Just on the surface, Mobileye (NASDAQ:MBLY) commands extraordinary relevancies due to its core driver assistance platform and the forward implications of full autonomy – one of the blue-sky opportunities in the artificial intelligence (AI) space. Still, post-pandemic realities, such as drivers becoming more reckless, could make the business even more compelling than originally expected. Therefore, I am very bullish on MBLY stock.

MBLY Stock Benefits from a “Reverse Target” Situation

Aside from the native relevancies of Mobileye’s driver assistance and autonomy innovations, MBLY stock benefits from the negative and persistent consequences of the post-COVID-19 new normal. As multiple news reports indicate, the pandemic sparked an increase in undesirable behaviors, including outright crimes. It’s enough that the matter deeply affected the bottom line for retailer Target (NYSE:TGT).

For the big-box retailing giant, a dramatic increase in shoplifting will likely result in a $500 million loss of profitability for the current fiscal year as compared to last year, according to Target Chair and CEO Brian Cornell. Obviously, Target’s feeling the pain of the post-pandemic new normal. In sharp contrast, for MBLY stock, it’s a “reverse Target” situation. Undesirable behaviors only make Mobileye more relevant.

On a scientific and psychological level, COVID-19 imposed changes at the individual and social levels. Regarding the former component, infection by the virus can affect brain function. For sufferers of long COVID, the consequence may involve personality changes.

As for the latter, many collectively feel anxious or angry because they perceive harm stemming from forces beyond their control. Combined, these elements may combust given the “right” circumstances. In other words, it’s never been more important for drivers to give each other leeway.

Driver assistance technology can help prevent flashpoints from materializing in the first place thanks to early warning mechanisms. Thus, MBLY stock organically represents an immediately relevant top-tier AI play.

It’s Not Just a Theoretical Deduction

To be sure, deducing a negative impact on one segment of society (in this case, personal transportation on American roadways) from an impact on another segment (COVID-related psychological effects) can be incredibly problematic. However, regarding the relevancy of MBLY stock, it’s not theory; it’s reality.

According to a local report from an NBC affiliate in Milwaukee, dangerous driving behavior has been rising since the pandemic. Late last year, the nonprofit American Automobile Association or AAA released a study finding that all types of reckless behaviors have increased since the start of the global health crisis.

“There’s really no way around the fact that that’s just people making bad choices behind the wheel,” said Nick Jarmusz, director of Public Affairs for AAA. Of course, it’s a worrying prospect for anybody, and while the folks of Mobileye would not want such recklessness to rise, it’s also unavoidable that this framework represents a facet of the new normal.

Given the unfortunate situation that doesn’t seem to have a readymade policy-level answer, the best solution is to develop technologies for personal safety. That’s what makes MBLY stock so powerful. Essentially, the underlying business addresses a serious problem for which few, if any, solutions exist.

Mobileye is a Stable Growth Machine

Another factor that helps move the needle for MBLY stock is that the underlying enterprise represents a growth machine. For instance, in the first quarter of 2023, Mobileye posted revenue of $458 million, up over 16% against the year-ago tally of $394 million.

Further, it’s demonstrating an expansion of its top line on an annual basis. Last year, the technology firm rang up sales of $1.87 billion, up over 34% against the prior year’s result of $1.39 billion. That tally was substantially higher than the $967 million posted in 2020. Further, in 2019, Mobileye generated $879 million in revenue.

Significantly, the company also benefits from consistently positive free cash flow (FCF). In Q1 2023, it posted FCF of $145 million, up favorably from the $24 million printed in the year-ago level. Also, Mobileye delivered positive FCF since at least 2019.

Finally, looking at its balance sheet, the driver assistance and autonomy specialist suffers no debt. Therefore, it enjoys financial flexibility at a difficult juncture in the market.

Is MBLY Stock a Buy, According to Analysts?

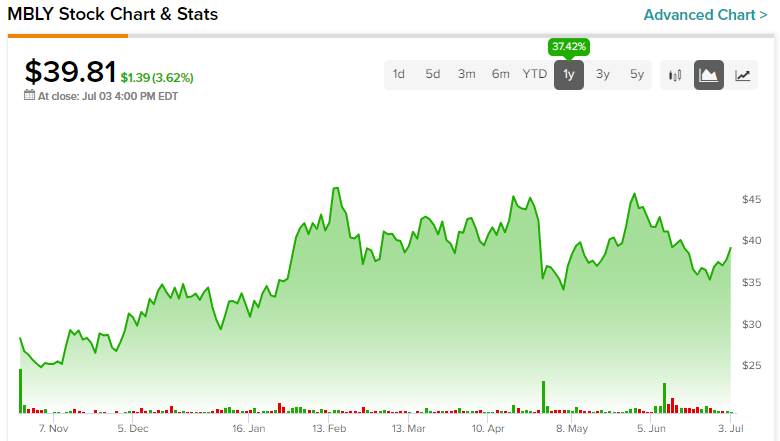

Turning to Wall Street, MBLY stock has a Strong Buy consensus rating based on 14 Buys, one Hold, and zero Sell ratings. The average MBLY stock price target is $47.47, implying 19.2% upside potential.

The Takeaway: MBLY Stock Practically Sells Itself

While some investments require a convoluted thesis to appreciate, MBLY stock practically sells itself. Fundamentally, recklessness has increased on U.S. roadways, with no real viable solutions in sight. However, Mobileye’s driver assistance tech can facilitate accident avoidance. As a bonus, the company offers a financially stout profile, thereby instilling confidence.