The broader basket of retail stocks has been under pressure in recent years, thanks in part to an increasingly challenged consumer. Undoubtedly, consumer spending could continue to be bogged down if the economy does enter a recession while the last of inflation leaves its mark — inflation and recession fears have taken quite a hit on consumer sentiment. Still, it’s been well over a year that consumers have braced themselves for a recession that’s yet to arrive.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Nowadays, the recession odds seem to be falling, and some consumers may be a tad more willing to spend as though an economic recovery is in full swing. Either way, I wouldn’t be too surprised if consumers become more comfortable opening their wallets wider in what could be a retail resurgence, even if a recession is still on the table.

Whenever expectations are low enough, a stock can sustain a rally, even in less-than-ideal environments. Eventually, consumers will grow tired of sitting on their wallets while waiting for a recession that always seems to be pushed back.

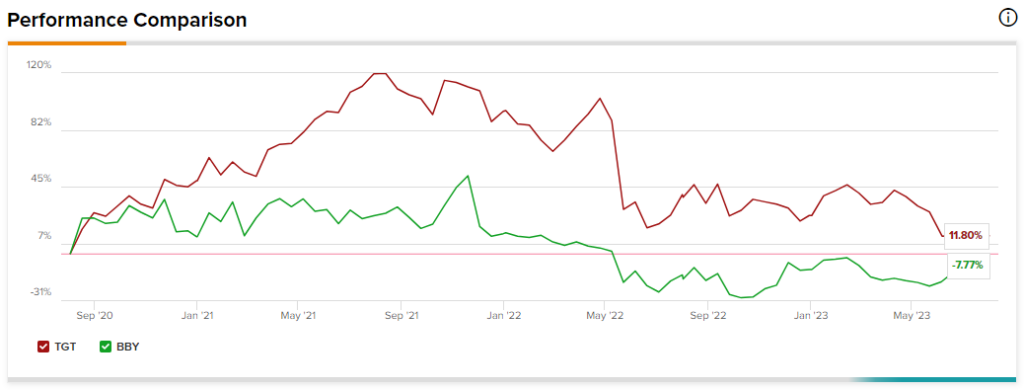

Therefore, let’s use TipRanks’ Comparison Tool to analyze these two popular American retailers.

Target (NYSE:TGT)

Target stock is currently sitting down 50% from its 2021 high of around $270 per share. Indeed, the big-box retailer has felt the heavy blow of macro headwinds. After a notable double downgrade from Raymond James analyst Bobby Griffin, it certainly seems like Target stock can only sink lower from here as it sails into a second quarter due to be released on August 16.

Griffin cut Target stock from a “Strong Buy” to a “Hold,” citing three major reasons for doing so — poor store traffic, weighed-down margins, and the impact of shoplifting.

All three headwinds, I believe, are transitory and should resolve once the consumer normalizes. Further, I don’t see Griffin’s negative note as impacting Target’s long-term fundamentals. At the end of the day, Target’s a decently-run discretionary-heavy retailer that’s sailed into a rough patch of waters, and it’s only expected that such a firm would feel the turbulence a bit more than non-discretionary retailers.

It’s not all bad news for Target of late, though. The company has made moves to better compete with digital retailers, including the extension of next-day delivery for its more distant customers and the announcement of a new week-long sales event in Target Circle Week.

It’ll definitely be a nail-biter as headwinds further weigh on discretionary sales, potentially paving the way for discounting and more pressure on margins. Though the stock’s become increasingly less popular among analysts in recent months, I’m inclined to stay bullish as expectations seem too gloomy. At writing, shares trade at 16.2 times forward price-to-earnings, in line with the 15.9 times specialty retail industry average.

Further, discretionary sales weakness can turn into pronounced strength at the turn of a dime, especially if that expected recession never happens! In such a scenario, there may be a chance for double upgrades.

What is the Price Target for TGT Stock?

Target stock sports a Moderate Buy rating, with 13 Buys and 13 Holds assigned in the past three months. The average TGT stock price target of $175.38 entails 31.1% upside potential.

Best Buy (NYSE:BBY)

Best Buy’s a big-box retailer of electronics and other discretionary home goods. Like Target, Best Buy stock already seems to have reacted as if a recession has already worked its way through the U.S. economy. Nonetheless, of late, BBY stock has shifted into rally mode, with shares now up over 30% from last year’s low. Thanks to a few quarterly earnings beats and an intriguing new membership plan, Best Buy stock certainly has a path to march even higher from here. As such, I’m staying bullish.

Up ahead, I expect the earnings beats to keep coming for Best Buy. Management has previously warned of negative comparable sales over “cautious” consumers. With expectations freshly lowered, I view BBY stock as having one of the better risk/reward trade-offs in the discretionary retail scene today. The stock trades at just 13.5 times forward price-to-earnings, well below the specialty retail industry average of 15.9. BBY’s dividend also sits at a bountiful 4.3%.

What is the Price Target for BBY Stock?

Best Buy has a Hold consensus rating on TipRanks, with three Buys, nine Holds, and two Sells assigned in the past three months. The average BBY stock price target of $78.71 implies 3.6% downside potential from here.

Conclusion

When it comes to battered big-box retailers like Target and Best Buy, I believe shares have already reacted as though a shallow recession has already struck. With modest, perhaps overly-depressed expectations now in place by some downbeat analysts, the following retail plays may actually have what it takes to put together a few quarterly beats.