EV (Electric Vehicle) titian Tesla (NASDAQ:TSLA) has been prioritizing volume over margins and profits. Though the company’s CEO, Elon Musk, sees margin headwinds as a short-term phenomenon, the company sold fewer cars in Q3 (sequentially) at a lower average selling price, implying that the pressure on its margins will continue for a fairly long time. Moreover, its profit margins could continue to head south, as the company will not shy away from aggressively cutting prices to ramp up volumes in the future.

Don't Miss our Black Friday Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Echoing similar sentiments, Toni Sacconaghi of Bernstein reiterated a Sell rating on Tesla stock on October 2. Despite the significant price cuts, Tesla’s lower-than-expected deliveries indicate weak demand, noted Sacconaghi. The analyst believes Tesla will have to lower its average selling prices next year to drive volumes, hurting its margins and earnings.

While Sacconaghi is bearish about Tesla, Mark Delaney of Goldman Sachs maintained a Hold rating on TSLA stock following Q3 deliveries. The analyst is upbeat about the company’s long-term prospects. However, he believes that Tesla’s additional price cuts to drive volumes will hurt near-term margins.

Nonetheless, Deutsche Bank analyst Emmanuel Rosner reiterated his bullish outlook about Tesla stock as the company maintained the full-year volume target despite lower Q3 deliveries, implying volumes will accelerate in Q4. However, Rosner pointed out that Tesla could witness lower volume growth in 2024. Further, the analyst sees less contribution to its financials from the launch of Cybertruck.

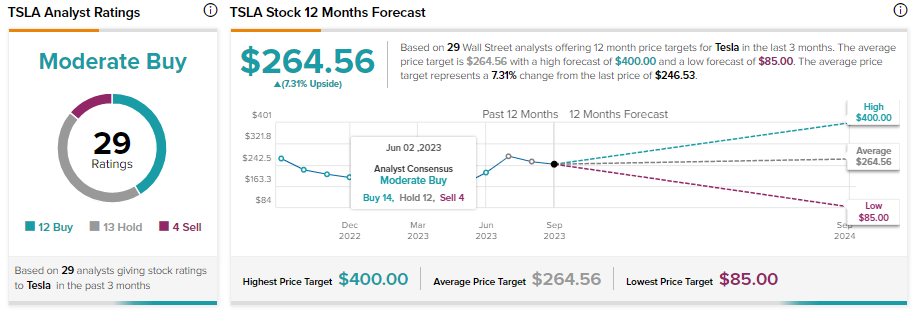

With concerns around Tesla’s margins, let’s look at the Street’s consensus rating for its shares.

Is Tesla a Buy or Sell Right Now?

Per Wall Street analysts’ consensus rating, Tesla stock is a Moderate Buy near the current levels. It has received 12 Buy, 13 Hold, and four Sell recommendations from a total of 29 analysts. However, their average price target of $264.56 implies a limited upside potential of 7.31% over the next 12 months.

Bottom Line

Tesla is undoubtedly a solid long-term stock, given its leadership in the EV space. The company’s peers are already grappling with higher costs, implying that Tesla will continue to maintain its lead in the EV sector in the coming years. Further, Tesla’s boss is optimistic that the company’s focus on cost reduction, new product development, and autonomy will help recoup margins in the long term.

However, the near-term pressure on margins, weakness in the overall automotive market, and significant year-to-date price gains may limit the stock’s upward potential.