The year’s final quarter is almost behind us, and we will soon learn how it panned out for Tesla (TSLA) via the all-important delivery figures.

Based on a combination of checks, data reported by region, and app download data, RBC’s Joseph Spak sees Q4’s deliveries hitting 285,000 units, amounting to a 58% year-over-year uptick and an 18% sequential increase. The figure is also 7% above consensus estimates and some way above Spak’s prior call for 262,500 units.

By models, the forecast includes 273,000 Model 3/Ys (up 69% YoY and 18% sequentially) and 12,500 Model S/Xs, a 35% quarter-over-quarter increase, yet a 34% decline from the same period last year. Based on the regional breakdown, Spak expects 107,500 units in the US, around 100,000 in China and Europe to contribute 59,000.

Should Spak’s forecast play out, Tesla will have delivered ~913,000 vehicles in total in 2021, 83% above last year’s numbers.

On the production side, going by third party reports, the analyst believes the Shanghai facility manufactured over 600,000 units this year and Spak estimates 165,000-170,000 units were “possibly” produced there during Q4.

Looking ahead to Tesla’s Q4 report, apart from an update on future developments for capacity buildouts, battery technology and the progress of 4680 cells and FSD, Spak also thinks a product roadmap update will be provided. As there have been a “flurry” of BEV truck announcements,” Spak thinks the company will shine the spotlight on the Cybertruck.

More color on 2022 expectations should also be forthcoming. “We’d expect high-level mid-term guidance of about 50% growth to remain,” the analyst said, before adding, “In our view, 2022 forecasts for TSLA are more about pace of capacity expansion (Germany, Texas) and supply than demand.”

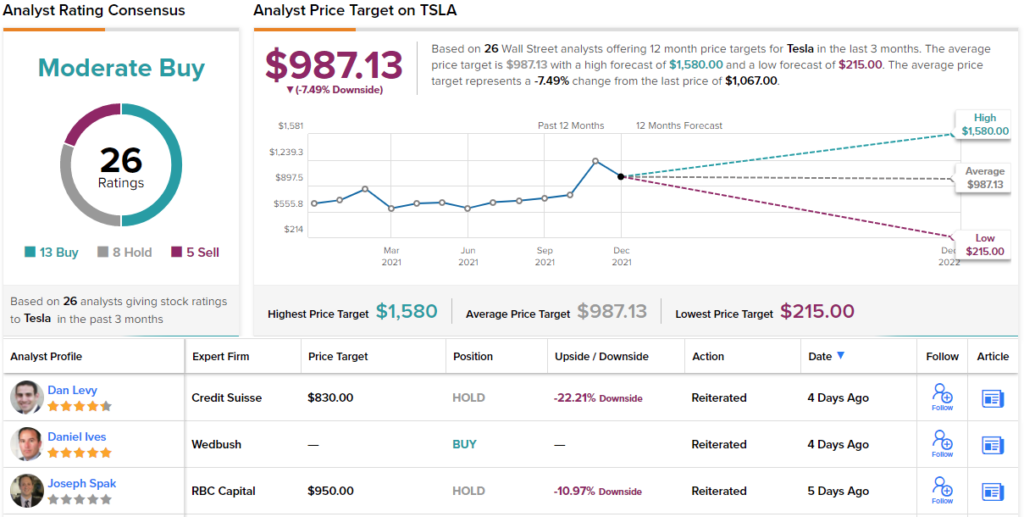

Despite expecting Q4 deliveries to come in above Street expectations, Spak remains on the sidelines with a Sector Perform (i.e., Hold) rating and $950 price target, suggesting downside of 11% from current levels. (To watch Spak’s track record, click here)

Of the 26 TSLA reviews submitted over the past 3 months, 7 other analysts join Spak on the fence, and with 13 extra Buys and 5 Sells, the stock has a Moderate Buy consensus rating. Like Spak, the analysts think the shares are overvalued, although based on the $987.13 average price target, only by 7%. (See Tesla stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.