Taiwan Semiconductor Manufacturing (TSM) manufactures and sells integrated circuits and wafer semiconductor devices.

Its chips are used in several end markets including high-performance computing platforms (like personal computers, tablets, servers, and game consoles), automotive, Internet of Things (includes connected devices like smart wearables and surveillance systems), and digital consumer electronics like TVs and cameras. The company was founded in 1987 and is headquartered in Hsinchu, Taiwan.

I am neutral on TSM stock. The company has very strong fundamentals, but valuation is mixed now. Its dividend yield is also not great but it can contribute to total return. Top Analysts are highly likely to include it in their stock picks.

Taiwan Semiconductor Manufacturing Business News

Back in November, the company announced that “MediaTek (TWSE: 2454) and TSMC (TWSE: 2330, NYSE: TSM) today unveiled the world’s first 7-nanometer 8K digital TV flagship system-on-chip (SoC), the MediaTek Pentonic 2000. Built with TSMC’s N7 advanced process technology, the MediaTek Pentonic 2000 offers unparalleled performance and power efficiency with features including powerful artificial intelligence (AI) engines, Motion Estimation and Motion Compensation (MEMC), Versatile Video Coding (VVC) decoding and picture-in-picture (PiP) technology.”

It is also notable that “as the first semiconductor company to bring 7nm technology to commercial production, TSMC possesses the longest track record for yield and quality improvement, as well as the most extensive design ecosystem support. TSMC’s 7-nanometer technology was also the recipient of the 2021 IEEE Corporate Innovation Award.”

On January 13, 2022, TSMC reported fourth-quarter 2021 earnings which are covered more analytically in the earnings section below.

Q4 2021 Earnings

TSM stock earnings show both consistency and growth, which makes Taiwan Semiconductor Manufacturing a high-quality growth company. GAAP EPS of $1.15 was a beat by $0.03, and revenue of $15.85 billion was a beat by $74.44 million.

TSMC’s revenue that increased 24.1% year-over-year and 5.8% compared to the previous quarter. The profitability was very strong as the gross margin for the quarter was 52.7%, operating margin was 41.7%, and net profit margin was 37.9%.

The company expects in the first quarter of 2022 to generate revenue between $16.6 billion and $17.2 billion.

TSMC expects its gross profit margin to be between 53% and 55%, and its operating profit margin to be between 42% and 44%.

The capital expenditures for 2022 are also expected to be in the range of $40 billion and $44 billion.

Fundamentals – Risks

Taiwan Semiconductor Manufacturing has consistent growth in revenue per share and although it has been issuing new debt during the past three years, the balance sheet is very strong with a D/E ratio of 0.23 per latest quarter.

The profitability is very strong and consistent. It is indicative that ROE% in 2021 was 29.7%, compared to 29.8% in 2020. Free cash flow declined in 2021 but it remains strong and consistent.

Valuation

The price is close to a 10-year high, but the stock dividend yield is close to a 10-year low. The expected EPS growth for the next three-to-five-year period is 19.44%, with a PEG ratio of 1.21.

Wall Street’s Take

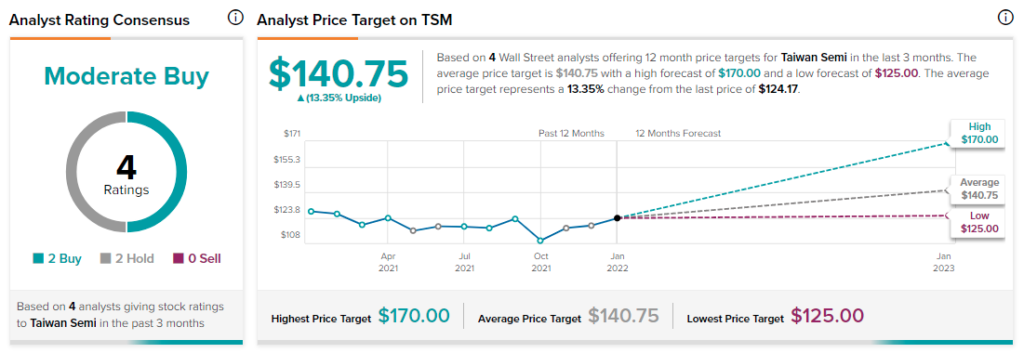

Taiwan Semiconductor has a Moderate Buy consensus based on two Buys and two Holds. The average Taiwan Semiconductor price target of $140.75 suggests 13.4% upside potential.

Conclusion

TSM is a semiconductor company with very strong fundamentals and growth, with consistent profitability and increased capital expenditures to meet demand.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure