Teladoc Health, Inc. (TDOC) is a leading global virtual healthcare services provider, connecting patients and physicians in the United States and internationally. Today, the company facilitates 76M members and 10K medical providers.

Recently, after a huge run-up in 2020, Teladoc’s stock has seen an extreme drop, and is currently trading at $97.77, 70% down from 52-week highs. Although the company’s valuation was stretched at price levels over $200, today the market’s hesitation towards the stock likely presents an appealing opportunity. I am bullish on the stock.

Macro Factors

After the COVID-19 pandemic hit in early 2020, almost every aspect of everyday life changed, limiting in-person contact in order to contain the spread of the virus. Teladoc’s business experienced a huge boost, to the point where the company was having trouble facilitating the aggressively growing customer/patient base. The time and money-saving benefits, as well as the easy access to physicians with which Teladoc provides patients, have established a system that will benefit healthcare for years to come.

Medical Teleconsultations offer more cost-effective services and also reduce the work strain on healthcare professionals and hospitals. While patients in the U.S. and other developed countries are discovering the benefits and applications of telemedicine, people in developing countries facing challenges accessing quality medical services will benefit significantly from the adoption of Teladoc’s services.

The Worldwide Telemedicine Industry is expected to experience rapid growth over the next decade, reaching $218+B by 2026, according to research by Researchandmarkets.com. According to the same research, the telemedicine market was valued at $68B in 2020, implying a CAGR of 21% through the next five years.

Fundamentals

Teladoc’s business model has evolved along with the company’s growth. Centered around Whole-Person Care that is personalized, convenient, connected and, most importantly, cost-effective, Teladoc offers virtual access to healthcare providers through subscription plans. The company operates both a Direct-to-Consumer and a Business-to-Business model.

Teladoc has been growing revenue exponentially over the last five years. With a remarkable 70% CAGR, the company’s bottom line has grown from 77M at the end of 2015 to 1.1B in 2020. For 2021, sales have already surpassed 2020 results with just the first three quarters amounting to $1.480B. For the whole year, revenue of 2.0B is projected.

Gross margins provide a testament to an effective business model, reliably greater than 62% throughout the company’s history since 2013, when Teladoc began reporting results, looking to become public.

While revenue and gross profit growth have been outstanding, Teladoc is still struggling to reach profitability. Operating expenses have soared as sales expand, while R&D expenses also cover a significant amount of the company’s overall cost profile. Investors are worried that Teladoc’s delayed arrival at profitability (consensus estimates expect positive net results in 2024) will bring elevated volatility and further dilution through the issuance of more shares outstanding.

A quick look at the balance sheet should ease any short-term liquidity concerns, as the company maintains a current ratio of 3.8 and a quick ratio of 3.6. Long-term debt amounted to 1.2B as of September 2021, implying, given the current market capitalization of 15B, a 0.08 Debt/Equity ratio.

Forward-Looking Valuation

Teladoc’s high growth potential and innovative business model appear to be trading at a discount today, after the massive pullback the stock has experienced. Currently, the stock trades at a 7x forward 2021 sales and a 5.5x forward 2022 sales multiple.

The current P/S multiple represents a huge discount from where the company was trading a few months ago. At the beginning of 2021, Teladoc was trading for almost 18x revenue, while just six months ago the P/S multiple stood at 14x.

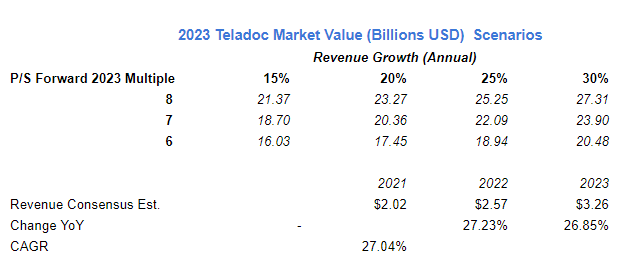

With a focus on the Price/Sales ratio, a projection of potential upside for the stock in the next 3 years through a scenario analysis is presented below, in an effort to mitigate the uncertainty looming around the company. Teladoc currently trades at a 7x forward Price/Sales multiple, with a 15.5B market capitalization. Revenue growth, as shown below, represents average annual growth up until 2023. For 2021 Revenue is expected to reach 2.02B.

Throughout this analysis, P/S multiples will appear conservative and significantly lower than the ones Teladoc used to trade at. Even if the stock gains momentum in 2022 and valuations become more generous, it is best to understate the market’s sentiment towards a young and therefore more risky company like Teladoc.

Bullish Case: The company beats growth expectations and grows revenue at a 30% per annum rate. In this best-case scenario, with the P/S ratio around 8x, the company will be trading at a 27.3B market cap, representing a 2-year 76% upside. If the P/S multiple drops to a more conservative 6x, Teladoc will maintain a 20.5B market cap, still implying a 2-year 32% upside.

Base Case: In this scenario, Teladoc meets growth expectations and grows revenue at a 25% per annum rate. With a market valuation that will range between 25.3B and 18.9B, Teladoc’s 2-year upside is still attractive, especially if the company maintains a valuation multiple close to today’s 7x. Maximum upside, assuming an 8x P/S multiple, sits at 63%. A significantly lower multiple of 5x at the end of the 2-year period, however, offers minimal potential upside.

Bearish Case: The company fails to meet growth expectations, but still grows revenue at a 20% per annum rate. In this case, at an 8x or even a 7x P/S multiple in 2023, there is still room for respectable price appreciation, while at a lower 6x, upside potential decreases significantly at 13%.

Very Bearish Case: Given the optimism and high expectations surrounding growth estimates, one final scenario of underperformance is included. Here, the 15% annual revenue growth rate that is selected, weak growth in the telemedicine industry, new competition, and a possible economic downturn that affects the markets. Both a 7x and a 6x P/S multiple, in this case, would mean upside potential confine in the 10-20% range for the 2-year period.

Wall Street’s Take

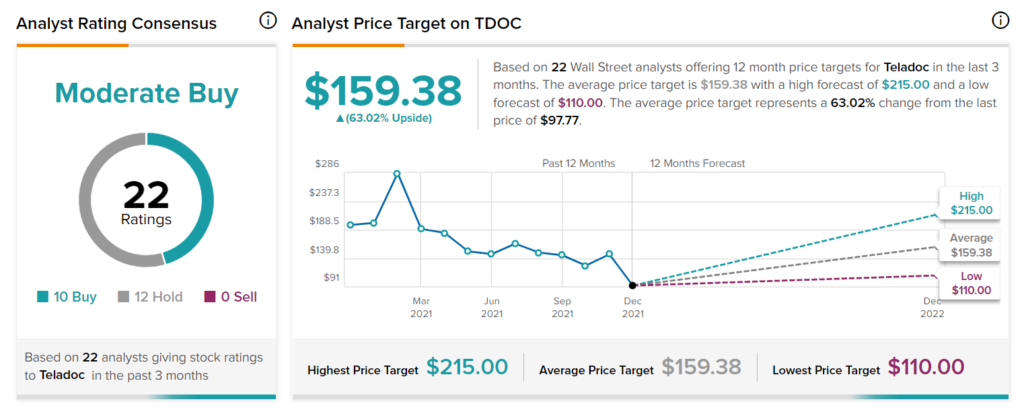

Turning to Wall Street, Teladoc has a Moderate Buy consensus

rating, based on 10 Buys, 12 Holds, and 0 Sells assigned in the last three

months. The average Teladoc price target is $159.38, representing a 65.40% upside from current price levels, with a high forecast of $215.0 and a low forecast of $110.00.

Disclosure: At the time of publication, Alex Galanis did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.