TFI International (TSE:TFII) (NYSE:TFII) shares have leaped 3x in the past three years. TFI has an excellent track record of outpacing street EPS expectations. In addition, the company has been regularly returning value to shareholders in the form of dividends.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Headquartered in Quebec, Canada, TFI International provides freight transportation and logistics services across Canada, the United States, and Mexico.

Earlier this month, TFI International announced a quarterly dividend of $0.27 per share. In fact, TFI International has a strong track record of paying regular dividends that have grown significantly from $0.16 in 2018 to $0.27 currently. Further, the dividends have a lower payout ratio of 13.35%.

The company has outperformed the Street’s expectations on a consistent basis, beating EPS estimates in all the last eight reported quarters. For the upcoming third quarter, expected to report on October 27, the street expects EPS of $1.98, which implies an impressive 85% year-over-year growth compared to the prior year’s EPS of $1.07.

Is TFI International a Good Stock to Buy?

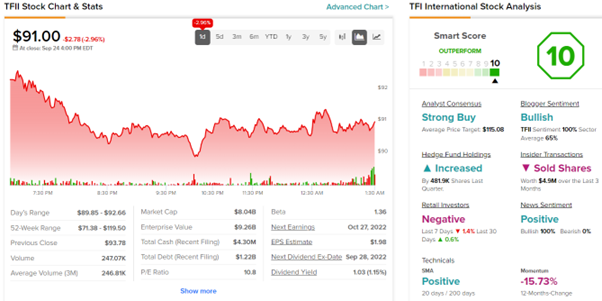

The Wall Street community is clearly optimistic about the stock. Overall, the stock commands a Strong Buy consensus rating based on 12 Buys and two Holds. TFI International’s average price target of $115.12 implies 26.51% upside potential from current levels.

Notably, TFI stock has a top-notch Smart Score of a “Perfect 10” on TipRanks, indicating that the stock has strong potential to outperform market expectations.

Further, TFI stock has a very positive signal from hedge fund managers, who added 481,900 shares during the last quarter.

Concluding Thoughts

Last month, TFI sold its Truckload, Temp Control, and Mexican Logistics Businesses to Heartland (HLTD) for $525 million. The sale will allow the company to focus on its core business, Dedicated business, enhance operating leverage as well as make smaller tuck-in acquisitions.

All these combined factors bode well for the company’s profitability in the long run.

Read full Disclosure