Tesla (TSLA) CEO Elon Musk is a polarizing figure, who has legions of fans along with many detractors. His latest public statement will no doubt divide opinions once more.

Musk has already made known his aversion to the COVID-19 lockdown, going so far as to call the measures ‘fascist.’ Musk was at it again on Saturday, when in a tweet berating Alameda county’s “unelected & ignorant ‘Interim Health Officer,” Musk said, “Tesla is filing a lawsuit against Alameda County immediately.”

Like at all non-essential businesses in the state of California, activity at Tesla’s Fremont plant, near San Francisco, has been suspended since March 23. While some restrictions in the state have been lifted, counties have their own criteria for opening up again and all but essential businesses in Alameda, where Fremont is located, will remain closed until the end of the month.

“This is the final straw,” Musk angrily tweeted, “Tesla will now move its HQ and future programs to Texas/Nevada immediately. If we even retain Fremont manufacturing activity at all, it will be dependent on how Tesla is treated in the future. Tesla is the last car maker left in CA.”

Wedbush analyst Daniel Ives believes the last step represents an attempt by Tesla to force Alameda into reopening its business. Although Ives argues there will be a long list of states ready to welcome a business of its size to a new location, there are questions concerning the implications of the move.

“Moving away from Fremont would take at least 12 to 18 months and could add risk to the manufacturing and logistics process in the meantime. In a nutshell, this is a game of high stakes poker and Musk just showed his cards; now all eyes move to the courts and the response from Alameda County and potentially California State officials,” Ives said.

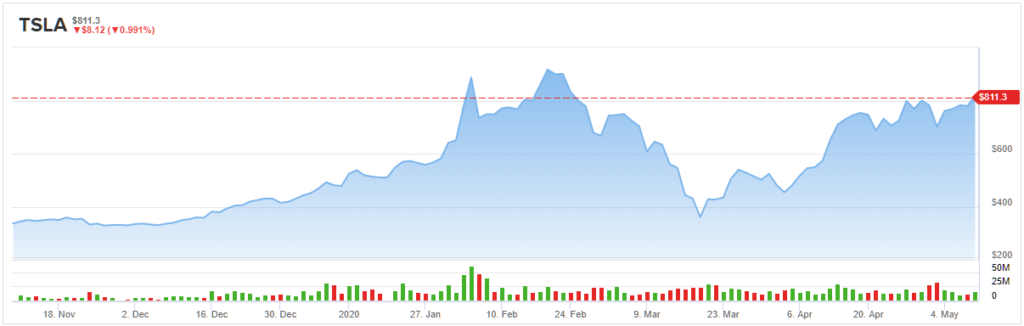

Ives maintains a Neutral rating on Tesla shares along with a $600 price target. The 5-star analyst, therefore, projects downside of 26% from current levels. (To watch Ives’ track record, click here)

The rest of the Street is on the same page. 7 Buys and 10 Holds and Sells, each, add up to a Hold consensus rating. With an average price target of $627.40, the analysts foresees shares dropping by 23% over the next 12 months. (See Tesla stock analysis on TipRanks)

Read more: