Recent times have been no easy ride for Tesla (TSLA). Production slowdowns in China, higher inventory levels and recent price cuts have put the EV leader on a path to miss Street estimates for Q4 and to provide a weakened outlook for 2023.

At least that is the opinion of Wedbush’s Daniel Ives, who cites the items above as the reason for lowering his estimates for Q4 and 2023.

“The reality is that after a Cinderella story demand environment since 2018 Tesla is facing some serious macro and company specific EV competitive headwinds into 2023 that are starting to emerge both in the US and China,” the analyst recently said.

Ives now sees Q4 deliveries coming in between 410,000 to 415,000, down from the previous forecast of 450,000 and lower than the “Street whisper numbers” of roughly 435,000.

But of course, these issues are compounded by the elephant in the room. As inventory builds while the prospect of a likely global recession looms and the company enacts price cuts, CEO Elon Musk has gone AWOL. Not that he’s disappeared, more like “asleep at the wheel” leadership-wise and “laser focused” on Twitter.

And that has had ruinous implication for TSLA shares. “In essence,” Ives explains, “Musk has lost credibility with the broader investment community as broken promises (selling stock again and again and again….), the Twitter fiasco, opening up the political firestorm on Twitter, and brand deterioration for Musk and Tesla has led to a complete debacle for the stock.”

So, time to throw the towel in? Not quite. While Tesla remains the clear leader of an EV industry set to “meaningful accelerate over the coming years,” the analyst believes the the “long term Tesla transformational story remains intact.”

However, to help sentiment shift, Musk will need to refocus his energies on Tesla and stop selling stock, while any other “strategic missteps will be carefully scrutinized by the Street and further weigh on shares.”

In the meantime, Ives sticks with an Outperform (i.e., Buy) rating, although reflecting “lowered estimates and higher near-term uncertainty around the Tesla story,” the price target is reduced from $250 to $175. Still, there’s upside of 42% from current levels. (To watch Ives’ track record, click here)

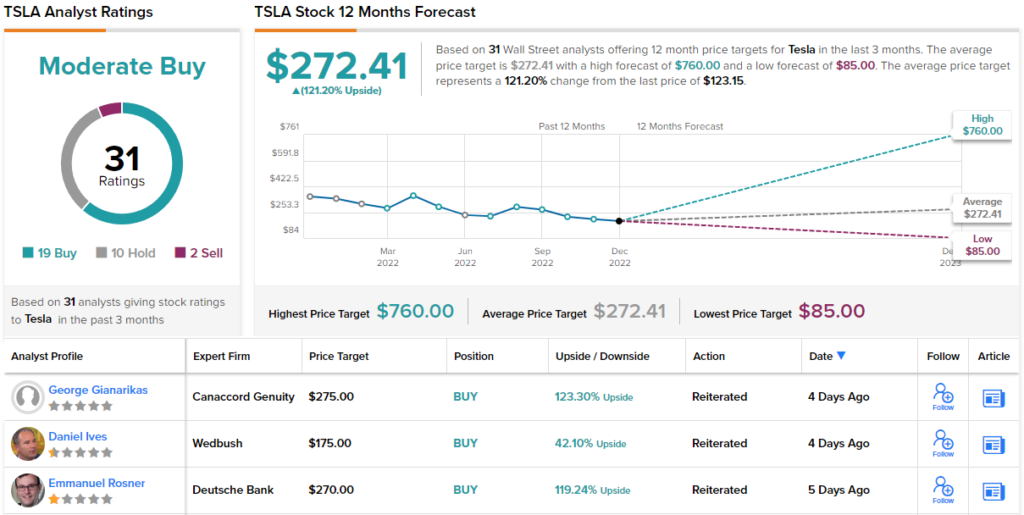

Looking at the consensus breakdown, based on 19 Buys, 10 Holds and 2 Sells, the analysts’ view is that this stock is a Moderate Buy. Following the stock’s ongoing sell-off, most think the shares are now severely undervalued; going by the $272.41 average target, they will climb 121% higher in the year ahead. (See Tesla stock forecast on TipRanks)

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.