Tesla’s (NASDAQ:TSLA) famous CEO, Elon Musk, pioneered an affordable EV strategy that’s been surprisingly effective in 2023. Sensible investors may be concerned about Tesla’s valuation, but I am bullish on TSLA stock because the company remains a trailblazer that EV market rivals can’t stand but also can’t ignore.

New-energy vehicle manufacturer Tesla brought EVs into the collective consciousness, and Musk is a love-him-or-hate-him kind of CEO. For instance, Musk recently baffled some social media users when he rebranded Twitter as “X.”

Similarly, Musk’s leadership of Tesla has, at times, confused and enraged the company’s critics and competitors. However, Tesla always seems to come out on top, and TSLA stockholders repeatedly prove the short sellers wrong and probably will continue to do so in 2023.

Valuation Concerns and Other Objections to Tesla

As we’ll discover, analysts are generally lukewarm about Tesla stock. Perhaps they’re worried about Tesla’s rich valuation, which is understandable. After all, Tesla’s trailing P/E, price-to-book (P/B), and price-to-sales (P/S) ratios are all far above their sector medians.

Yet, that’s been the case for a while, and TSLA stock continues to push higher. This doesn’t mean that you should ignore old-school valuation multiples. There’s still a takeaway, though. As long as Tesla maintains a strong track record of quarterly EPS beats and high revenue growth, Tesla’s true value can’t be expressed simply through a P/E or other ratio.

Another objection comes from Barclays (NYSE:BCS) analysts, who reaffirmed their Neutral rating on Tesla stock and issued an unambitious $260 price target on the shares. Apparently, the Barclays analysts aren’t too impressed with Tesla’s Cybertruck; they “don’t anticipate it being a significant source of share loss risk for” Tesla’s Detroit-based EV truck manufacturing rivals.

I’ll grant that the Cybertruck is a niche product and an unusual-looking vehicle. However, it’s certainly not intended to be Tesla’s bread and butter. If Tesla does manage to achieve its proposed annual Cybertruck production volume goal of 250,000 to 500,000 units, that would represent a notable achievement for this specific type of EV.

Additionally, I can’t ignore the competing EV charging network that seven major automakers, including General Motors (NYSE:GM), are reportedly proposing to build. This was inevitable, and it’s a good sign for Tesla that its rivals are following Musk’s lead and that it would evidently require seven competitors to match what Tesla’s already done.

Is Tesla’s Price-Cutting Strategy Crazy or Brilliant?

Building a cross-compatible EV charging network isn’t Tesla’s only game-changing strategy. The company is also making waves in the EV industry by repeatedly reducing its vehicle prices. It’s a strategy that seems to be working so far. Again, Tesla’s most recent quarterly EPS beat and revenue growth can’t be disputed.

By the way, Tesla isn’t only making its vehicles more affordable in the U.S. Reportedly, the automaker plans to cut the prices of multiple Model 3 and Model Y vehicle models in Hong Kong, China, starting August 4. These will be significant price discounts, ranging from 6% to 11.9%.

There’s abundant evidence that Tesla’s pricing strategy is influencing the EV industry. Several popular electric and hybrid vehicles in the U.S. are reportedly selling below their manufacturer’s suggested retail prices (MSRPs).

Ford (NYSE:F) now expects to lose $1.5 billion more than previously anticipated from its EV segment in 2023 due in part to Tesla’s pricing strategy. In addition, Mazda (OTC:MZDAY) is apparently exiting the U.S. all-electric vehicle market altogether.

That’s what I would call market-moving influence. Now, Tesla has an EV model with a sticker price slightly below $40,000. Moreover, Tesla might be able to produce even cheaper EVs in 2025 when the company’s Mexico-based facility gets up and running.

Is TSLA Stock a Buy, According to Analysts?

Turning to Wall Street, TSLA stock comes in as a Hold based on 10 Buys, 13 Holds, and four Sell ratings assigned in the past three months. The average Tesla stock price target is $263.33, implying 1.3% downside potential.

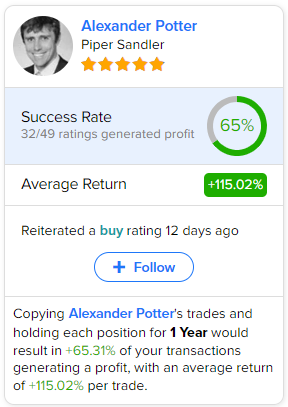

If you’re wondering which analyst you should follow if you want to buy and sell TSLA stock, the most profitable analyst covering the stock (on a one-year timeframe) is Alexander Potter of Piper Sandler, with an average return of 115.02% per rating and a 65% success rate. Click on the image below to learn more.

Conclusion: Should You Consider TSLA Stock?

Tesla’s tactics aren’t loved by everyone, but the company’s results speak for themselves. Besides, despite the company’s lofty valuation, betting against Tesla stock is like standing in front of a moving train.

At the end of the day, you don’t have to like Musk to appreciate Tesla’s enormous and enduring influence. Musk and Tesla will undoubtedly continue to surprise Wall Street, even if analysts aren’t all feeling bullish at the moment. Therefore, I believe TSLA stock is worth considering.