Tesla (NASDAQ:TSLA) has long been a polarizing name on Wall Street, and that does not look likely to change anytime soon. The EV pioneer has many fans, those who hail its commanding position at the forefront of the electric vehicle revolution and its thriving and expanding ecosystem, which includes batteries, supercharging stations and the prospect of full-self driving (FSD) cars.

On the other hand, you have the naysayers who will point to the stock’s extremely lofty valuation as being unsustainable, while there’s also growing competition in the EV space from legacy automakers and newer incumbents, alike. Plus, it’s impossible to ignore the presence of CEO Elon Musk, whose unpredictable nature and often detrimental actions add a chaotic element to the Tesla story.

For investors, the main issue in recent times has been the balance Tesla has been trying to strike between stimulating demand while still delivering on the margin profile. Although the series of price cuts taken by the company have helped drive sales, margins have been affected, as was evident in the recent Q2 print.

This is a serious issue that is unlikely to disappear soon, says Guggenheim analyst Ronald Jewsikow, who also thinks the stock is due a cooling down period after its sustained run this year (up by 103%).

“While the [Q2] print was better than feared, forward-looking pricing, production, operating leverage and demand commentary will likely weigh on shares following the considerable run in the stock since disappointing 1Q23 results were reported,” Jewsikow explained. “We continue to believe the direction for pricing and margins is lower near-term, a difficult backdrop with shares trading at ~75X our FY24 EPS estimates.”

Jewsikow comes down squarely in the bear camp, recommending investors Sell while his $125 price target implies shares are currently trading 50% above their fair value. (To watch Jewsikow’s track record, click here)

While the Q2 readout had its fair share of fodder for the bears, some Street analysts think the Tesla bull story remains intact. Amongst these is Baird analyst Ben Kallo, who recommends investors use “any pullback to accumulate shares.”

Explaining his stance, Kallo said, “Management reiterated its cautious tone regarding the macroeconomic backdrop for 2H, but we are encouraged by TSLA’s cost improvements and continue to believe that it is well positioned. Bears will pick around the lower volumes produced and FSD transferability in Q3; however, we estimate that TSLA is still on pace to achieve its production guidance of 1.8M vehicles for the full year.”

Based on the above, Kallo rates TSLA shares an Outperform (i.e., Buy), backed by a $300 price target. This suggests the stock still has room to move 20% higher in the year ahead. (To watch Kallo’s track record, click here)

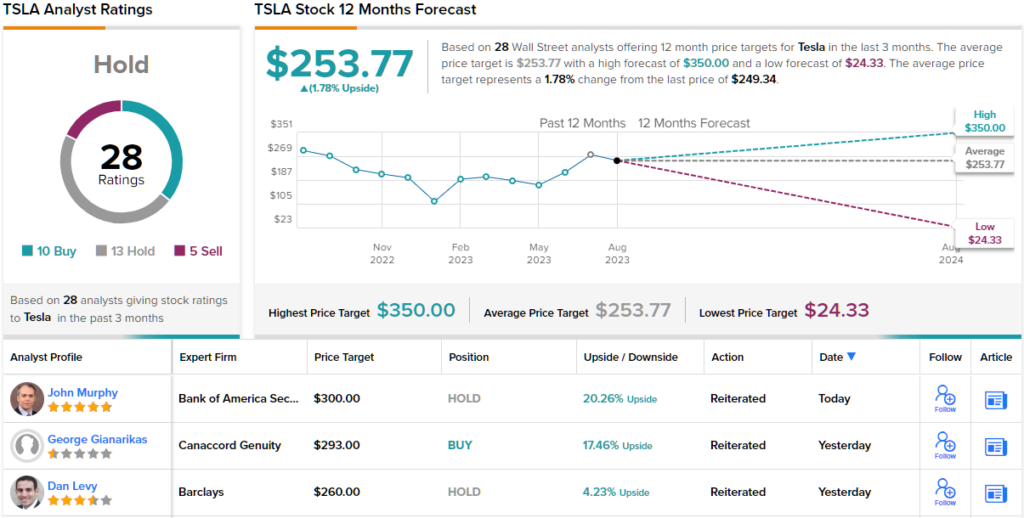

Interestingly, on balance, the Street’s take comes down somewhere in the middle of these two opinions. Based on 13 Holds, 10 Buys and 4 Sells, the stock claims a Hold consensus rating. The $263.33 average target implies the shares’ current price is just about right. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.