Elon Musk appears ready to vacate his CEO position at Twitter. Musk took of one his periodic polls on the platform to let “the people” decide on a matter, the latest being whether he should step down as CEO of Twitter and hand over the reins to someone else. The people said yes, although taking Musk at his word has not always been the most reliable barometer so let’s see how this pans out.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Nevertheless, Tesla (TSLA) investors will no doubt be happy with this latest move. Since officially taking over Twitter at the end of October, it has been nothing but chaos and then more chaos, with Tesla shares on a constant downtrend.

The stock is now languishing below the $500 billion market cap threshold for the first time since the end of November 2020 and following some quick calculations – using a market cap of $500 billion and adjusting to EV for net debt “at each point in time” – Morgan Stanley’s Adam Jonas notes that TSLA is “currently trading at almost a 40% lower multiple on 2025 EBITDA compared to the last time the market cap was below $500 billion.”

While Jonas thinks the recent selloff “contains an element of investor uncertainty” regarding Musk’s strategy and his ongoing Twitter shenanigans, he also claims it is to do with uncertainty around “underlying TSLA fundamentals (weakening demand, uncertainty of future price cuts, overall macro picture).”

So, what’s an investor to do? For Jonas, the answer is clear. While he expects 2023 won’t be easy going for either legacy OEs or “pure play” EV names, as Tesla leverages its cost leadership and vertical integration in a “deflationary” EV climate, he expects the company will “widen its gap to competition.”

Therefore, investors now have “an attractive entry point” to get involved in the company Jonas still considers is the “clear leader in EVs.”

Bottom-line, Jonas sticks with an Overweight (i.e., Buy) rating and a $330 price target, suggesting shares have room for 120% growth over the coming months. (To watch Jonas’ track record, click here)

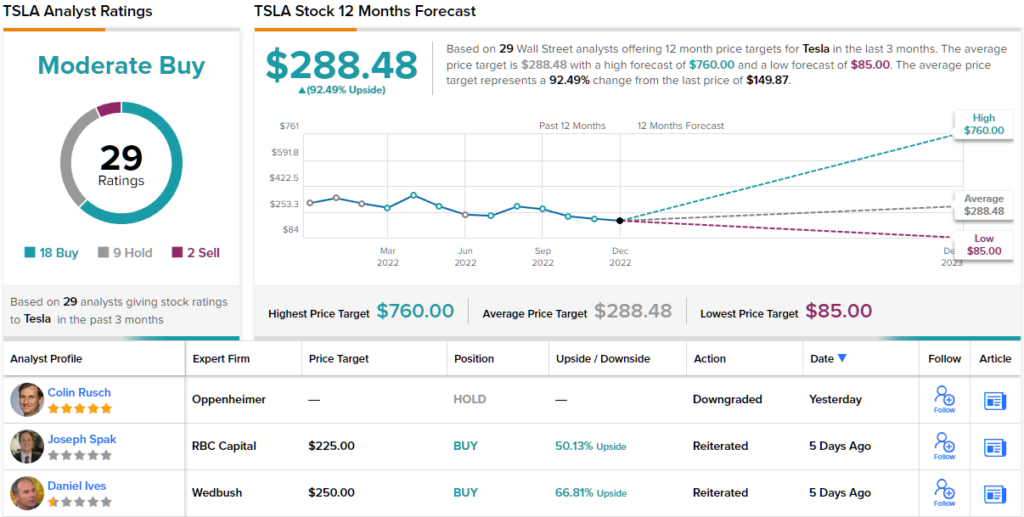

And the rest of the Street? Based on 18 Buys, 9 Holds and 2 Sells, the stock claims a Moderate Buy consensus rating. there’s plenty of upside projected here; at $288.48, the average target makes room for one-year returns of 92%. (See Tesla stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.