TipRanks has introduced a new feature called the Ownership Tab that offers a detailed look at the ownership structure of a stock. Using this tool, we will delve into electric vehicle (EV) giant Tesla’s (NASDAQ:TSLA) ownership to know the holdings of different shareholders of the company.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

It is vital to assess the ownership structure as it helps understand the impact that a major owner or shareholder can have on the company’s governance, decisions, and risks. For instance, an insider with a significant holding could influence the company’s stock price with his/her buy or sell transactions.

Who Owns Most of TSLA Stock?

As per TipRanks’ Ownership Tab, Individual Investors and Public Companies hold a majority stake (47.1%) in Tesla stock. Next, Institutional Investors own 39.9% of the shares (13.8% by Mutual Funds and 26.1% held by Other Institutional Investors), while Insiders hold the remaining 13.1%.

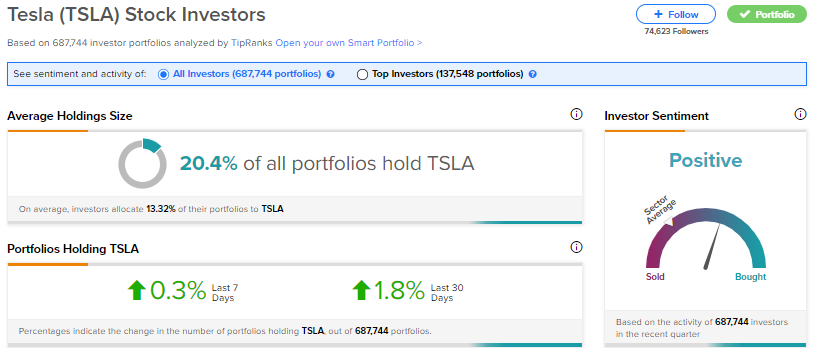

For Individual Investors, the sentiment on TSLA stock is Positive, given that in the last 30 days, the number of portfolios (tracked by TipRanks) holding the stock increased by 1.8%. Overall, 20.4% of all investor portfolios analyzed by TipRanks hold TSLA.

Within Institutional Investors, let’s first look at Hedge Funds (Other Institutional Investors). Currently, the Hedge Fund Confidence Signal is Very Negative for Tesla, based on the activity of 37 hedge funds. As per TipRanks’ Hedge Funds Trading Activity Tool, hedge funds decreased their TSLA holdings by 2 million shares last quarter.

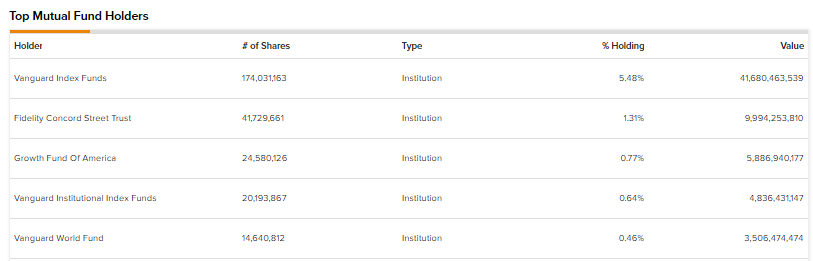

Let’s now move to Mutual Funds. Vanguard Index Funds owns the largest percentage (5.48% of TSLA stock) among mutual funds. Vanguard owns 174.03 million Tesla shares worth $41.7 billion. Tracking the holdings of Mutual Funds could give insights into the investment decisions of reputable fund managers.

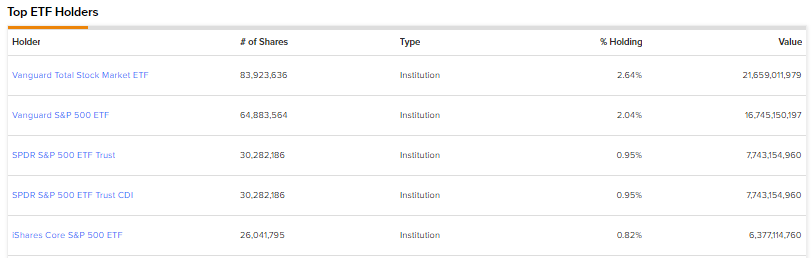

Meanwhile, among Exchange Traded Funds (ETFs), Vanguard Total Stock Market ETF (VTI), Vanguard S&P 500 ETF (VOO), and SPDR S&P 500 ETF Trust (SPY) are the top three ETFs holding TSLA stock.

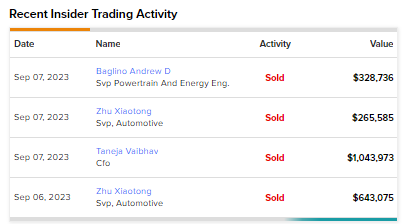

As for Corporate Insiders, TipRanks’ data reveals that no particular trend in Informative Buys or Sells has been noticed in Insiders’ trading activity in Tesla over the past three months. Recent sales by Insiders were all categorized as Uninformative.

It is worth noting that Tesla Insider CEO Elon Musk is the top shareholder, with a nearly 13% stake. In particular, Musk owns over 411 million TSLA shares valued at more than $100 billion.

Conclusion

TipRanks’ Ownership Tab provides valuable insights into the category-wise ownership structure of the company, enabling investors to make well-informed investment decisions.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue