs. recently approved Carvykti (LEGN/JNJ) and potentially other emerging anti-BCMA treatments…”

“We think patient demand for anti-BCMA CAR-T cell therapies vastly exceeds current commercial availability, providing room for several commercial competitors, and TSVT/BMY’s first-to-market position could prove as a potential advantage. As such, we see a favorable risk/reward for TSVT,” Goodwin added.

These comments provide solid support for Goodwin’s Buy rating on TSVT stock, and his $30 price target implies ~78% upside for the year ahead. (To watch Goodwin’s track record, click here)

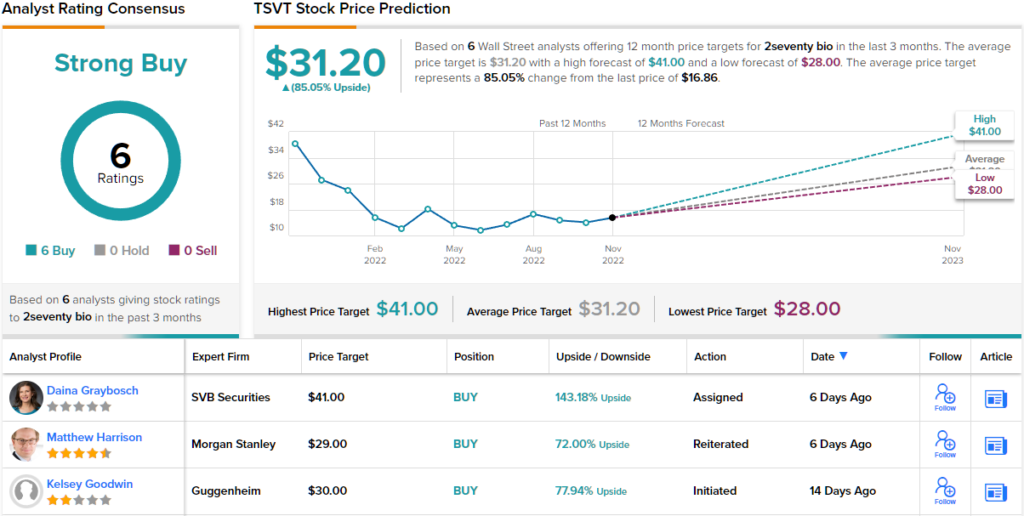

All in all, there are only 6 recent analyst reviews on record for this small-cap biotech stock, and they all agree that the stock is fit to buy – making the Strong Buy consensus rating unanimous. The shares are priced at $16.86 and their average price target of $31.20 suggests a robust 85% upside from current levels. (See TSVT stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.