October inflation data has triggered hopes that the U.S. Federal Reserve might dial back its hawkish stance. That said, persistent macro uncertainty continues to spook investors. Amid this scenario, many investors are avoiding growth stocks and looking for safer value bets. Stocks of companies trading at lower prices than what their fundamentals suggest are called value stocks. Using TipRanks’ Stock Comparison Tool, we will place AT&T (NYSE:T), Abbott (NYSE:ABT), and Procter & Gamble (NYSE:PG) against each other to pick the most attractive value stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

AT&T (T) Stock

Despite a tough macro backdrop, telecom giant AT&T reported better-than-anticipated third-quarter results due to the solid performance of its wireless business. The quarter saw total wireless net additions of 7.1 million, including 964,000 postpaid net additions. However, business and consumer wireline businesses continued to be under pressure due to the weakness in the demand for legacy voice and data services.

Meanwhile, AT&T sees strong growth opportunities in 5G and fiber. Most of its targeted capital expenditure of $24 billion for 2022 is directed toward these two growth engines. The company is on track to reach 1 million AT&T Fiber net additions this year.

What is the Target Price for AT&T stock?

Recently Truist Financial analyst Gregory P. Miller upgraded AT&T stock to Buy from Hold but kept the price target unchanged at $21. Miller feels that the company “demonstrated an ability to focus on core business as opposed to acquisitions of loosely related companies at market high valuations.”

Furthermore, the analyst contends that digital subscriber line (DSL) losses will moderate moving forward. Miller believes the company is on the path to generate more than $17 billion in free cash flow in 2023 and beyond, which it can either reinvest in its core business or return to shareholders.

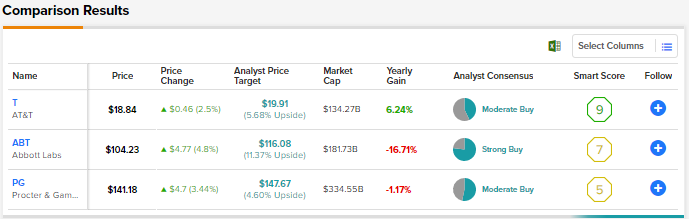

Overall, the Street is cautiously optimistic about AT&T stock, with a Moderate Buy consensus rating based on six Buys and eight Holds. The average T stock price target of $19.91 implies 5.7% upside potential. AT&T stock is highly attractive for dividend-oriented investors. Its dividend yield stands at an impressive 7.4%.

Abbott Laboratories (ABT) Stock

Abbott is a diversified healthcare company focused on four key areas –nutrition, diagnostics, medicines, and medical devices. The company’s Q3 results surpassed the Street’s estimates. However, ABT stock still fell as investors were concerned about the year-over-year decline in sales and earnings due to lower COVID-19 testing revenue, a significant drop in Nutrition segment’s sales, and currency headwinds.

Notably, the Nutrition segment was hit by the shutdown (initiated in February) of Sturgis, Michigan, facility, due to the contamination of certain infant formula products. Abbott recalled its baby formula products earlier this year, causing a nationwide shortage. The company resumed production at the facility in Q3.

Looking ahead, Abbott sees strong potential in its Medical Devices segment. The segment’s international sales declined in Q3 due to the impact of COVID-19 lockdowns in China and supply constraints in certain areas. However, these pressures seem temporary. High-growth products, like the FreeStyle Libre continuous glucose monitoring system, are expected to fuel the company’s growth in the times ahead.

Is Abbott Labs a Buy, Sell, or Hold?

Following the results, Barclays analyst Matt Miksic reduced his price target for Abbott stock to $114 from $118 but maintained a Buy rating. The analyst noted that the sell-off following the results brought back Abbott stock to early October levels, even as the performance of diabetes, Established Pharmaceuticals division, and cardio devices was “encouraging.” Miksic feels that the post-earnings pullback in the stock was overdone.

On TipRanks, Abbott earns the Street’s Strong Buy consensus rating based on 10 Buys and three Holds. The average ABT stock price prediction of $116.08 suggests 11.4% upside potential. Abbott has increased its dividends for 50 consecutive years. Its dividend yield stands at 1.9%.

Procter & Gamble (PG) Stock

Consumer staples giant Procter & Gamble sells household and personal care products. The demand for these products generally remains resilient during an economic downturn, which makes PG stock an attractive pick.

Despite higher costs due to soaring inflation and significant currency headwinds, PG topped analysts’ estimates for the first quarter of Fiscal 2023 (ended September 30, 2022), thanks to its pricing power and impressive brand portfolio. PG owns some of the most popular global brands, like Head & Shoulders, Oral-B, Pampers, Pantene, Tide, and Gillette.

Meanwhile, currency headwinds are expected to continue to hurt PG’s performance. Consequently, the company now expects its Fiscal 2023 EPS growth at the low end of the previously issued guidance range of “in-line to up four percent” compared to EPS of $5.81 in the prior fiscal year.

Is PG a Good Stock to Buy?

Following the Q1 FY23 results, Jefferies analyst Kevin Grundy reiterated a Buy rating on PG stock, with a price target of $149. The analyst feels that the broad-based portfolio momentum (organic sales grew 7% against the analysts’ consensus estimate of 5.5%) in Q3 reflected the company’s impressive brand portfolio, “durable” supply chain, and scale that can withstand a challenging macro environment.

All in all, the Street’s Moderate Buy consensus rating on Procter & Gamble stock is based on eight Buys and seven Holds. The average PG stock price target of $147.67 implies upside potential of 4.6%. PG offers a dividend yield of 2.6%. Furthermore, PG is a dividend king and has raised its dividends for 66 consecutive years.

Conclusion

AT&T stock has risen 1.4% year-to-date and fared better than Abbott and Procter & Gamble stocks, which have declined 26% and 14%, respectively. However, Wall Street analysts are more bullish about Abbott and see higher upside potential in the stock.

That said, if we consider dividend yields as well, then the estimated total returns of AT&T and Abbott are comparable. Investors can choose between these two value stocks based on their investment objective, risk appetite, and dividend orientation.