With the change of Administrations in Washington, maintaining secure cyber systems will be a top priority for the new White House.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

President Joe Biden is no stranger to matters of cybersecurity. He has already shown this in his choice of Anne Neuberger for the new post of deputy national security adviser for cybersecurity. Neuberger has a long history in the intelligence services, focuses on digital security matters.

The appointment comes after the embarrassing SolarWinds hack attack on federal systems, and it shows that Biden has grasped importance of the threat. Importantly, as part of a $1.9 trillion American Rescue Plan, Biden plans to inject $9 billion into the U.S.’s IT infrastructure and remediate the SolarWinds breach.

For investors, the key here is looking forward. Cybersecurity firms are going to find a new contract environment, from civilian, military, and intelligence agencies within the Federal government.

Wedbush analyst Daniel Ives believes that that contract environment is going to be lucrative in 2021, noting: “We believe federal cyber security budgets could see an incremental 25% YoY increase in 2021 with a laser focus on reconstructing cyber security risk frameworks, threat detection, cloud security, privileged access management and endpoint/vulnerability among other areas. This federal cyber boom will add to the growth prospects of the overall cyber security sector looking ahead, which remains one of our favorite areas of tech for 2021.”

Against this backdrop, Ives and his team have picked two cybersecurity stocks that they believe are worth buying. We used TipRanks’ database to find out what other Wall Street analysts have to say about the prospects of these two.

SailPoint Technologies (SAIL)

First up, SailPoint, focuses on access management for cloud computing systems, plugging a natural security weakness of the cloud. SailPoint’s solutions include, among other features, access certification, password, management, and cloud governance. The security products allow for tracking and managing traffic into and out of cloud systems – a vital component of network security.

SailPoint showed increases revenues in 2020. In Q1, the company registered a 25% yoy gain; in Q2, the gain was 46%. For the third quarter, SAIL’s year-over-year gain was again 25%. These increases come as the pandemic has pushed an increasing portion of office work online – and prompting more demand for access security to digital networks.

Wedbush’s Ives notes the company’s increasing sales on increasing demand: “It’s clear the company’s product suite is in the sweet spot of spending as more enterprises move to the cloud with SAIL’s compelling footprint resonating with both new and existing customers… With our estimate that 33% of workloads are currently on the cloud moving to 55% by 2022, SAIL has a golden opportunity to gain share against legacy vendors as well as further penetrate IT budgets going forward in this fluid cloud shift.”

In line with this bullish stance, Ives rates SAIL shares an Outperform (i.e. Buy), and his $75 price target indicates confidence in 31% upside for the next 12 months. (To watch Ives’ track record, click here)

Wall Street agrees with Ives, as shown by the Strong Buy analyst consensus rating. The rating is based on 11 recent reviews, including 9 Buys and 2 Holds. However, the recent share appreciation has pushed the price almost to the $60.50 average target, leaving room for 6% upside. (See SAIL stock analysis on TipRanks)

Fortinet (FTNT)

Fortinet is a Silicon Valley tech firm focused on cybersecurity products. Fortinet is known for its anti-virus systems, firewalls, intrusion prevention, and endpoint security – a high-end line of security products to protect data, networks, and users. The company’s value to customers is clear – in 2019, the last full year for which the numbers are available, Fortinet brought in $2.2 billion in total revenue.

In the past year, Fortinet has seen its revenues outperform past performance. The 1Q20 top line hit $576.9 million, up 22% year-over-year, while the Q2 and Q3 yoy gains were 18% and 19%, respectively. The Q3 revenues were $651.1 million, coming in just over the analyst forecasts.

Among the fans is Ives, who wrote, “The company is seeing a strong demand environment… We believe that FTNT’s security fabric offering is increasingly resonating with the global market… FTNT has a slew of new products into the mid-range and high-end market that should serve as another positive catalyst heading into 2021 and beyond… In a nutshell, Billings growth of 20%, strong FCF, and a healthy pipeline should be the trifecta to drive this stock higher as this remains one of our favorite cyber security plays.”

Ives backs his comments with a $180 price target and an Outperform (i.e. Buy) rating. His target implies an upside of ~20% for the year ahead.

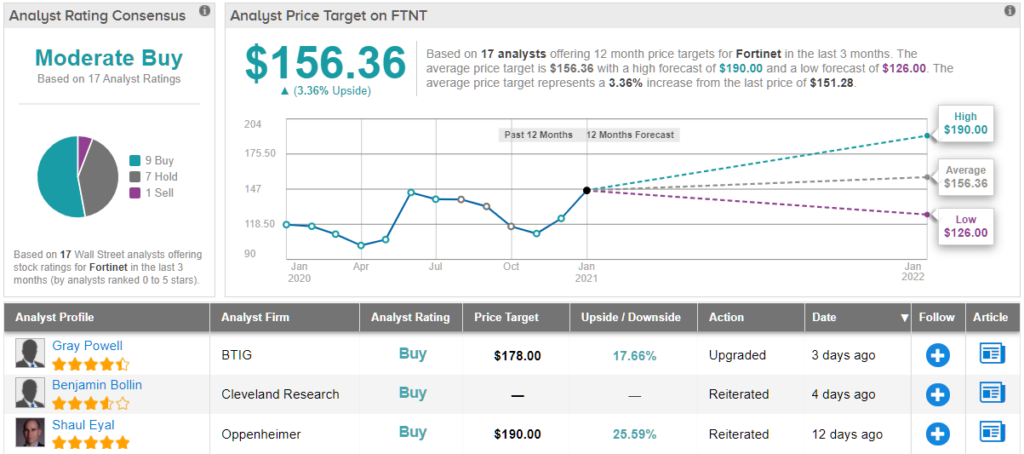

What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 9 Buys, 7 Holds and 1 Sell add up to a Moderate Buy consensus. In addition, the $156.36 average price target indicates a modest 3% upside potential. (See FTNT stock analysis on TipRanks)

To find good ideas for cybersecurity stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.