Is a big gamble about to pay off for Tesla (NASDAQ:TSLA)? Tomorrow, on Thursday, November 30th, marks the official unveiling of the Cybertruck, as Tesla delivers this innovative pickup truck to its first ten customers.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Since its initial reveal in November 2019, the Cybertruck has been subject to more than 1 million reservations. According to RBC analyst Tom Narayan, conversion rates are expected to be on par with or slightly below the Model 3 conversion rate. However, even at Tesla’s targeted production rate of approximately 250,000 units annually, this is “still enough for a few years’ worth of demand.”

Tesla does not anticipate reaching the full capacity rate until sometime in 2025 and kept a lid on profitability expectations by saying during its Q3 earnings call that it will be 18 months before it reaches meaningful free cash flow generation, in early 2025 or thereabouts.

Narayan is calling for the sale of 68,000 units in 2024, which is only around 3% of the expected total haul. That should increase to 155,000 in 2025 – or 6% of the total.

At only 3% of all Tesla volumes next year, the financial impact won’t be too substantial, but Narayan thinks the “polarizing product” might have an altogether different purpose. “Rather,” the analyst explained, “we view this model as a ‘halo’ truck – one that is intended to reinvigorate a brand that has arguably lost some of its shine in the past few years given a lack of new models.”

Tesla says 2016 was the last time it saw such lines form outside its showrooms, when the Model 3 was unveiled. That brings to mind the Dodge Viper, says Narayan, which decades ago represented a low volume model for Chrysler, but one that many believe played its part in reinvigorating the Chrysler brand.

As with some other Street analysts, Narayan’s “investment case” for Tesla is based on other elements of its business. It is its ability to be a “leader in autonomy (FSD and eventually robotaxi), and specifically as a software business,” rather than just a company that manufactures vehicles. However, not anticipating “near-term autonomy catalysts,” the fact the Cybertruck can help “reinvigorate the brand” and assist with selling more Model 3/Ys, could be a positive for the shares.

To this end, Narayan reiterated an Outperform (i.e., Buy) rating on Tesla stock, backed by a $301 price target. The implication for investors? Upside of 20% from current levels. (To watch Narayan’s track record, click here)

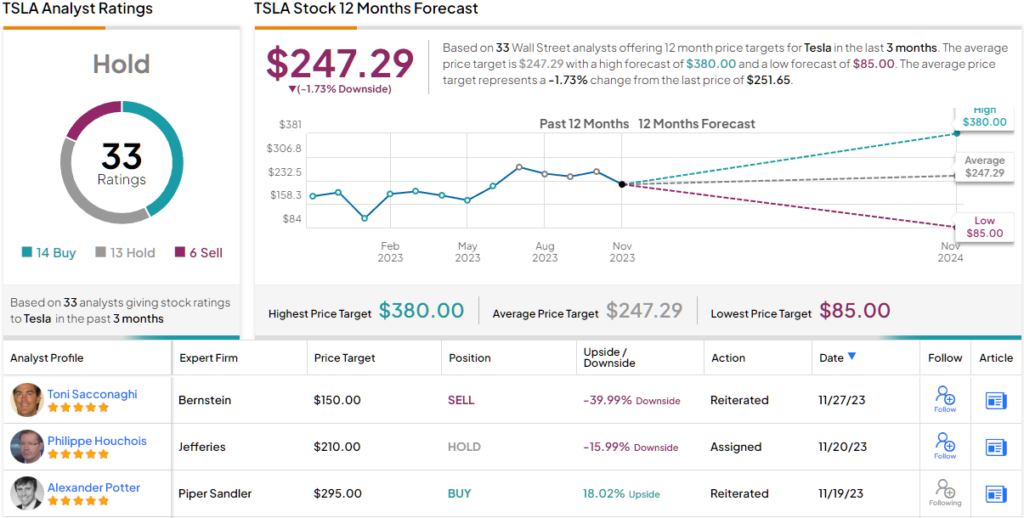

All in all, TSLA has 33 analyst reviews, split three ways: 14 Buys, 13 Holds, and 6 Sells. Therefore, the consensus view is to Hold here, to wait and see. The $247.29 average target is slightly below the current share price. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.