Sysco (NYSE:SYY) and Realty Income (NYSE:O) have a stellar history of dividend payments and growth (more than 25 consecutive years). While these Dividend Aristocrats (learn more about Dividend Aristocrats here) are reliable bets for earning a worry-free income, they are also loved by the Top Wall Street analysts.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

But before we dig deeper, investors should note that TipRanks ranks the top analysts according to industry, timeline, and benchmarks. The ranking reflects an analyst’s ability to deliver higher returns through recommendations. Following the ratings, TipRanks’ algorithms calculate the statistical significance of each rating, the analysts’ overall success rate, and the average return.

With this backdrop, let’s delve into Sysco and Realty Income stocks.

Is Sysco a Good Dividend Stock?

Sysco has increased its dividend for 54 consecutive years, making it a dependable stock. On April 27, the company increased its quarterly dividend to $0.50 a share from $0.49. Currently, it offers a forward yield of over 2.6%.

The company recently delivered better-than-expected quarterly earnings, reflecting improved volumes, market share gains, and efficiency. Following the earnings announcement, Barclays analyst Jeffrey Bernstein reiterated a Buy recommendation on SYY stock on August 1. Further, J.P. Morgan analyst John Ivankoe also maintained a Buy on Sysco stock on August 2.

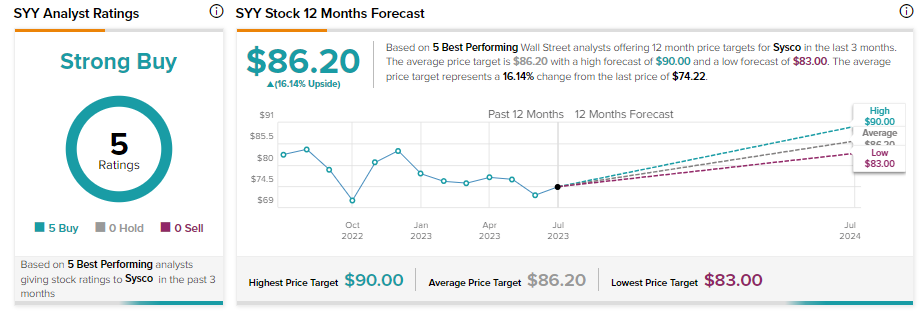

The stock has received Buy ratings from all five top analysts who have recently rated it. Collectively, their 12-month average price target of $86.20 implies an upside of nearly 16%.

What is the Forecast for Realty Income Stock?

Realty Income is a solid income stock that recently increased its dividend, translating into an annual amount of $3.066 per share. Since listing on the exchange in 1994, Realty Income has increased its dividends 121 times. Further, it offers a compelling forward yield of over 5%.

The solid payouts of this Real Estate Investment Trust are supported by its extensive portfolio of high-quality real estate properties and long-term leases. Moreover, its diversified customer base supports its cash flows and dividend payouts.

On July 20, Brad Heffern of RBC Capital reiterated the Buy rating on Realty Income stock. In addition, Realty Income stock has received Buy ratings from all three top analysts who have recently rated it. Collectively, their 12-month average price target of $71.08 implies an upside of about 21%.

The Bottom Line

Sysco and Realty Income stocks have strong fundamentals, a growing earnings base, and solid dividend payments, making them reliable investments for stable earnings. Further, a Strong Buy consensus rating supports the bull case.